Offerpad Stock Spikes 2% In After-Hours Trading: Here's Why Its Moving

Offerpad Solutions Inc. (NYSE:OPAD) gained 2.15% to $5.22 in after-hours trading on Tuesday. The after-hours movement continues the stock’s volatile pattern amid Federal Reserve rate cut speculation.

Check out the current price of OPAD stock here.

Fed Policy Expectations Drive Momentum

The Californian online real estate gains mirror sector peer Opendoor Technologies Inc. (NASDAQ:OPEN), as Federal Reserve rate cut expectations boost iBuyer sentiment. Both companies’ business models depend heavily on housing turnover and mortgage affordability, making them highly sensitive to interest rate policy changes.

See Also: Why Nuburu Stock Shot Up 50% In After-Hours Trading

Investment banks including Morgan Stanley & Co. LLC (NYSE:MS), Goldman Sachs Group Inc. (NYSE:GS), and JPMorgan Chase & Co. (NYSE:JPM) have forecasted multiple Fed easing rounds through 2026.

Recent Volatility

Over the past six months, Offerpad’s stock increased significantly from $0.91 on June 30 to $6.23 on August 28, with trading volume rising from 82,000 shares to 112 million. However, by the close on Tuesday, the stock had pulled back to $5.11 with a volume of just 21,000 shares.

Retail Interest Amplifies Moves

OPAD has surged over 325.83% in last one month, driven partly by retail investor interest surrounding Opendoor’s 325.83% rally. Lower borrowing costs from potential Fed cuts would directly benefit companies relying on housing market activity, supporting the after-hours gains on Tuesday.

The stock’s 52-week range spans $0.91 to $6.35, with current market capitalization at $156.28 million and average volume of 13.89 million shares.

Price Action: According to Benzinga Pro, Offerpad closed at $5.11 on Tuesday, down 0.78%.

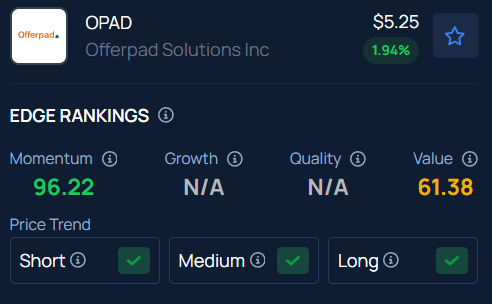

With a strong Momentum in the 96th percentile, Benzinga’s Edge Stock Rankings indicate that OPAD has a positive price trend across all time frames. Know how its momentum lines up with other industry players.

Read Next:

Shutterstock: JHVEPhoto / Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English