Why CVR Energy (CVI) Is Up 11.8% After Major EPA Waivers Slash Renewable Credit Costs

- Recently, the Environmental Protection Agency granted CVR Energy’s subsidiary, Wynnewood Refining Company, waivers for Renewable Fuel Standard compliance from 2017 through 2024, covering more than 400 million renewable fuel credits.

- This regulatory change could substantially reduce CVR Energy’s financial obligations related to renewable fuel credits and ease compliance challenges for the company.

- We'll explore how these EPA waivers could reshape CVR Energy's future compliance costs and broader investment outlook going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CVR Energy Investment Narrative Recap

Owning shares in CVR Energy means believing the company can effectively manage risks tied to refinery operations, regulatory obligations, and swings in earnings, while capitalizing on catalysts like improved throughput and cost relief. The newly granted EPA waivers meaningfully lower a key compliance burden in the near term, directly affecting what has been the biggest short-term risk: rising costs under the Renewable Fuel Standard; however, recent earnings pressures and operational challenges remain important watchpoints.

The recent announcement that CVR Energy will not pay a cash dividend for the first quarter of 2025 is highly relevant, given how regulatory relief from the EPA could support future profitability but has yet to materially change the company's near-term cash flow decisions. This move reaffirms that while cost relief from waivers is significant, operational earnings and capital allocation will likely remain under scrutiny as management works through this volatile period, and as executive leadership transitions continue.

In contrast, while compliance risks appear lower now, investors should also be aware that...

Read the full narrative on CVR Energy (it's free!)

CVR Energy's outlook anticipates $8.1 billion in revenue and $101.0 million in earnings by 2028. This calls for a 4.0% annual revenue growth rate and a $434.0 million increase in earnings from the current -$333.0 million.

Uncover how CVR Energy's forecasts yield a $23.50 fair value, a 23% downside to its current price.

Exploring Other Perspectives

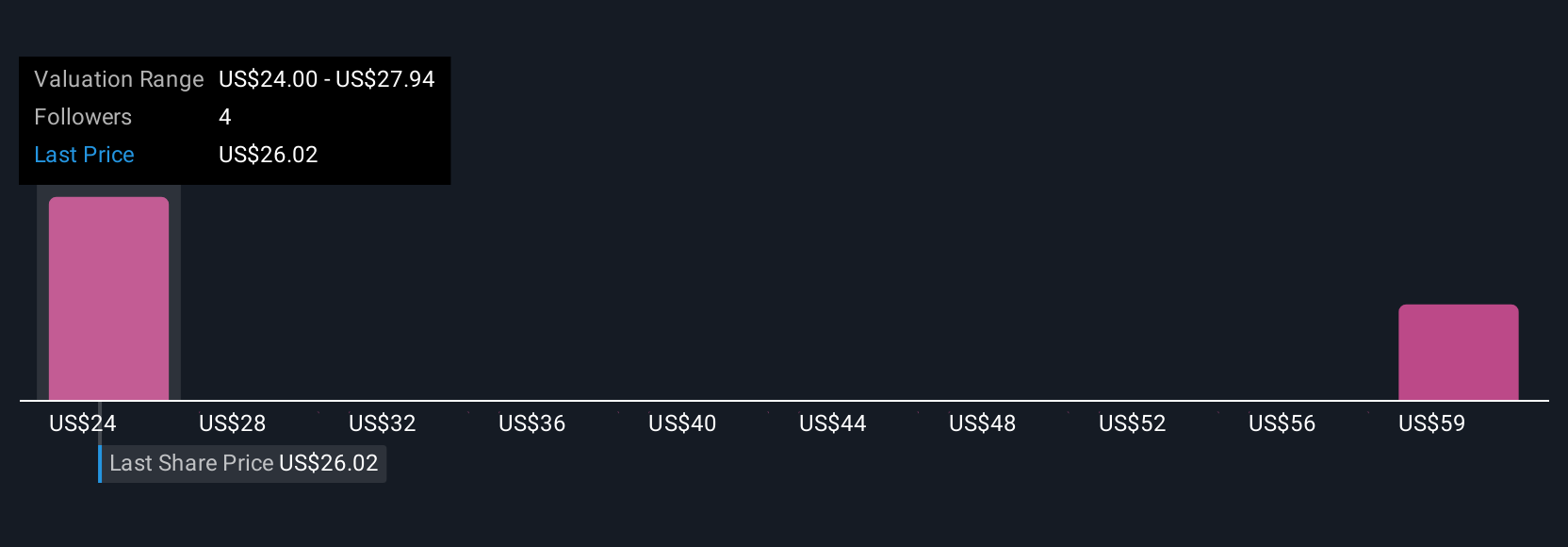

Simply Wall St Community members estimated CVR Energy’s fair value in a narrow US$23.50 to US$26.37 range, with just two viewpoints captured. However, with regulatory costs now sharply reduced, how future margin outcomes evolve remains a crucial question for all perspectives represented here.

Explore 2 other fair value estimates on CVR Energy - why the stock might be worth 23% less than the current price!

Build Your Own CVR Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CVR Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English