HP Stock Forecast: Can AI PCs and Windows 11 Refresh Take HPQ Higher?

While Nvidia’s (NVDA) earnings got all the attention this week, HP Inc (HPQ) also reported its earnings the same day. HPQ stock gained 4.6% on Thursday, Aug. 28, which helped it bridge its year-to-date losses to 12.3%. In this article, we’ll look at the key takeaways from HP’s fiscal Q3 2025 earnings and examine whether the stock is a buy.

Key Takeaways from HP’s Earnings

HP reported net revenues of $13.9 billion in the quarter, up 3.1% from the corresponding quarter last year, and representing the fifth consecutive quarter of growth. Its adjusted earnings per share (EPS), however, fell 10.7% to $0.75 in the quarter. It generated free cash flows of $1.5 billion in the quarter, of which it returned $400 million to shareholders in the form of dividends and buybacks.

The buyback activity was tepid by historical standards as the company prioritized deleveraging since its leverage multiples ran up slightly above its target range. Notably, HP is committed to returning all of its free cash flow to investors through dividends and buybacks as long as its gross debt to earnings before interest, tax, depreciation, and amortization (EBITDA) multiple is below 2x, and it does not see other opportunities that promise a higher return on investment.

HP’s Printing Business Continues to Decline

HP is actually a mix of two businesses – PC and printing. While the PC industry is still growing, the print business has been in a structural decline. However, the print business boasts of high margins and is a key driver of the company’s profitability. The company’s Personal Systems segment, which sells PCs, posted revenues of $9.9 billion in the fiscal third quarter, 6% higher than the corresponding quarter last year, while its Printing net revenues fell 4% to $4 billion. The situation is not expected to flip anytime soon, and HP expects the print market to fall by low single digits in 2025 and 2026 while projecting growth in the PC segment.

In terms of margins, the Personal Systems segment had an operating margin of 5.4%, less than a third of the 17.3% that the Printing segment posted.

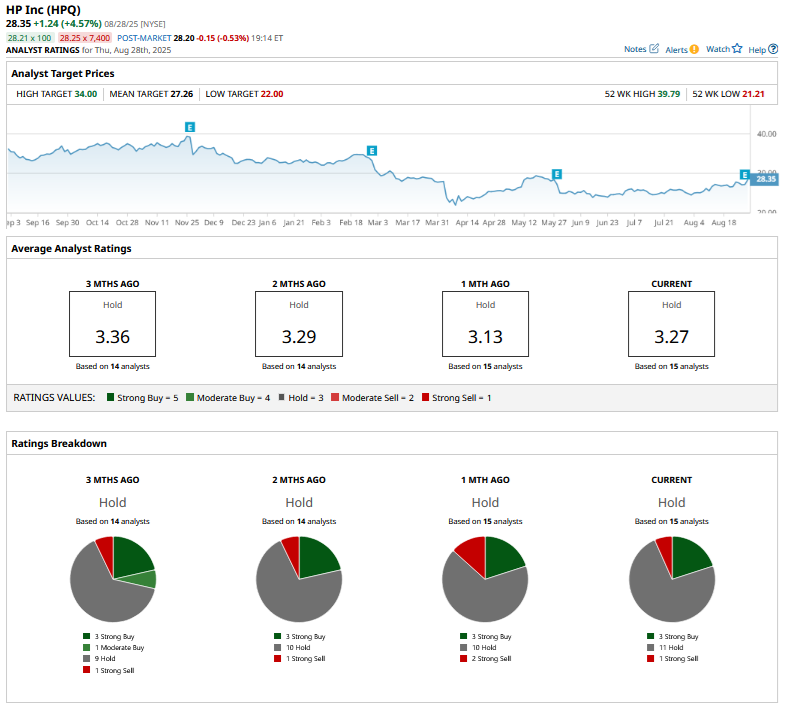

Wall Street analysts have been bearish on HP for quite some time now, and it has a consensus rating of “Hold” while its mean target price of $27.26 is lower than current price levels.

The Investment Case for HP

HP is expected to benefit from the continued uptick in the PC market, driven by three key factors. These are the Windows 11 refresh cycle, the aging of the current installed base of PCs, and rising sales of artificial intelligence (AI) PCs. The company said that AI PCs accounted for over a quarter of its sales mix in the quarter, while adding that they have higher average selling prices.

While HP’s business has been hit by tariffs, the company has reoriented its supply chain and now, nearly all of the products that it sells in the U.S. are made outside of China. That said, the company won't be able to fully mitigate the tariffs as President Donald Trump has imposed tariffs on all countries as part of trade deals. Specifically, Vietnam and Thailand, where HP is ramping up production, are subject to 20% and 19% tariffs, respectively.

Should You Buy HPQ Stock?

HP is not the fastest growing company on the planet. And, as I have noted previously, the stock won't fit the portfolios of investors who are looking for outsized gains. It is, however, a free cash flow powerhouse and expects to generate free cash flows between $2.6 billion and $3 billion in the current fiscal year after accounting for $400 million in cash restructuring charges. The cash flows should increase next year amid top-line growth, higher ASPs, and cost cuts.

Overall, I believe that at a forward price-earnings (P/E) multiple of 8.78x, HP looks fairly priced. The company has a dividend yield of over 4% and given the current strength in the PC market, led by the Windows 11 refresh and AI PC demand, it should be able to deliver double-digit annualized returns, including dividends, to investors over the next couple of years.

On the date of publication, Mohit Oberoi had a position in: HPQ , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English