Dynatrace (DT): Evaluating Valuation After Oppenheimer’s Bullish Coverage and Growth Narrative

Dynatrace (DT) Catches a Bid After Oppenheimer's Bullish Initiation

If you have been watching Dynatrace (DT), you probably noticed the spark today. Shares jumped 3.1% after Oppenheimer started coverage with a decidedly upbeat view, highlighting the company’s expanding footprint in cloud observability software. The trigger was strong confidence in Dynatrace’s technological edge, particularly its Grail data lakehouse and AI-powered Davis engine. There are also signs that new sales strategies and moves into log management and security could accelerate revenue growth.

This upside comes at an interesting time for the stock. While Dynatrace has managed only a modest 1% gain over the past year, that headline number does not tell the full story. The past month has been weaker, but over the past three years the stock has shown significantly stronger momentum, up 39%. Positive news like today's raises questions about whether the market's expectations are still conservative or if the tide is starting to turn. Meanwhile, investors remain focused on how the company’s competitive advantages might influence long-term performance.

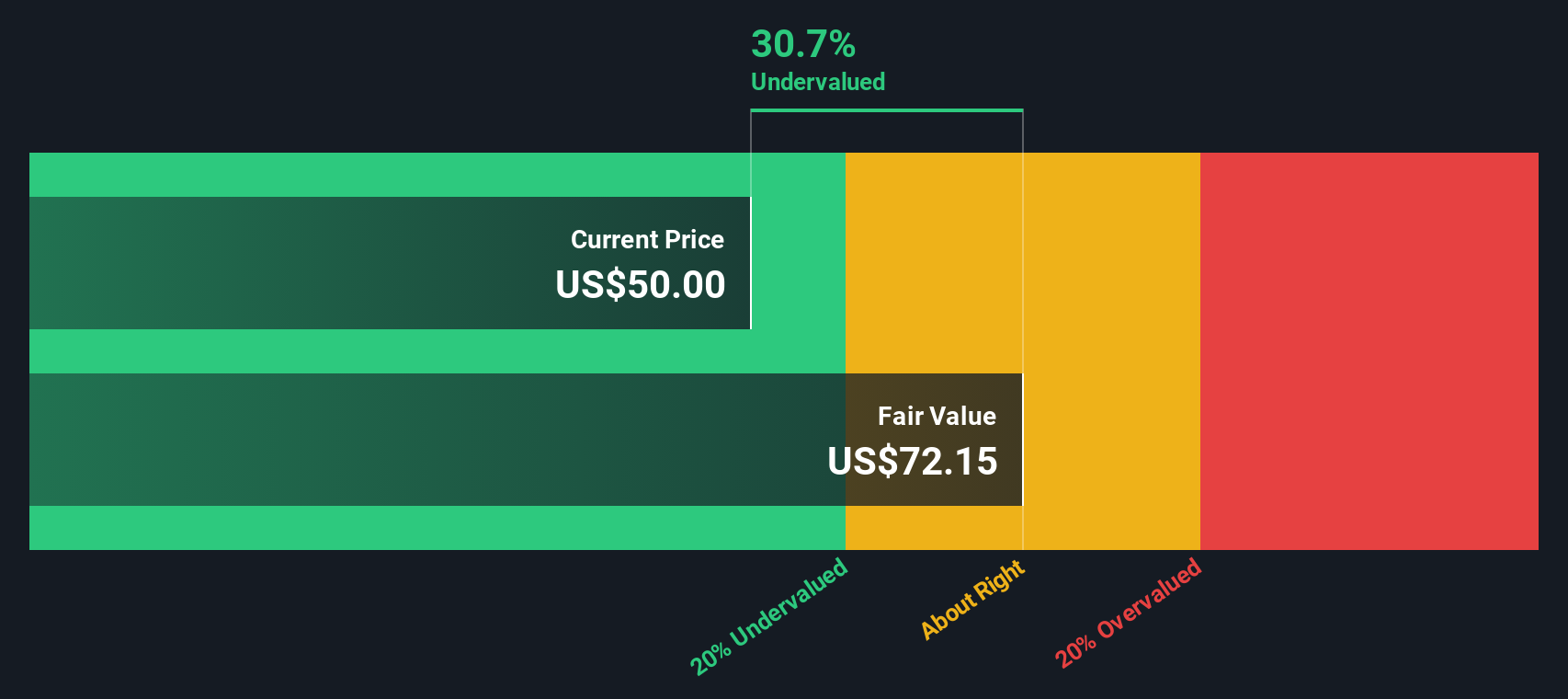

With Dynatrace’s latest bounce, the question is whether the market is still underestimating its growth, or if recent optimism is already reflected in the stock's price. Is this a buying window, or are expectations running ahead of reality?

Most Popular Narrative: 19% Undervalued

According to community narrative, Dynatrace is currently trading at a notable discount to its fair value. The market appears to be underestimating the company's future growth trajectory, with analysts widely in agreement that there is significant upside potential from current levels.

Dynatrace is well positioned to capture incremental share of the expanding addressable market created by enterprises accelerating digital transformation and cloud modernization initiatives. This is evidenced by multi-million dollar, end-to-end observability deals and a pipeline heavily weighted toward large, strategic consolidations. These developments are catalyzing sustained revenue growth and increased average ARR per customer over time.

Want to know why analysts think Dynatrace could outperform? This forecast is powered by bold growth projections and aggressive margin assumptions that might surprise you. Curious about the key numbers and future targets anchoring this narrative's high valuation? Dig deeper into the forecast and discover the foundational figures driving this claim of undervaluation.

Result: Fair Value of $63.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, competitive pressure from hyperscalers and longer enterprise deal cycles could challenge Dynatrace’s growth story if conditions shift unexpectedly.

Find out about the key risks to this Dynatrace narrative.Another View: Sizing Up the SWS DCF Model

Taking a step back from analyst targets, our SWS DCF model offers its own perspective. This method also indicates Dynatrace is undervalued, but reaches that conclusion using the company’s future cashflow assumptions. Which view aligns most closely with reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dynatrace Narrative

If you are unconvinced by these perspectives or want to take your own approach, it is quick and easy to craft your own insights. Do it your way.

A great starting point for your Dynatrace research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are ready to step up your investing game, do not let new opportunities pass you by. The Simply Wall Street screener gives you an edge with tailored suggestions you will not want to miss. Check out these hand-picked themes. Each one could be the next game-changer for your portfolio:

- Capitalize on market underdogs by tracking undervalued opportunities. They might deliver the upside you have been searching for with undervalued stocks based on cash flows.

- Seize the moment in healthcare innovation by scouting companies at the intersection of AI and medicine through healthcare AI stocks.

- Start pursuing steady income streams by zeroing in on standout companies offering yields above 3% with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English