Will Moody’s (MCO) Analytics Strategy Evolve Under Interim Leadership After Presidential Resignation?

- On August 19, 2025, Stephen Tulenko resigned as President of Moody’s Analytics, with Chief Operating Officer Andy Frepp appointed as Interim President, effective immediately.

- This leadership transition places Moody’s Analytics, a core growth engine for the company, under interim stewardship at a critical time for its evolving analytics strategy.

- We'll assess how the appointment of an interim leader in Moody’s Analytics may influence the company’s long-term growth narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Moody's Investment Narrative Recap

To be a shareholder in Moody’s, you need to trust in the company’s ability to maintain its leadership in risk assessment and analytics, especially as private credit and AI-driven analytics reshape demand. The recent interim leadership appointment at Moody’s Analytics appears unlikely to affect the company’s short-term momentum in private credit analytics, but it does sharpen attention on how well the division can execute its strategy and retain key talent during this period of transition, an area now more exposed as a possible risk.

Of the recent announcements, Moody’s April partnership with MSCI to offer independent risk assessments for private credit investments is especially relevant. This move directly aligns with the division’s core growth areas, underscoring the importance of keeping expert leadership in place to help deliver on major partnerships and product launches that drive recurring revenues.

By contrast, ongoing pressure from customer churn following the loss of long-term partnerships and client consolidation is something investors should be aware of if…

Read the full narrative on Moody's (it's free!)

Moody's narrative projects $9.0 billion revenue and $3.0 billion earnings by 2028. This requires 7.3% yearly revenue growth and a $0.9 billion earnings increase from $2.1 billion currently.

Uncover how Moody's forecasts yield a $543.40 fair value, a 9% upside to its current price.

Exploring Other Perspectives

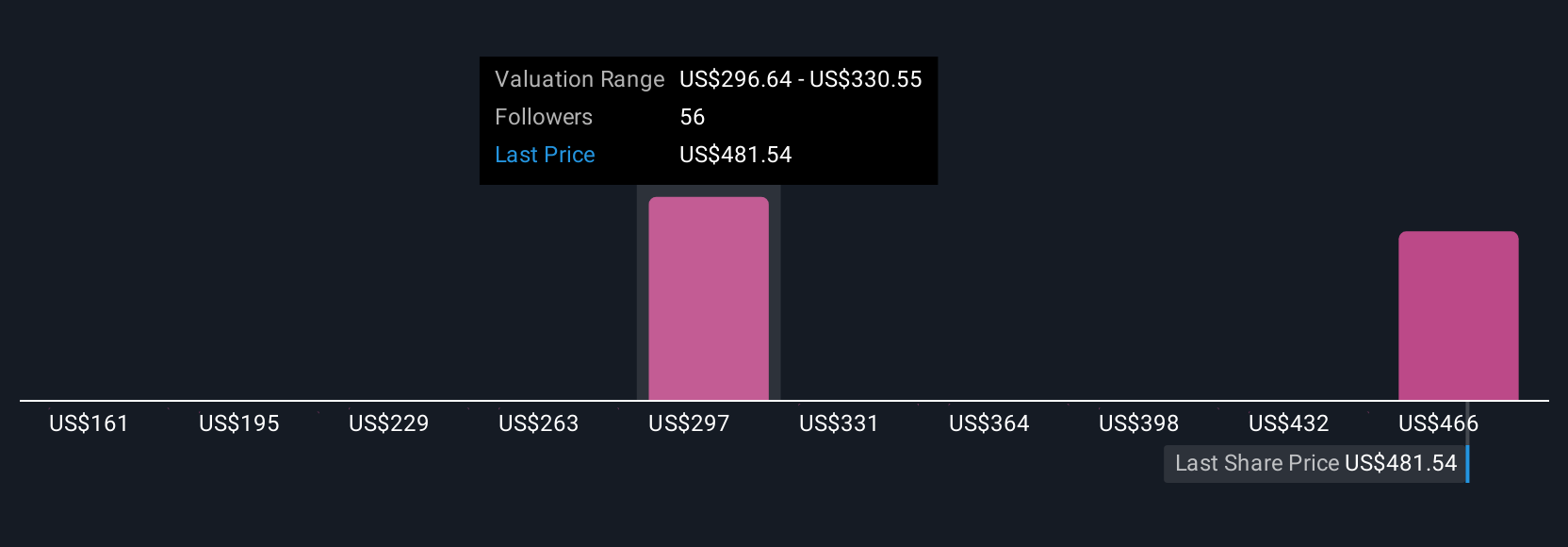

Simply Wall St Community members have published 12 fair value estimates for Moody’s stock ranging between US$251 and US$543. While many expect AI and analytics investment to fuel recurring revenue growth, opinions differ widely on how industry risks could impact future profit potential. Explore these contrasting approaches to better inform your own view.

Explore 12 other fair value estimates on Moody's - why the stock might be worth as much as 9% more than the current price!

Build Your Own Moody's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Moody's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moody's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English