Analysts Warn GoPro Stock Could Plunge 50% From Here

GoPro (GPRO) stock appears to be the latest beneficiary of meme stock action, as shares jumped 30% on Aug. 25 despite an absence of company news or regulatory filings. The company followed that up with an additional 9% gain on Aug. 26, on the strength of the company’s early-stage rollout of its artificial intelligence (AI) data licensing pilot program.

However, Wall Street analysts remain unconvinced, and based on the average price target for GPRO stock, shares are at risk of falling 50%. So, the stock may be overheated despite the excitement from this week.

About GoPro Stock

California-based GoPro is best known for making handheld video cameras that can be mounted on vehicles, helmets, and other gear. They are popular among content creators, athletes, and people doing adventure sports because they show immersive, first-person footage. The company also sells mounts and accessories for their cameras and operates a mobile app that allows users to control cameras remotely, edit footage, post to social media, and store files in the cloud.

The company has a market capitalization of only $268 million. Shares are up 37% in the last 12 months, beating the Nasdaq Composite’s ($NASX) gain of 22%, but have been exceptionally volatile. GoPro stock has been as low as $0.40 per share in the last 52 weeks and rose as high as $2.37.

The stock trades at a price-to-sales (P/S) ratio of 0.3, indicating that the stock is undervalued. By way of comparison, Sony Group (SONY) has a forward P/S of 2, while Garmin (GRMN) operates at a forward P/S of 6.3.

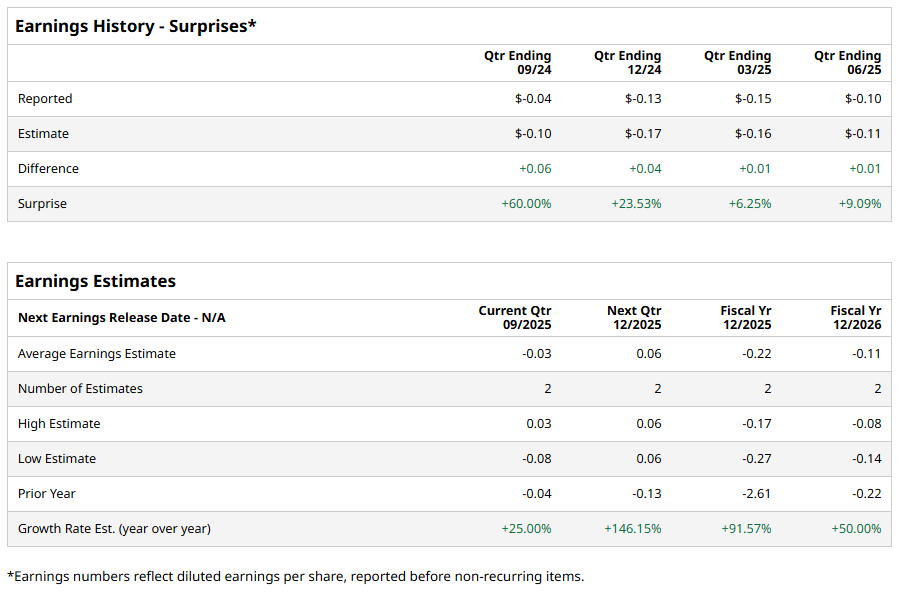

GoPro Beats on Earnings

GoPro reported second-quarter earnings on Aug. 11. Revenue was $153 million, down 18% from a year ago. The company reported a loss of $0.10 per share, but that was a penny better than analysts had expected. The report continued GoPro’s recent trend of managing to beat on earnings but still recording net losses.

The company reported sales of 500,000 camera units, down 23% from a year ago, and that GoPro subscriber count dropped 3% to 2.45 million. Retail revenue makes up 79% of GoPro’s overall revenue, but that was down 19% from a year ago. Revenue from the company’s website and subscriptions was down 16% from the same period last year.

“Our priorities for the balance of 2025 and into 2026 continue to be managing operating expenses, protecting our (intellectual property), and launching new products, which we believe will return GoPro to both unit and revenue growth, and improve profitability, starting in the fourth quarter of this year,” CEO Nicholas Woodman said.

