Willis Towers Trades Above 50-Day SMA: How to Play the Stock?

Willis Towers Watson Public Limited Company WTW has been trading above its 50-day simple moving average (SMA), signaling a short-term bullish trend.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as this is the first marker of an uptrend or downtrend.

Price Performance of WTW

Shares of WTW have gained 4.4% in the year-to-date period against the industry’s decline of 14.1%. The Finance sector and the Zacks S&P 500 Composite increased 12.9% and 9.9%, respectively, in the same time frame.

The insurer has a market capitalization of $31.8 billion. The average volume of shares traded in the last three months was 0.6 million.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

WTW Shares Are Affordable

Shares of WTW are trading at a discount compared to the industry. Its price-to-forward 12-month earnings of 17.84X is lower than the industry average of 20.63X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

However, shares of Arthur J. Gallagher & Co. AJG and Brown & Brown, Inc. BRO are trading at a multiple higher than the industry average, while shares of Aon plc AON are trading at a discount.

Projections for WTW

The Zacks Consensus Estimate for WTW’s 2025 earnings per share is pegged at 16.81, and the consensus estimate for revenues is pegged at $9.6 billion. The consensus estimate for 2026 earnings per share and revenues indicates a rise of 13.5% and 5.4%, respectively, from the corresponding 2025 estimates. The expected long-term earnings are pegged at 7.5%.

Optimistic Analyst Sentiment on WTW

The Zacks Consensus Estimate for 2025 earnings has moved up 1.5% in the past 30 days, while the same for 2026 has moved up 0.6% in the same time frame.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

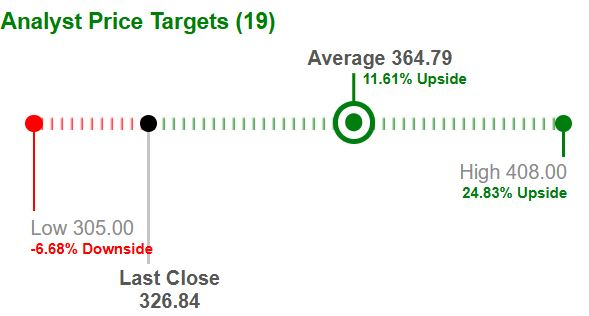

Average Target Price for WTW Suggests Upside

Based on short-term price targets offered by 19 analysts, the Zacks average price target is $364.79 per share. The average suggests a potential 11.6% upside from the last closing price.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Key Points for WTW

Willis Towers’ emphasis on operational streamlining, investments in emerging opportunities, and strong client-centric services provides a solid foundation for long term growth.

The company’s growth plan emphasizes capturing opportunities with the highest potential returns, such as expanding share in Risk & Broking and the Individual Marketplace. Efforts remain focused on organic investments, enhancing the business mix and expanding its role across the insurance value chain.

WTW’s strategy focuses on enhancing business performance, improving efficiency, and refining its portfolio mix to drive long-term growth. The company targets steady mid-single-digit organic revenue growth, supplemented by selective acquisitions, while also aiming for consistent margin improvement through operational enhancements and a more favorable business mix.

Rising organic commissions and fees, combined with healthy customer retention and the expansion of new business, are expected to drive revenue momentum.

WTW is focused on expanding operating margins through greater efficiency and scale. The ongoing transformation program is designed to increase productivity and streamline processes, with additional benefits expected from offshoring and right-shoring measures. The firm is also advancing automation and AI adoption to lift output, and it aims to achieve roughly 100 basis points of average annual margin expansion in its Retirement & Benefits segment over the next three years.

Despite the positives, rising expenses have pressured margins in recent quarters, making prudent cost management essential to prevent further erosion. While the company expects margins to expand over the long run, foreign currency exposure remains another challenge. Revenues and expenses of non-U.S. subsidiaries are vulnerable to exchange rate movements, and in some cases, projected sterling costs in London operations may surpass related revenues.

Another concern is the company’s weaker profitability metrics compared to its peers, highlighting a less efficient deployment of shareholder funds. Its return on equity stood at 21.6%, below the industry average of 24.7%, while its return on invested capital came in at 6.3%, compared to the industry’s 8.5%.

Wealth Distribution of WTW

Willis Towers remains focused on enhancing shareholder value by delivering consistent capital returns. WTW has increased its dividend six times over the past five years, resulting in 5.7% growth in payouts during that period. The company plans to repurchase approximately $1.5 billion worth of shares in 2025, subject to market trends and broader considerations.

Conclusion

WTW’s focus on efficiency, automation, selective acquisitions, and strong client retention supports steady revenue growth and margin expansion. However, rising expenses, exposure to currency fluctuations, and profitability levels that trail industry averages remain key challenges that could limit upside in the near term.

Ongoing headwinds limit the potential for meaningful upside for Willis Towers. It is therefore wise to adopt a wait-and-see approach on this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aon plc (AON): Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English