Why Coeur Mining (CDE) Is Up 8.9% After Beating Q2 Earnings and Paying Down Debt

- Earlier this week, Coeur Mining reported second quarter financial results that surpassed expectations, highlighted by free cash flow of US$146 million and earnings per share of US$0.20, both above analyst consensus.

- The company further improved its financial strength by expanding its treasury and fully paying off its US$110 million revolving credit facility, showcasing disciplined balance sheet management.

- With the company exceeding cash flow and earnings forecasts, we'll explore how this operational momentum might influence its investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coeur Mining Investment Narrative Recap

To be a Coeur Mining shareholder today often means believing in the company’s potential to capitalize on robust demand for gold and silver, supported by operational momentum at key assets like Rochester and Las Chispas. The recent earnings outperformance and strong free cash flow improve financial stability, but they do not fundamentally alter the biggest short-term catalyst, continued production ramp-up at core mines, or the largest risk, which remains regulatory and permitting delays that could impact project timelines.

Among recent updates, the completed tranche of the share buyback program stands out in the context of the company’s surplus free cash flow. While buybacks can offer short-term support to share price and signal balance sheet strength, they do not directly address the ongoing need to replace depleting reserves through exploration and permitting, which remains critical to the longer-term investment narrative.

In contrast, investors should also remain alert to the potential for permitting or regulatory setbacks to delay future expansion projects...

Read the full narrative on Coeur Mining (it's free!)

Coeur Mining's outlook anticipates $2.1 billion in revenue and $676.1 million in earnings by 2028. This forecast requires 12.8% annual revenue growth and a $485.4 million increase in earnings from the current $190.7 million.

Uncover how Coeur Mining's forecasts yield a $12.86 fair value, in line with its current price.

Exploring Other Perspectives

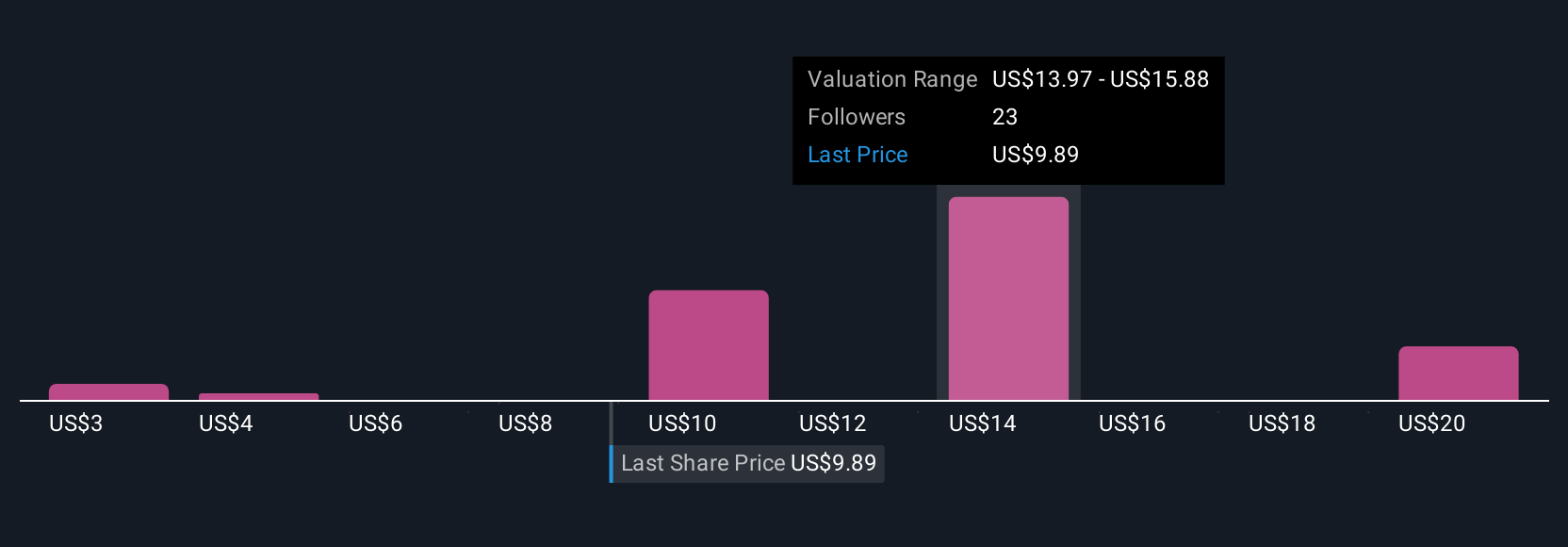

Simply Wall St Community members contributed 9 fair value estimates for Coeur Mining ranging from US$2.52 to US$24.37 per share. While opinions diverge widely, the company’s ongoing reliance on new permits highlights why broad perspectives matter when assessing performance and future opportunity.

Explore 9 other fair value estimates on Coeur Mining - why the stock might be worth less than half the current price!

Build Your Own Coeur Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coeur Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coeur Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coeur Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English