CVS Health Sees Momentum in HCB Segment Amid Utilization Pressure

CVS Health’s CVS Health Care Benefits (“HCB”) segment continued its strong run in the second quarter of 2025. Revenues grew more than $36 billion, up more than 11% from the prior year, driven mainly by increases in the government businesses, reflecting the impact of the 2022 Inflation Reduction Act on the Medicare Part D program. Notably, adjusted operating income jumped nearly 40%, benefiting from the favorable year-over-year impact of changes to individual exchange risk adjustment estimates, stronger performance in government businesses and higher positive prior-period development.

Earlier this year, CVS Health announced it would exit the individual exchange business in 2026, where Aetna independently runs ACA plans. Despite years of effort, management concluded that there is no near- or long-term way to materially improve performance and projects $350 million-$400 million in variable losses from this business for 2025. Medical membership as of June 30 dropped sequentially to 26.7 million, primarily due to expected declines following the expiration of a premium grace period shortly after the first-quarter end.

CVS recorded a $471 million premium deficiency reserve (PDR) related to its Group Medicare Advantage (MA) product line through the remainder of the 2025 coverage year. This raised the quarter’s medical benefit ratio to 89.9%, reflecting a 30-basis-point increase from last year. The company’s Medicare business gained from favorability within the supplemental benefit offerings and Part D in individual MA business, even as trends remain elevated.

Performance across all other lines of business tracked mostly with CVS’ expectations, with no changes to the prior PDR established for individual exchange business. Days' claims payable were 40.9 days, down approximately 2 days sequentially, led by a higher mix of pharmacy costs, partially offset by the impact of the group MA PDR. CVS remains confident in the adequacy of its reserves.

Update From CVS Health Rivals

Elevance Health ELV posted second-quarter 2025 operating revenues of $41.6 billion in its Health Benefits segment, up 12% year over year. This was mainly driven by higher premium yields, recently closed acquisitions and growth in its Medicare Advantage membership, partly offset by lower Medicaid membership. ELV’s medical membership totaled approximately 45.6 million as of June 30, a decline of 212,000 sequentially, due to lower Medicaid membership and attrition resulting from lower effectuation rates in the Individual ACA business.

Humana’s HUM performance in the second quarter was led by CenterWell pharmacy, along with better-than-expected individual MA membership. Humana has taken steps to simplify and streamline the prior authorization process, building on the recent commitments made by multiple health plans. In addition, Humana continues its strategic expansion in Medicaid with the launch of its Virginia contract, bringing its active footprint to 10 states, with three more states awarded in pending.

CVS Stock Performance, Valuation and Estimates

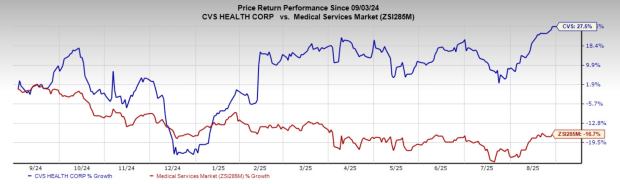

Over the past year, CVS Health shares have risen 27.5% against the industry’s 16.7% fall.

Image Source: Zacks Investment Research

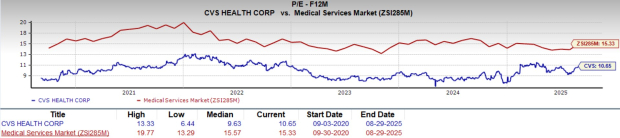

In terms of valuation, CVS Health is trading at a forward five-year earnings multiple of 10.65, which is lower than the industry average of 15.33. The stock has a Value Score of A.

Image Source: Zacks Investment Research

The consensus estimates for the company’s 2025 and 2026 earnings are showing a bullish trend.

Image Source: Zacks Investment Research

CVS currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM): Free Stock Analysis Report

CVS Health Corporation (CVS): Free Stock Analysis Report

Elevance Health, Inc. (ELV): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English