Did the Expanded East Buy Deal Just Shift New Oriental Education Group's (EDU) Investment Narrative?

- On August 22, 2025, East Buy Holding Limited announced the renewal and expansion of its framework agreement with New Oriental Education & Technology Group, covering the sale of private label and e-commerce-related products through May 2026.

- This renewed collaboration signals intensified cross-company activity in fast-growing segments like livestreaming e-commerce, potentially unlocking wider product offerings and operational integration.

- We'll examine how the renewal and expansion of this commercial partnership could influence New Oriental Education & Technology Group's investment outlook.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

New Oriental Education & Technology Group Investment Narrative Recap

To invest in New Oriental Education & Technology Group, you need to see value in its ability to adapt and capitalize on new business verticals like livestreaming e-commerce and private label sales, while managing risks linked to regulatory pressures and shifting demand in core education markets. The renewed and expanded deal with East Buy supports diversification efforts, but does not fundamentally change the company’s immediate catalyst, ongoing consumer adoption of non-academic and AI-powered learning solutions, nor does it fully offset margin and market share risks from intensifying competition in K-12 and non-academic segments.

Among recent announcements, the July 30, 2025, reporting of a US$60.3 million impairment in the kindergarten operation stands out, highlighting how regulatory shifts and demographic pressures can challenge even diversified segments. When put in context, this underscores the importance of growing revenue streams like livestreaming e-commerce and AI-driven products for supporting margins and balancing downside from legacy businesses.

Yet, despite these efforts, the heightened competition in both traditional and emerging segments remains a factor every investor should be aware of, especially if ...

Read the full narrative on New Oriental Education & Technology Group (it's free!)

New Oriental Education & Technology Group is projected to reach $6.5 billion in revenue and $628.5 million in earnings by 2028. This outlook assumes a 9.7% annual revenue growth rate and a $256.8 million increase in earnings from the current $371.7 million.

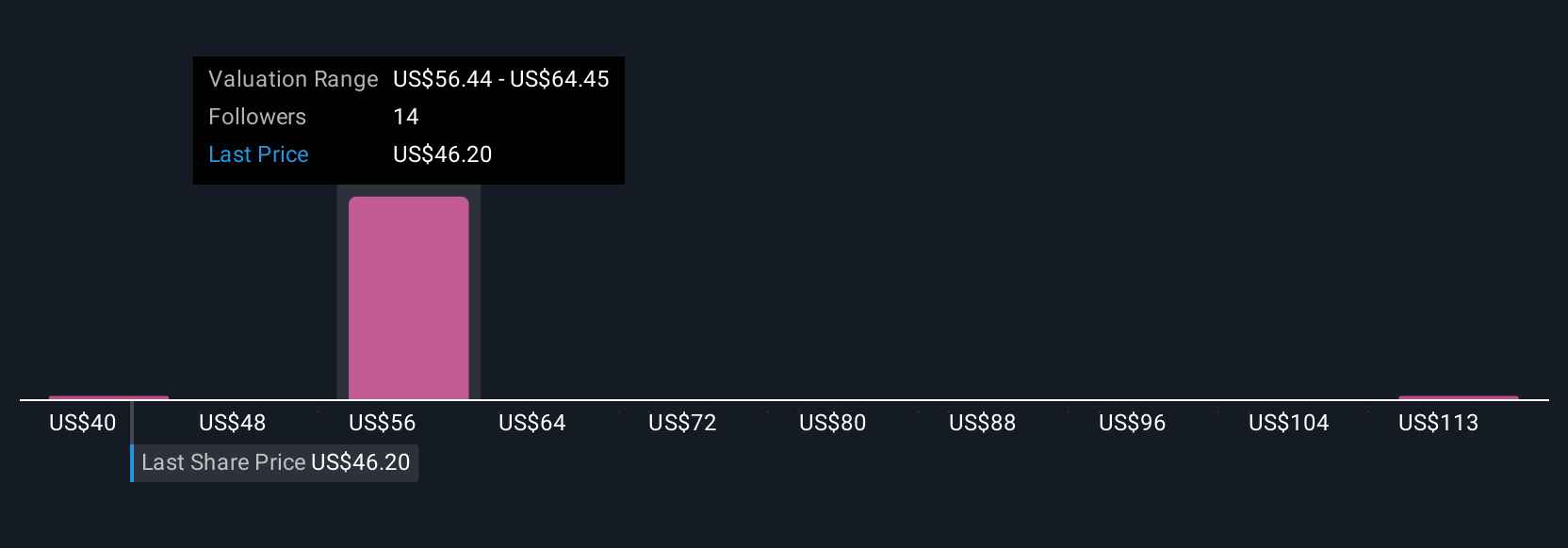

Uncover how New Oriental Education & Technology Group's forecasts yield a $57.61 fair value, a 20% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for New Oriental Education & Technology Group range from US$38.65 to US$121.44 based on four analyses. Even as opinions diverge, the latest agreement with East Buy highlights the company’s ongoing pursuit of product innovation and revenue diversification that could shape future performance, make sure to explore the range of these independent viewpoints.

Explore 4 other fair value estimates on New Oriental Education & Technology Group - why the stock might be worth over 2x more than the current price!

Build Your Own New Oriental Education & Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free New Oriental Education & Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Oriental Education & Technology Group's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English