Part of that involves the company’s new AI program. GoPro’s opt-in program allows subscribers to monetize their GoPro cloud-based videos by making them available to train AI models. GoPro says subscribers will earn 50% of the licensing revenue that GoPro expects to generate. The company says it has 13 million hours of video that potentially could be in the program. It also announced on Aug. 26 that subscribers have already opted in more than 125,000 hours of content.

The company issued third-quarter guidance for revenue of $160 million, down 38% from a year ago, and a loss of $0.04 per share.

What Do Analysts Expect for GPRO Stock?

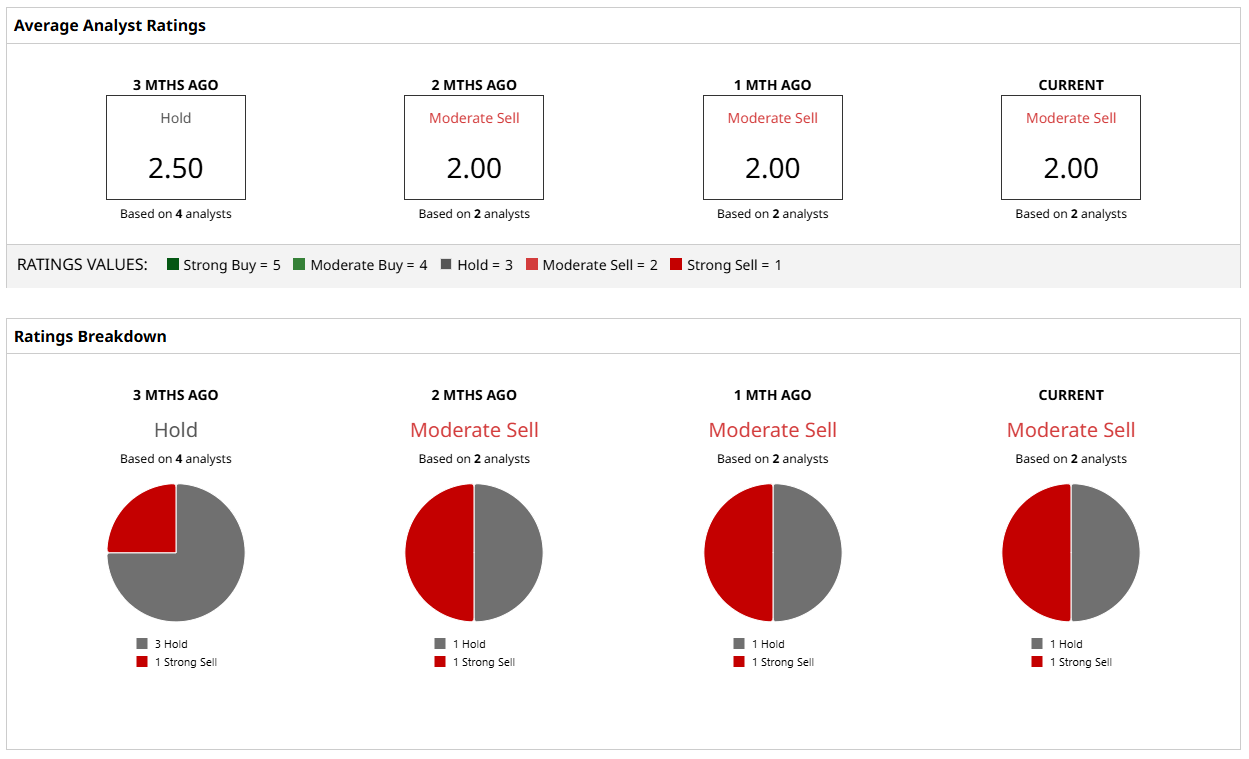

Only two analysts currently cover GoPro, but that’s to be expected because the company has a low market capitalization. One lists GPRO stock as a “Strong Sell” and the other has the stock as a “Hold.”

Both analysts have a price target of $0.80 on GoPro stock, indicating potentially a 53% drop in the coming months. Until GoPro demonstrates consistent profitability and stabilizes its subscriber base, Wall Street’s outlook suggests caution is warranted. Considering the company’s continued lack of profits, its shrinking customer base, and analyst sentiment, GoPro appears to be a risky investment now.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English