MINISO Group Holding Limited (NYSE:MNSO) Stocks Shoot Up 34% But Its P/E Still Looks Reasonable

The MINISO Group Holding Limited (NYSE:MNSO) share price has done very well over the last month, posting an excellent gain of 34%. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

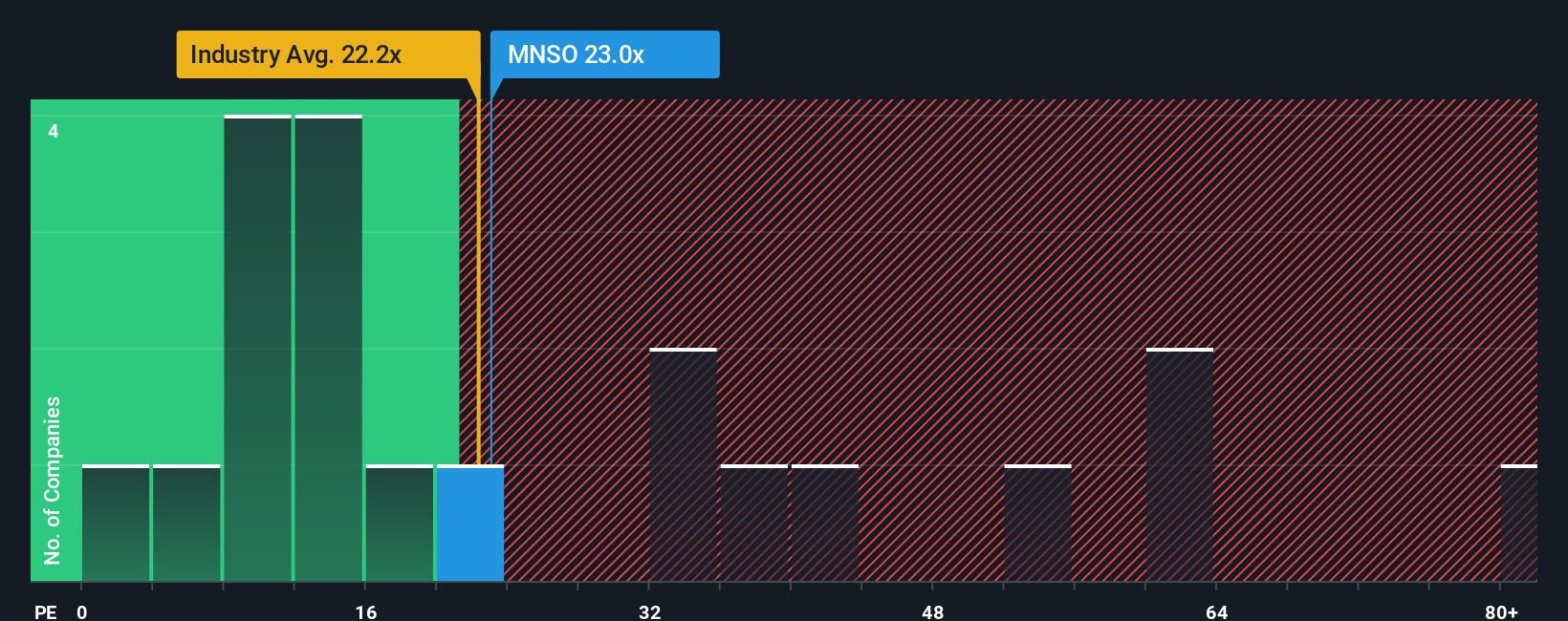

Following the firm bounce in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 19x, you may consider MINISO Group Holding as a stock to potentially avoid with its 23x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

MINISO Group Holding could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for MINISO Group Holding

How Is MINISO Group Holding's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like MINISO Group Holding's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.9%. Even so, admirably EPS has lifted 265% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 20% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that MINISO Group Holding's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From MINISO Group Holding's P/E?

MINISO Group Holding shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of MINISO Group Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for MINISO Group Holding you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English