Is Marsh & McLennan Stock Underperforming the Dow?

New York-based Marsh & McLennan Companies, Inc. (MMC) provides advice and solutions to clients in the areas of risk, strategy, and people worldwide. With a market cap of $101.2 billion, Marsh & McLennan operates through Risk and Insurance Services and Consulting segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Marsh & McLennan fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the insurance brokers industry. It serves businesses, public entities, insurance companies, associations, professional services organizations, and private clients.

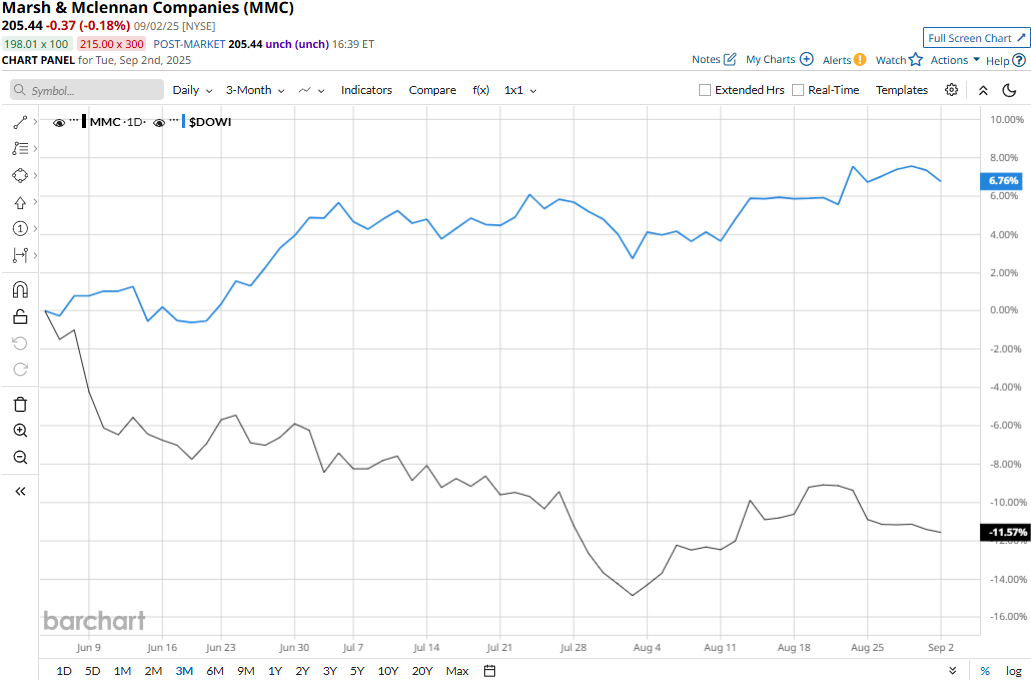

Despite its notable strengths, MMC stock has plunged 17.2% from its all-time high of $248 touched on Apr. 4. Meanwhile, MMC has dropped 12.5% over the past three months, notably underperforming the Dow Jones Industrial Average’s ($DOWI) 7.1% gains during the same time frame.

Marsh & McLennan’s performance has remained grim over the longer term as well. MMC stock has dropped 3.3% on a YTD basis and 9.7% over the past 52 weeks, lagging behind the Dow’s 6.5% gains in 2025 and 9% surge over the past year.

To confirm the bearish trend, MMC stock has remained mostly below its 50-day moving average since early April, with some fluctuations, and consistently below its 200-day moving average since early June.

Despite delivering better-than-expected results, Marsh & McLennan’s stock prices observed a marginal 44 bps dip in the trading session following the release of its Q2 results on Jul. 17. Driven by notable organic growth and contribution from acquisitions, the company’s overall revenues for the quarter surged 12.1% year-over-year to $6.97 billion, surpassing the Street expectations by 75 bps. Furthermore, the company’s adjusted EPS for the quarter increased by an impressive 11.5% year-over-year to $2.72, exceeding the consensus estimates by 2.3%. Following the initial dip, MMC stock prices gained 59 bps in the subsequent trading session.

Marsh & McLennan has notably underperformed its peer, Arthur J. Gallagher & Co.’s (AJG) 6.6% gains on a YTD basis and 3.4% uptick over the past 52 weeks.

Among the 22 analysts covering the MMC stock, the overall consensus rating is a “Hold.” Its mean price target of $234.58 suggests a 14.2% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English