State Street (STT) Secures Global Back Office Services Deal With Columbia Threadneedle

Columbia Threadneedle Investments recently selected State Street (STT) as its service provider for a global back office, enhancing its operational scope and potentially impacting investor sentiment positively. Over the last quarter, State Street's share price increased 20%, coinciding with broader market trends. This gain may have been supported by the Columbia Threadneedle partnership along with other developments like dividend increases and share buybacks. However, the gains align with the broader market rise of 17% over 12 months, suggesting that while these events added strength to the stock's performance, they were part of a general upward trend in the market.

Every company has risks, and we've spotted 2 risks for State Street you should know about.

The recent collaboration between Columbia Threadneedle Investments and State Street (STT) as a service provider, while reflecting an effort to enhance operational capacity, could further fuel investor confidence in STT's strategic direction. Over the longer term, State Street's total return, combining share price appreciation and dividends, rose 100.89% over the past five years, showcasing its robust growth trajectory. Despite the recent 20% share price increase aligning with the market's upward trend, STT's performance over the past year has been on par with the US Capital Markets industry, returning 33.9% compared to the broader market's 17.5% rise.

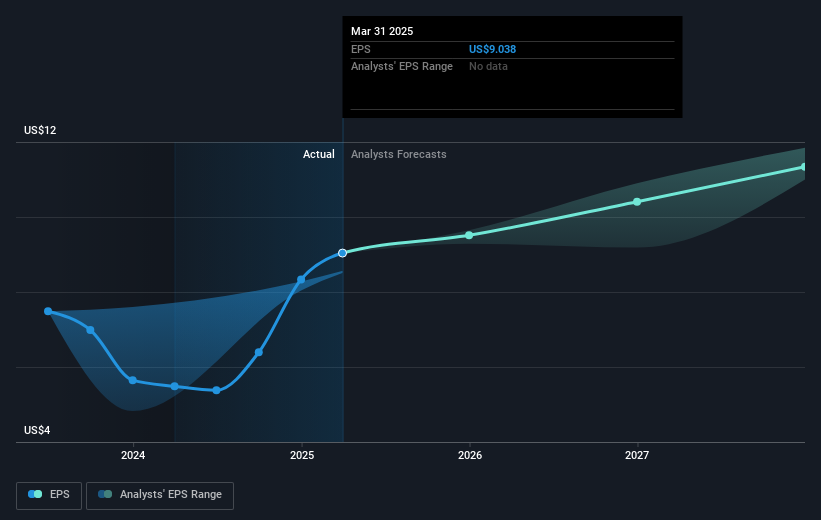

Should the Columbia Threadneedle partnership translate into tangible revenue increments, this could potentially refine earnings forecasts. Currently, analysts predict an annual revenue growth of approximately 3.2% over the next few years. Given the consensus price target for STT stands at US$115.11, only slightly below the current share price of US$115.24, the present market dynamics appear to view STT as fairly valued. Maintaining alignment with analyst expectations will be critical, particularly in navigating through future revenue and earnings landscapes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English