Will V.F (VFC)'s New Credit Facility Shift Its Balance Sheet Strategy for the Long Term?

- On August 26, 2025, V.F. Corporation and its subsidiaries entered into a new five-year US$1.50 billion senior secured revolving credit facility with a syndicate of major banks, replacing their previous agreement and including options for multinational and multicurrency borrowing.

- This expanded and flexible credit facility signals a concerted focus on debt management and financial discipline, providing additional liquidity for working capital and corporate initiatives.

- We'll examine how the new revolving credit facility bolsters V.F.'s investment narrative, particularly around enhanced balance sheet flexibility and operational improvements.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

V.F Investment Narrative Recap

To own V.F. Corporation stock, you typically need conviction in its ability to execute a profitable turnaround in core brands like Vans and North Face while managing high debt levels and adapting to evolving consumer preferences. The new US$1.50 billion revolving credit facility meaningfully boosts liquidity and short-term balance sheet flexibility, though it does not directly address the continuing revenue headwinds in core banners, which remain the principal near-term catalyst and risk for the business.

The latest Q1 2026 earnings report is especially relevant here, showing ongoing year-over-year sales declines but improvement in net losses and loss per share. This underscores that despite increased borrowing flexibility, the pressure remains on operational turnaround and revenue stabilization as the key swing factors for both sentiment and results.

By contrast, investors must also keep in mind the persistent risk around...

Read the full narrative on V.F (it's free!)

V.F's narrative projects $10.3 billion in revenue and $571.3 million in earnings by 2028. This requires 2.6% yearly revenue growth and a $466.4 million earnings increase from $104.9 million today.

Uncover how V.F's forecasts yield a $15.19 fair value, in line with its current price.

Exploring Other Perspectives

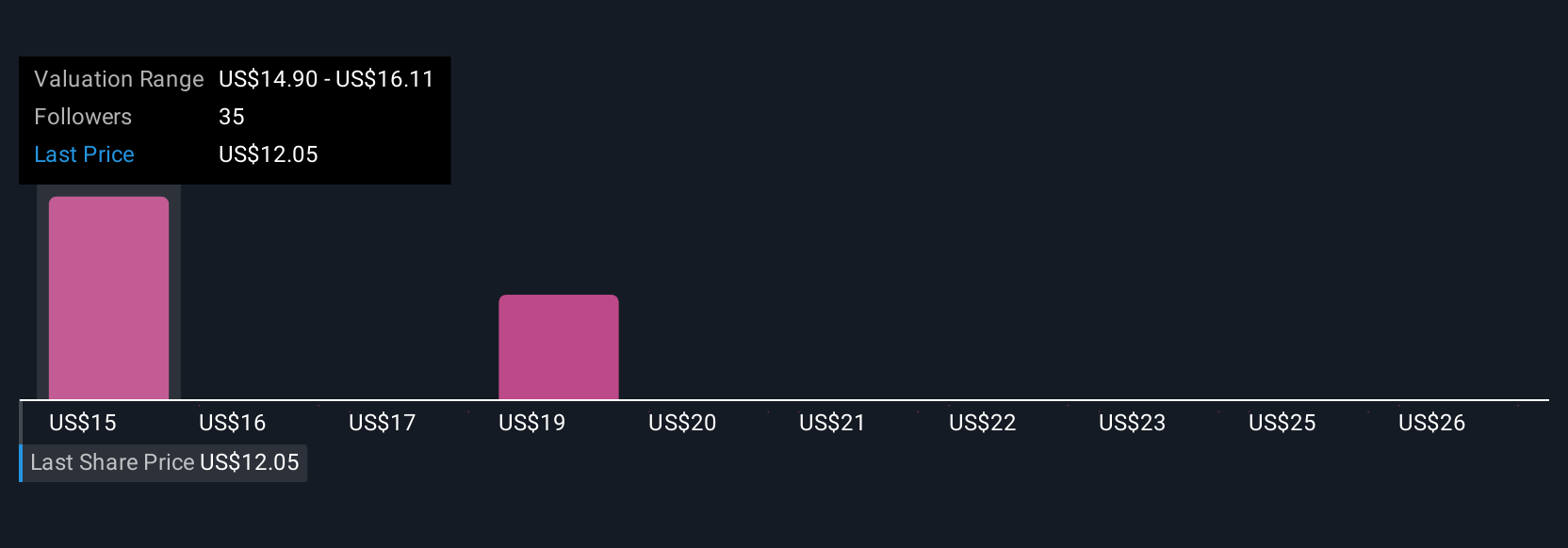

Seven Simply Wall St Community members provided fair value estimates for V.F. ranging from US$10.00 to US$27.06 per share. While revenue turnaround prospects dominate professional views, private investors continue to offer broad and sometimes conflicting expectations for the company's outlook.

Explore 7 other fair value estimates on V.F - why the stock might be worth as much as 79% more than the current price!

Build Your Own V.F Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free V.F research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V.F's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English