Do Insider Moves at Match Group (MTCH) Hint at Shifting Management Confidence During Its Turnaround?

- In recent days, Match Group witnessed significant insider trading activity as Director Ann Mcdaniel sold 5,423 shares and CEO Spencer Rascoff acquired 13,250 shares, following its quarterly report.

- This combination of leadership stock transactions came as the company reported solid Hinge growth but continued revenue challenges at Tinder, all during an ongoing multi-phase business transformation strategy.

- We'll examine how these leadership stock moves reflect operational confidence and risk at a pivotal moment in Match Group's transformation efforts.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Match Group Investment Narrative Recap

To be a shareholder in Match Group today, you need confidence that the company’s three-phase transformation, anchored by Hinge’s product momentum and international growth, can ultimately counteract Tinder’s ongoing revenue declines. The latest leadership stock transactions do not materially shift the significance of Tinder’s turnaround as the most important near-term catalyst, nor do they alter the substantial risk posed by persistent core user metric declines that could pressure long-term growth.

The most relevant update connected to the recent insider trading is Match Group’s second-quarter earnings, where management reiterated a focus on product innovation and international expansion at Hinge amid a challenging period for Tinder. This signals that operational priorities remain unchanged and underscores management’s commitment to delivering growth where user engagement is strongest, even as investor attention stays fixed on whether Tinder can reverse its slide.

Yet, while Hinge is seeing strong gains, the greater risk investors should be aware of is...

Read the full narrative on Match Group (it's free!)

Match Group's narrative projects $4.0 billion in revenue and $811.8 million in earnings by 2028. This requires 5.0% yearly revenue growth and a $274 million earnings increase from $537.8 million today.

Uncover how Match Group's forecasts yield a $38.47 fair value, a 3% upside to its current price.

Exploring Other Perspectives

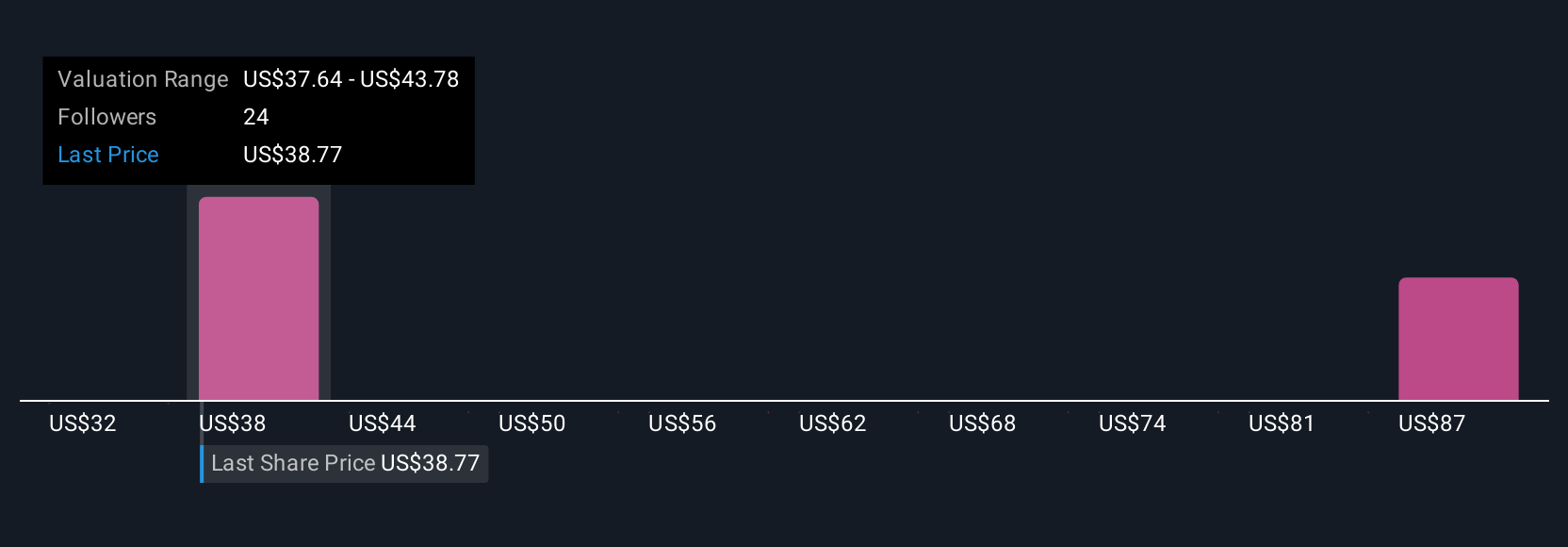

Five fair value estimates from the Simply Wall St Community range widely from US$28 to US$91.39 per share. Even as these opinions diverge, ongoing declines in Match Group’s core user metrics remain a crucial factor that could impact future growth and investor confidence.

Explore 5 other fair value estimates on Match Group - why the stock might be worth 25% less than the current price!

Build Your Own Match Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Match Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Match Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Match Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English