Investors Are Looking at This 1 Earnings Season Clue for the Next Big Pop in Palantir Stock

Palantir (PLTR) remains in focus this morning after its artificial intelligence (AI) peer MongoDB (MDB) said its cloud-native platform Atlas grew 29% on a year-over-year basis in its fiscal Q2.

Investors are cheering the MDB announcement primarily because it signals continued demand for AI data infrastructure, a core competency for Denver-headquartered PLTR.

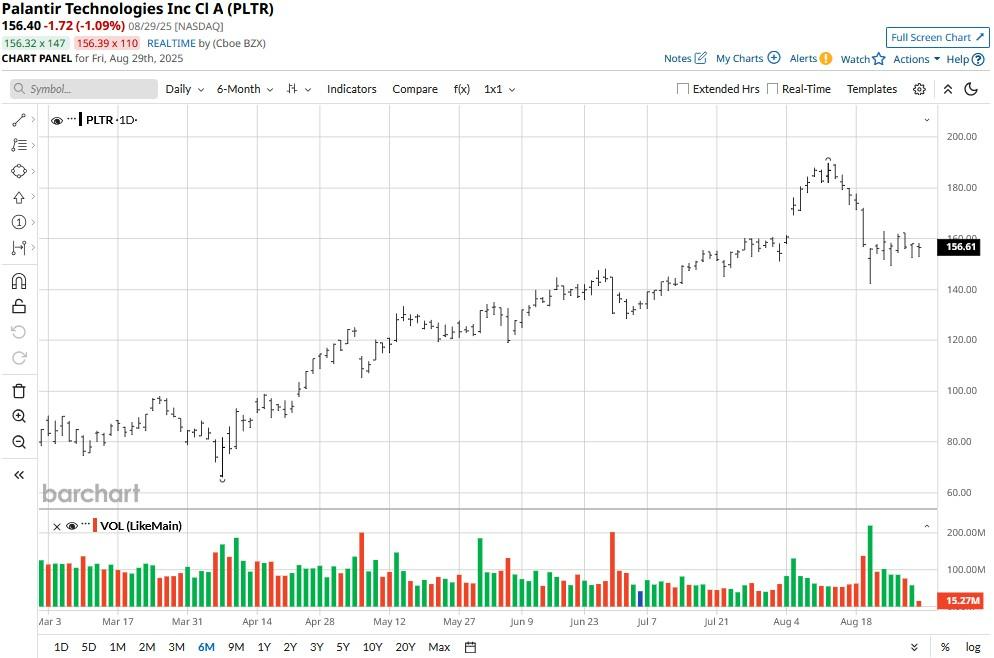

Valuation concerns triggered a significant pullback in Palantir stock this month. However, the data analytics specialist remains up more than 140% versus its April low.

Why MongoDB Earnings Bode Well for Palantir Stock

MongoDB recording exceptional growth in Atlas revenue indicates surging enterprise demand for scalable AI data infrastructure, a home ground for PLTR through platforms like Foundry and AIP.

MDB earnings validate the broader market appetite for AI-native solutions, suggesting Palantir’s offerings are well-positioned for accelerated adoption ahead.

As investors continue to reward names with real AI traction, MDB’s momentum acts as a bullish proxy for PLTR stock, reinforcing its relevance in mission-critical data environments.

Since Palantir’s commercial growth is already accelerating, MongoDB’s beat could foreshadow upside in PLTR’s next earnings cycle, making it a timely play on the AI infrastructure boom.

James Cakmak Recommends a Small Position in PLTR Shares

Despite an explosive rally in Palantir shares over the past four months, seasoned equity research analyst James Cakmak remains bullish on them as a core long-term holding.

Palantir is “a company that’s will permeate every single aspect of corporations around the world,” he told CNBC in a recent interview.

However, the market expert believes valuation is a legit concern for PLTR shares at the $160 level, which is why “you have to own it, but at smaller size than what it would have been, call it 6 months ago.”

Wall Street Remains Cautious on Palantir Technologies

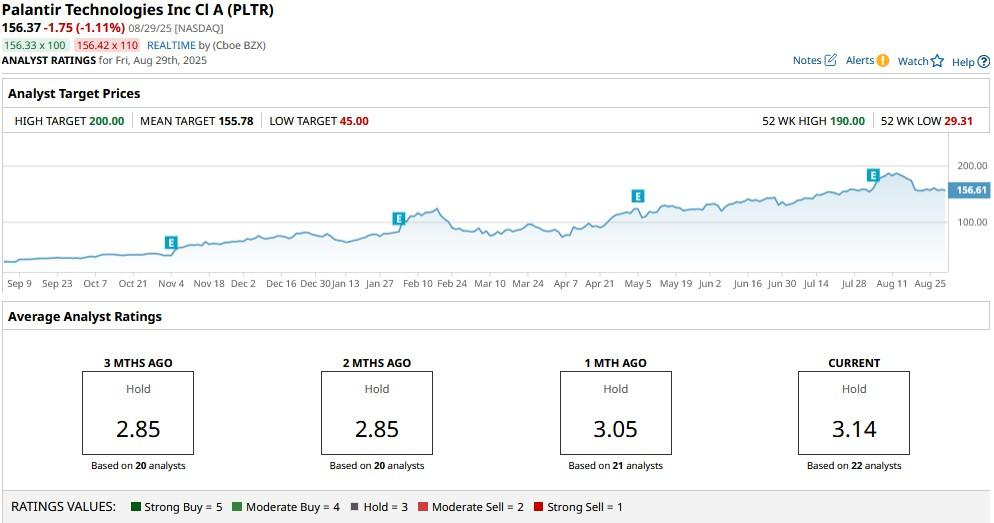

Wall Street analysts also recommend caution in initiating a position in Palantir shares at the current price.

According to Barchart, the consensus rating on PLTR stock currently sits at “Hold” only, with the mean target of roughly $156 indicating a lack of further upside from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English