CommScope (COMM): Assessing Valuation After DOCSIS 4.0 Breakthrough and Enhanced Interoperability

Most Popular Narrative: 15.6% Undervalued

According to community narrative, CommScope Holding Company is seen as undervalued, with an estimated fair value 15.6% above the current market price.

The ongoing rollout of DOCSIS 4.0 amplifiers and next-generation networking products, fueled by increased investments from major cable operators, positions CommScope's ANS segment to take advantage of long-term demand for higher-speed broadband and infrastructure upgrades and supports sustained revenue growth.

Curious what ambitious growth benchmarks lie beneath this bullish price target? The analysis combines expectations of higher future profit margins and a premium profit multiple that is not commonly seen in the industry. Want to find out which precise projections give this narrative its edge? Keep reading for the full valuation breakdown.

Result: Fair Value of $19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected DOCSIS 4.0 adoption or increased reliance on a handful of customers could quickly undermine these optimistic projections.

Find out about the key risks to this CommScope Holding Company narrative.Another View: Our DCF Model Tells a Different Story

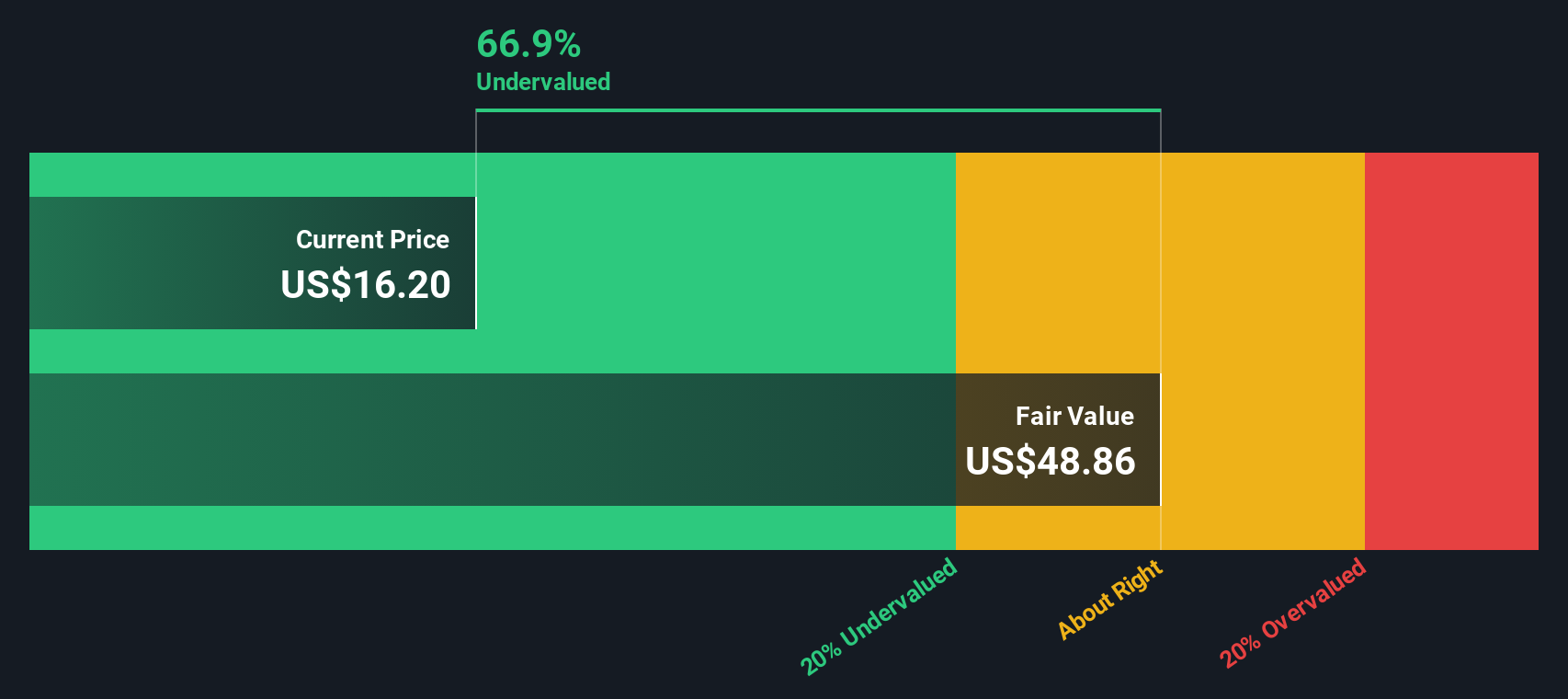

While the community sees value based on market pricing, our DCF model takes a different approach by projecting long-term cash flows. Interestingly, this method also signals CommScope remains undervalued. Which story carries more weight for you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CommScope Holding Company Narrative

If you see things differently or want to craft your own perspective, you can build a personalized CommScope narrative in just a few minutes. Do it your way.

A great starting point for your CommScope Holding Company research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Don't let your next portfolio winner slip by. The Simply Wall Street Screener helps you spot top opportunities across dynamic markets and sectors. Here are three unique ways you can seize the advantage right now:

- Uncover fast-growing small companies with solid financials and long-term potential by checking out our handpicked group of penny stocks with strong financials.

- Tap into the artificial intelligence trend and target tomorrow’s innovators leading the charge in smart technology with our list of AI penny stocks.

- Target stocks trading below their fundamental value and potentially poised for strong appreciation by using our exclusive collection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English