Can B1 Shipments Push QuantumScape Closer to 2026 Road Testing?

QuantumScape Corp. QS is edging closer to the moment investors have been waiting for — real-world validation of its solid-state batteries. In the second quarter of 2025, the company shipped its final Raptor-based B0 samples for pack integration and safety testing. The next stage will be B1 samples, built using the more advanced Cobra process.

This matters because B1 shipments are not just about lab performance. QuantumScape says the program is designed as a “low volume, high visibility” project that will put its cells into real-world vehicle applications. The goal is to generate customer feedback and pave the way for field testing in 2026.

The Cobra process, which replaces the older Raptor method, is the key here. It boosts ceramics production efficiency dramatically, allowing QuantumScape to produce more reliable cells at higher volumes. That step-up is essential as the company works to prove that its technology can be scaled beyond the lab.

For investors, the upcoming B1 milestone signals that QuantumScape is moving beyond promises and into practical demonstrations. If the 2026 road tests confirm the company’s claims of faster charging, higher energy density and improved safety, it could lead to a serious momentum toward commercialization.

That said, the challenges of scaling remain significant, but B1 shipments would mark progress that investors will be closely watching. QuantumScape is no longer just talking about revolutionizing EV batteries— it is preparing to put them on the road.

Competitors to Watch

Solid Power, Inc. SLDP operates a roll-to-roll production line in Colorado, producing prototype all-solid-state lithium metal batteries. Solid Power is working with strategic partners like BMW to validate these prototypes. In September 2024, Solid Power secured a $50 million U.S. Department of Energy grant to expand electrolyte manufacturing, targeting 75 metric tons in 2026 and expanding further to 140 metric tons by 2028.

SES AI Corp. SES is developing AI-enhanced lithium-metal batteries through its Molecular Universe platform. SES AI showcased its new 2170 cylindrical cell early this year, highlighting applications in robotics and drones. With over $9.3 million in H1 2025 revenues, SES AI is building commercial traction and emphasizes AI-driven material discovery across Asia, Europe and U.S. partnerships.

The Zacks Rundown on QuantumScape

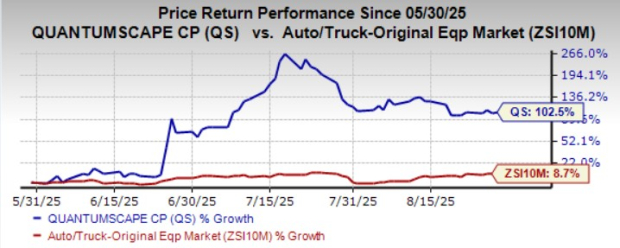

Shares of QS have increased around 102% over the past three months compared with the industry’s gain of 9%.

Image Source: Zacks Investment Research

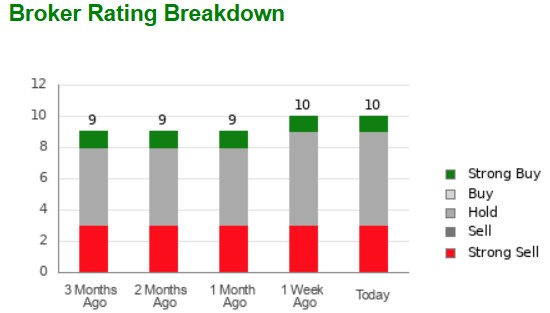

Image Source: Zacks Investment Research

QuantumScape currently has an average brokerage recommendation (ABR) of 3.4 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by nine brokerage firms.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

See how the Zacks Consensus Estimate for QS’ earnings has been revised over the past 90 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SES AI Corporation (SES): Free Stock Analysis Report

QuantumScape Corporation (QS): Free Stock Analysis Report

Solid Power, Inc. (SLDP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English