Should Harley-Davidson’s (HOG) Securitized Loan Sale to KKR and PIMCO Prompt Investor Action?

- Earlier this week, Harley-Davidson, Inc. announced the completion of a major transaction, selling 95% of its residual interests in securitized consumer loan receivables to KKR and PIMCO, as part of its ongoing efforts to transform Harley-Davidson Financial Services into a capital-light financing business.

- This move marks a substantial advancement in Harley-Davidson's strategy to unlock cash, reduce leverage, and reshape its financial services operations through a high-profile partnership with global investors.

- To understand how the transformed financial services model could impact growth, we’ll examine the implications for Harley-Davidson’s overall investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Harley-Davidson Investment Narrative Recap

To be a Harley-Davidson shareholder today, you need to believe the company can counter persistent weak motorcycle sales, demographic pressures, and a volatile tariff outlook while capitalizing on its brand and new growth initiatives. The recent sale of financial receivables to KKR and PIMCO is an important step in the shift to a capital-light model, but the impact on near-term revenue growth and ongoing consumer demand challenges appears limited at this stage.

Among the latest announcements, the Q3 dividend affirmation stands out as most relevant to this news event. This steady payout signals management’s ongoing commitment to returning capital to shareholders, even as they pursue business transformation and take steps to unlock cash for growth and efficiency, key elements as they address critical catalysts for future performance.

However, investors should also be aware that while Harley-Davidson seeks to unlock capital, the bigger risk remains unchanged: persistently weak global retail sales and ongoing consumer demand uncertainties...

Read the full narrative on Harley-Davidson (it's free!)

Harley-Davidson's narrative projects $3.9 billion in revenue and $390.5 million in earnings by 2028. This requires a 4.4% annual revenue decline and a $147.7 million increase in earnings from the current $242.8 million.

Uncover how Harley-Davidson's forecasts yield a $29.33 fair value, in line with its current price.

Exploring Other Perspectives

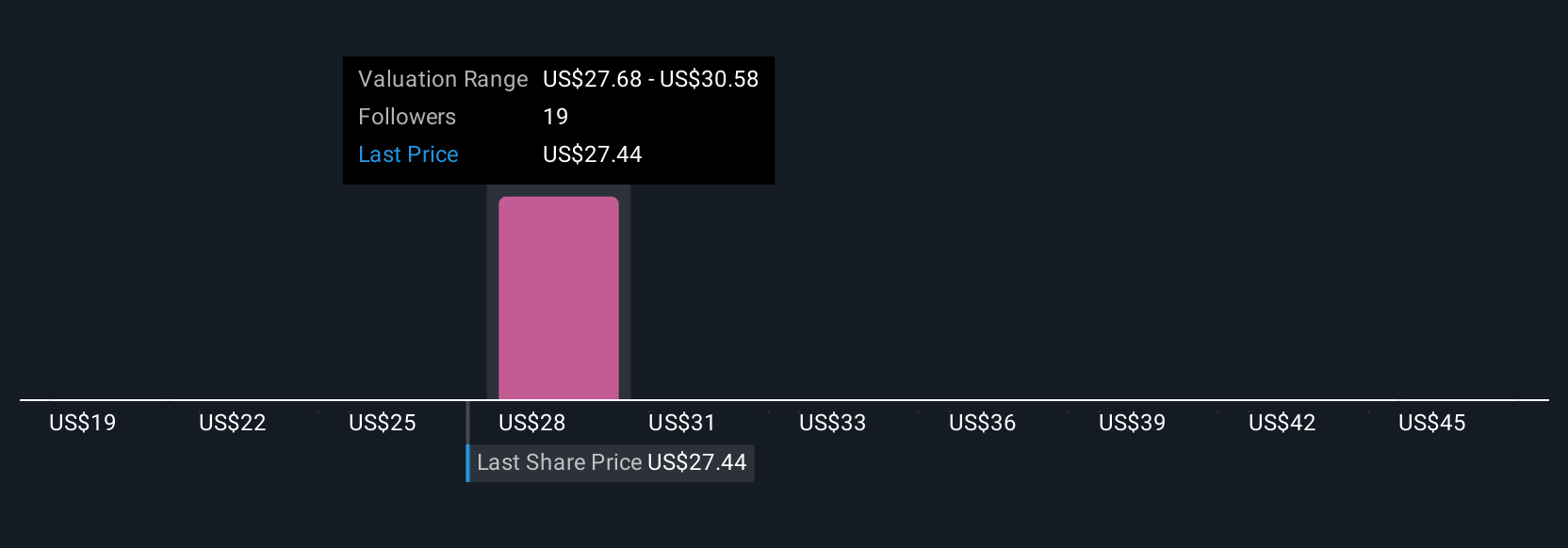

Simply Wall St Community fair value estimates for Harley-Davidson, Inc. range from US$19 to US$47.94, based on four unique viewpoints. With forecasts still highlighting risks in core sales and top-line growth, readers can explore how widely opinions differ on future returns and challenges.

Explore 4 other fair value estimates on Harley-Davidson - why the stock might be worth 35% less than the current price!

Build Your Own Harley-Davidson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harley-Davidson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Harley-Davidson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harley-Davidson's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English