The Bull Case For Kanzhun (BZ) Could Change Following Dividend Debut, Buyback Boost and C-Suite Overhaul

- Kanzhun Limited recently announced a series of developments, including strong half year earnings growth, the adoption of an annual dividend policy with a US$80 million initial payout, an increased US$250 million share buyback authorization, and new executive appointments aimed at optimizing governance and efficiency.

- These moves collectively highlight Kanzhun’s commitment to strengthening shareholder returns and signal management’s confidence in the company’s outlook, supported by upbeat revenue guidance for the third quarter.

- We’ll explore how the combination of robust earnings, a new dividend policy, and buyback program shape Kanzhun’s ongoing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kanzhun Investment Narrative Recap

To be a shareholder in Kanzhun, you need to believe that its strengths in AI-powered recruitment and deepening reach into China’s job market will continue to drive user growth and solidify its industry leadership. The recent series of executive changes does not materially alter the most important near-term catalyst, which remains the company’s ability to deliver on its projected revenue growth, while risks linked to demographic headwinds and competitive pressures remain prominent. Kanzhun’s decision to implement an annual dividend policy with an initial payout of US$80 million is particularly relevant, as it reflects management’s intent to return capital to shareholders at a time when the company is reporting strong earnings and providing positive short-term revenue guidance. However, investors should also be aware that despite upbeat earnings, the drop in new verified graduates points to an underlying demographic shift that…

Read the full narrative on Kanzhun (it's free!)

Kanzhun's outlook projects CN¥11.3 billion in revenue and CN¥3.7 billion in earnings by 2028. This requires 13.2% annual revenue growth and a CN¥1.5 billion earnings increase from the current CN¥2.2 billion.

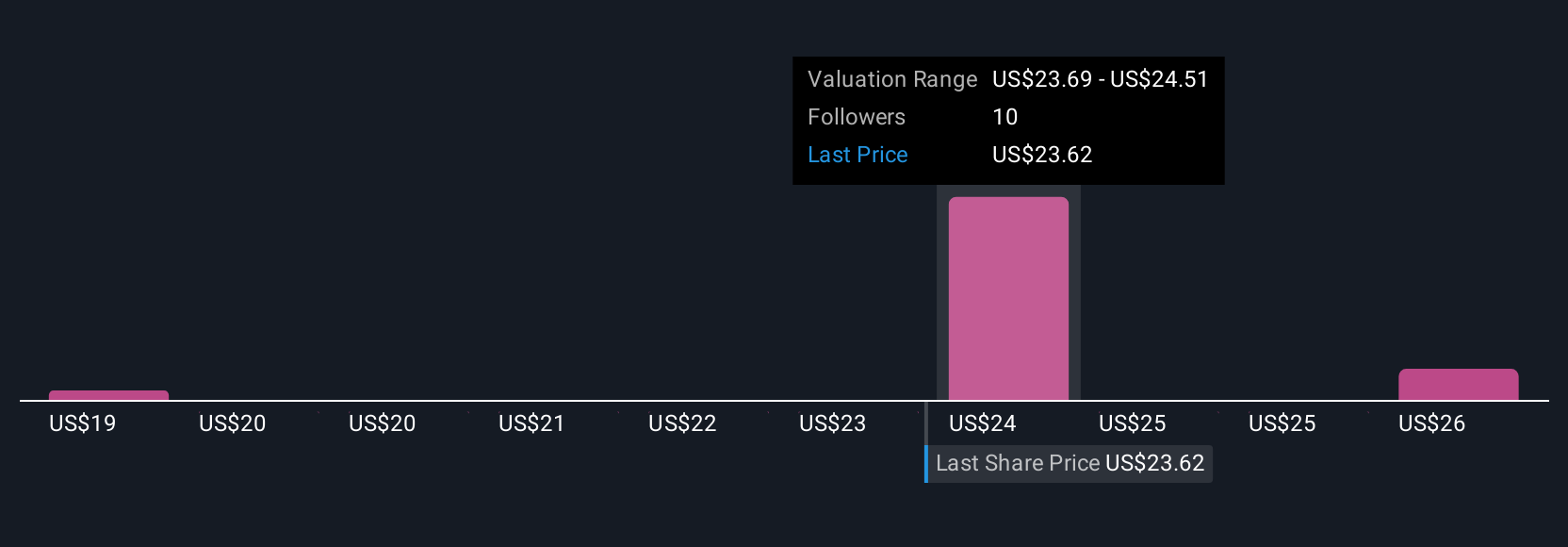

Uncover how Kanzhun's forecasts yield a $23.95 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span a tight range from US$23.95 to US$26.95, with two individual forecasts represented. While recent results have shown strong topline and profit growth, ongoing competition and a shrinking graduate talent pool could influence Kanzhun’s future revenue streams. Explore several contrasting viewpoints on what could come next.

Explore 2 other fair value estimates on Kanzhun - why the stock might be worth as much as 17% more than the current price!

Build Your Own Kanzhun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kanzhun research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kanzhun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kanzhun's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English