ATRenew (NYSE:RERE): Assessing Valuation After Profitable Quarter and Upbeat Guidance

There is a lot to digest after ATRenew (NYSE:RERE) released its second quarter results. The buzz is real as investors have watched this company swing from losses a year ago to strong profitability, and this latest report serves up more than just good news. ATRenew not only delivered higher earnings and revenue than expected, but also doubled down with an upbeat outlook for its next quarter. For anyone evaluating what to do next with the stock, these events stand to reshape the conversation around growth expectations and risk.

Zooming out, the numbers paint a picture of strong momentum for ATRenew. Over the past year, the share price has nearly doubled, driven by impressive revenue gains and a return to profit. Online secondhand sales have fueled much of the growth. The recent share buyback execution adds another layer of support, and higher revenue guidance suggests management’s confidence is not slowing down.

With all this in mind, the key question becomes: is ATRenew priced right for the growth that could be coming, or has the market already factored in a lot of optimism?

Most Popular Narrative: 32.6% Undervalued

According to the most widely followed narrative, ATRenew is currently seen as significantly undervalued relative to its fair value estimate. This perspective is grounded in ambitious growth projections and an expectation of expanding profit margins driven by favorable industry shifts and internal operational improvements.

The continued integration of government-backed trade-in subsidies and eco-friendly consumption policies is accelerating consumer adoption of device recycling and recommerce in China, presenting a structural long-term tailwind for transaction volume and revenue growth. Rising consumer preference for sustainable consumption and the normalization of secondhand trading, particularly among younger demographics, are expanding ATRenew's addressable market and are likely to drive sustained increases in user acquisition, boosting recurring revenues.

What is really fueling the bullish case? There is a specific set of analyst assumptions behind the company’s perceived value, involving aggressive forecasts and future profit multiples that few in the sector dare to model. Want to discover the bold financial bets shaping just how high this stock could go? The key metrics and what they assume about ATRenew’s future might surprise even longtime market watchers.

Result: Fair Value of $7.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ATRenew’s heavy reliance on government subsidies and rising competition could quickly reverse its growth prospects if either factor changes in an unfavorable way.

Find out about the key risks to this ATRenew narrative.Another View: Market Multiples Paint a Different Picture

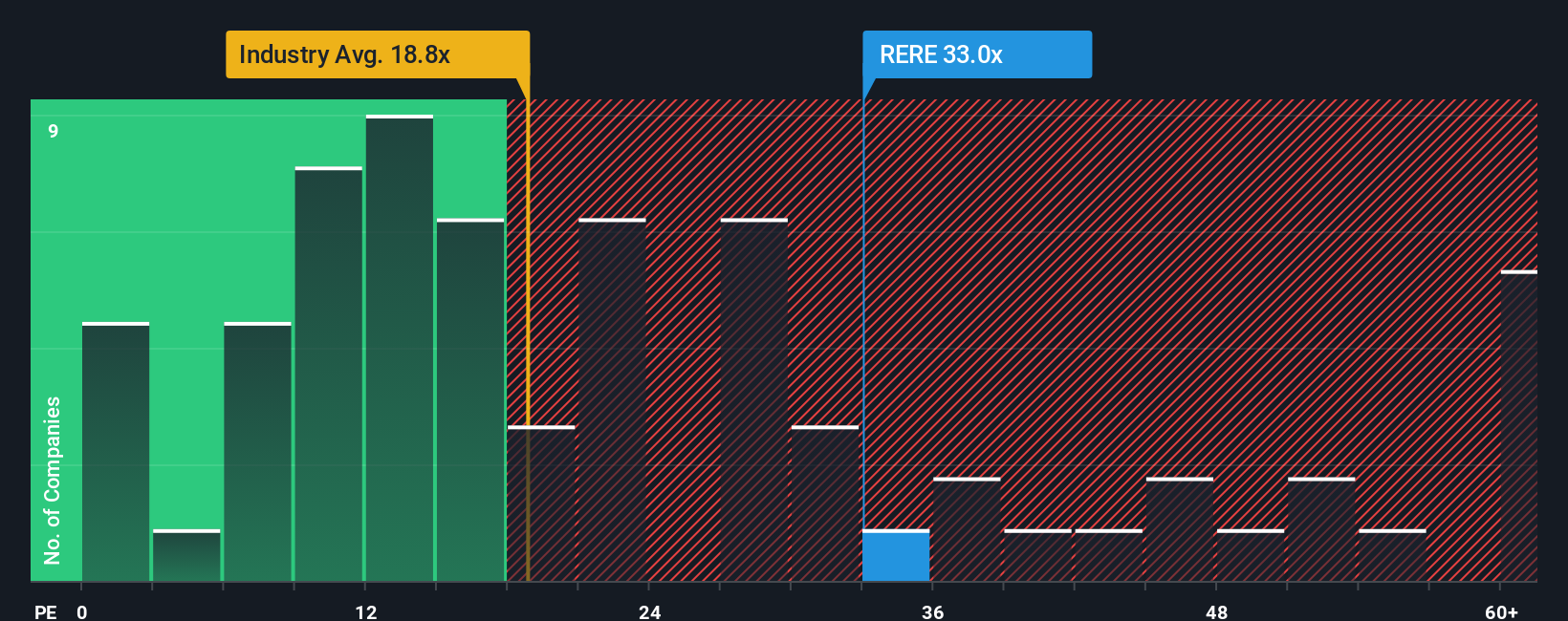

While one approach flags ATRenew as undervalued, analysis based on its price-to-earnings ratio suggests the shares may look expensive compared to the overall industry. Are the market’s expectations too high, or is growth still underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ATRenew Narrative

If you have a different perspective or want to dig into the numbers yourself, you’re free to craft your own view of ATRenew in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ATRenew.

Looking for More Investment Ideas?

Expand your horizons by tapping into other hot investment themes that savvy investors are tracking. Miss these, and you might miss out on your portfolio’s next big win.

- Unlock consistent income streams by reviewing leading opportunities among dividend stocks with yields > 3%.

- Ride the surge of innovation by targeting companies transforming healthcare with breakthroughs in artificial intelligence with healthcare AI stocks.

- Seize early-stage potential and strong balance sheets by zeroing in on fast-moving upstarts using penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English