Flowers Foods (FLO): Assessing Valuation After Another Dividend Boost Despite Payout Concerns

Most Popular Narrative: 3% Undervalued

According to the most widely followed narrative, Flowers Foods appears slightly undervalued versus its estimated fair value, driven by analyst expectations for gradual growth in the years ahead.

“The accelerating shift away from traditional bread, driven by increased adoption of low-carb, keto, and fresh, minimally processed foods, is expected to shrink Flowers Foods' core markets. This is putting persistent downward pressure on long-term revenue growth and hindering the company's ability to fully offset volume declines with innovation.”

Curious what’s propelling Flowers Foods’ price target beyond its current struggles? This narrative hinges on a unique blend of slow revenue growth, shifting profit margins, and an ambitious future price-to-earnings multiple. Want to uncover which financial bets and bold assumptions analysts are stacking up to reach that fair value? See the full narrative for the details that could make the difference for FLO investors.

Result: Fair Value of $15.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, powerful growth in premium brands, or a breakout success with new products, could quickly flip the story in Flowers Foods’ favor.

Find out about the key risks to this Flowers Foods narrative.Another View: What Does the SWS DCF Model Say?

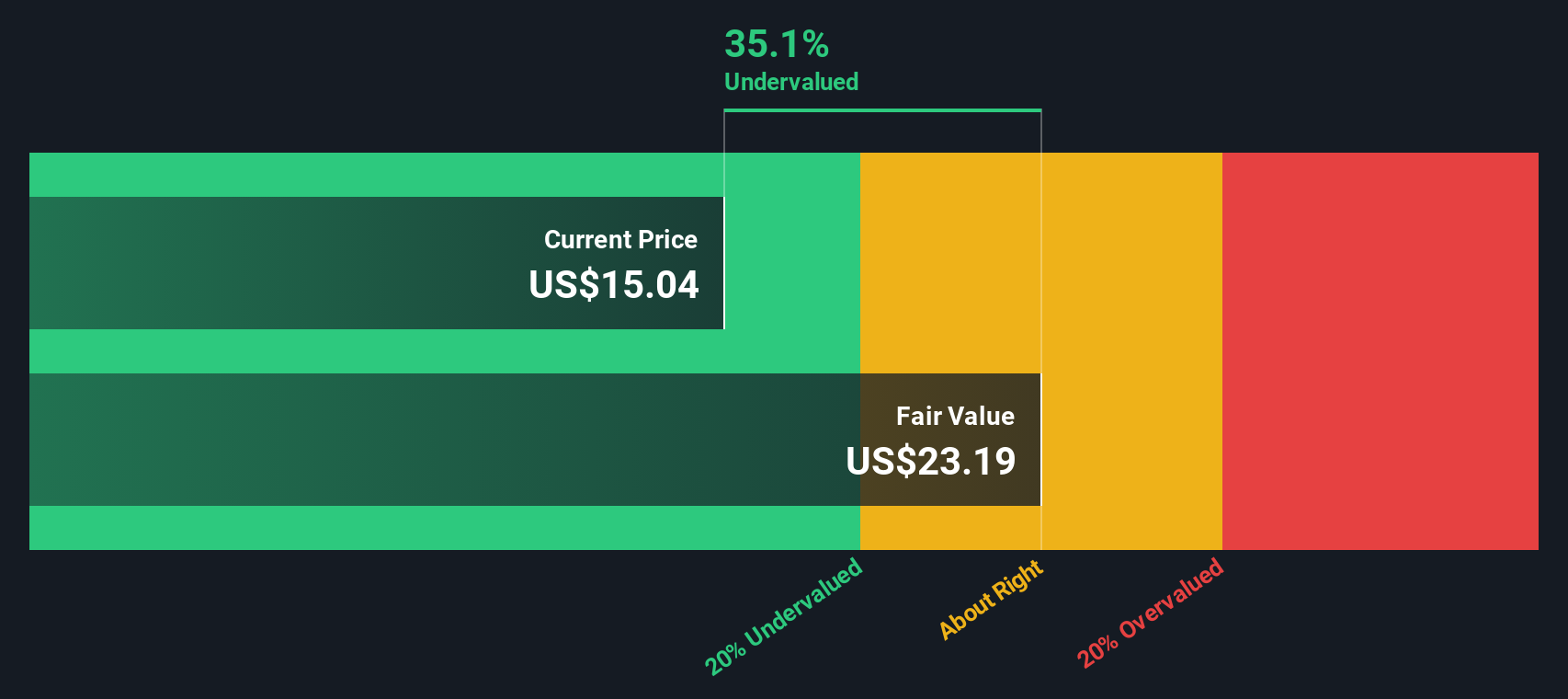

Taking a different approach, the SWS DCF model points to clear undervaluation. This method offers a more optimistic outlook compared to the analyst consensus. The question remains whether this long-term view will prove more accurate than today’s cautious forecasts.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Flowers Foods Narrative

If these conclusions do not quite fit your perspective or you would rather follow your own path, you can build an independent narrative from the ground up in just a few minutes. Do it your way

A great starting point for your Flowers Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Maximize your growth potential and stay ahead of the market by searching beyond Flowers Foods. Simply Wall Street’s screeners help you uncover hidden gems you might not want to miss.

- Uncover potential bargains that could boost your long-term returns by scanning for undervalued stocks based on cash flows and see which companies look attractive based on strong cash flows.

- Spot tech innovators set to transform healthcare and benefit from the shift towards artificial intelligence with our list of promising healthcare AI stocks.

- Target reliable cash flows for your portfolio’s future by searching for dividend stocks with yields > 3%, featuring companies delivering superior dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English