How CommScope’s DOCSIS 4.0 Speed Breakthrough Could Impact COMM Investors

- In August 2025, CommScope achieved record-breaking downstream speeds of 16.25 Gbps in a DOCSIS 4.0 network at the CableLabs interoperability event, showcasing results across multiple vendors and chipsets using its vCCAP Evo platform.

- This achievement highlights the potential for DOCSIS 4.0 to offer fiber-like speeds and increased network flexibility without the high costs of deploying new infrastructure.

- We'll examine how CommScope's DOCSIS 4.0 speed and interoperability breakthrough could shape its investment outlook and competitive positioning.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

CommScope Holding Company Investment Narrative Recap

Investors in CommScope need to believe that the company’s focus on innovation, especially in next-gen network infrastructure, can offset the volatility created by the sale of the CCS segment and greater exposure to cyclical, project-based revenues. While the DOCSIS 4.0 breakthrough at the CableLabs event points to strong technical execution, it does not materially change the near-term risk that comes from customer concentration and the uncertain pace of technology adoption in the ANS segment.

Among the recent announcements, the August 5 agreement to sell its Connectivity and Cable Solutions (CCS) segment stands out. This move reshapes CommScope’s business mix, leaving the company more dependent on the performance of DOCSIS 4.0 and enterprise Wi-Fi products, aligning closely with the short-term catalysts but also heightening exposure to the risks outlined above.

In contrast, investors should pay close attention to possible delays in DOCSIS 4.0 adoption among major cable operator customers...

Read the full narrative on CommScope Holding Company (it's free!)

CommScope Holding Company's outlook anticipates $6.6 billion in revenue and $139.1 million in earnings by 2028. This scenario is based on an expected 11.8% annual revenue growth rate and a $48.8 million increase in earnings from the current earnings level of $90.3 million.

Uncover how CommScope Holding Company's forecasts yield a $19.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives

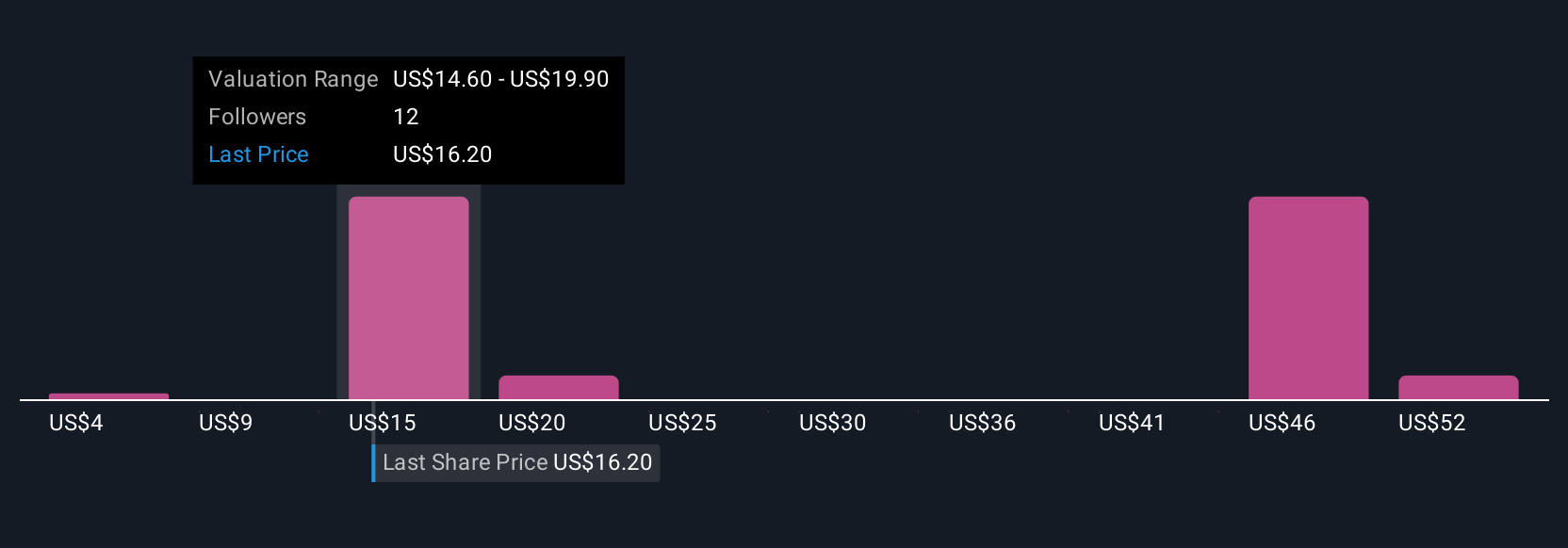

Seven members of the Simply Wall St Community estimate CommScope’s fair value anywhere from US$4 to US$56.99 per share. While many see upside in the company’s sustained revenue growth prospects, uncertainty remains as project-based revenues become more significant after the CCS sale.

Explore 7 other fair value estimates on CommScope Holding Company - why the stock might be worth over 3x more than the current price!

Build Your Own CommScope Holding Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CommScope Holding Company research is our analysis highlighting 4 key rewards and 5 important warning signs that could impact your investment decision.

- Our free CommScope Holding Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CommScope Holding Company's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English