FDA Approval of First RRP Therapy Could Be a Game Changer for Precigen (PGEN)

- Precigen recently held a special call to discuss the FDA approval of the first and only approved therapy for adults with recurrent respiratory papillomatosis (RRP).

- This regulatory milestone not only introduces a new treatment option for a previously underserved condition but also signals a significant advance for the company in addressing rare diseases.

- We'll explore how launching the first FDA-approved RRP therapy may reshape Precigen's investment narrative by expanding its clinical impact.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

What Is Precigen's Investment Narrative?

To own shares in Precigen right now, you need to believe this FDA approval is a turning point from a high-risk, unprofitable biotech to a possible rising contender with real commercial traction. The recent green light on PAPZIMEOS for RRP gives the company its first approved product and a shot at putting meaningful revenue on the board, which could shift the most important short-term catalyst to initial sales figures and market adoption. Before this milestone, the discussion around Precigen always pointed to risk: persistent losses, limited cash runway, and questions over ongoing viability flagged by the auditor. This news softens but doesn’t erase those risks, the cash burn and negative equity remain front and center, and market volatility (with a huge year-to-date price surge) hints that sentiment could turn just as quickly if early commercial results disappoint. For now, the main narrative moves from "can they get approval?" to "can they deliver on launch results and steady the financials?" Yet despite this progress, the company’s ability to fund operations over the next year is a crucial risk investors should not overlook.

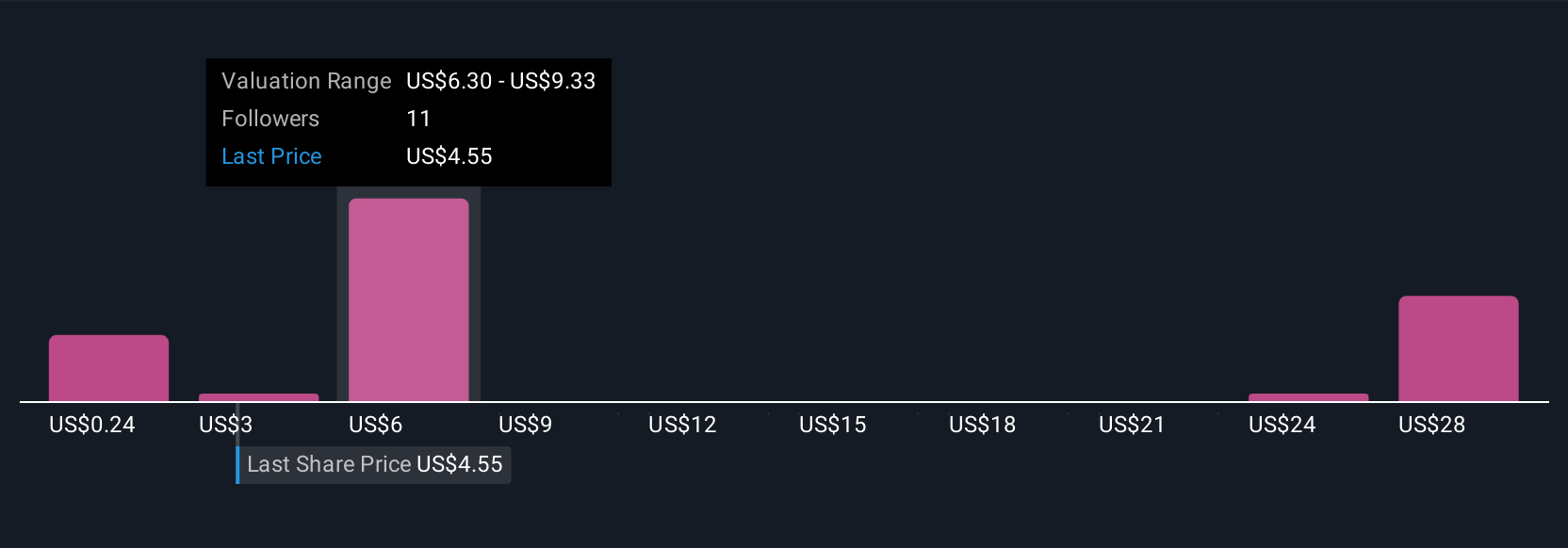

Precigen's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 9 other fair value estimates on Precigen - why the stock might be worth over 6x more than the current price!

Build Your Own Precigen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precigen research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Precigen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precigen's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English