Is Procore’s Strategic AI Partnership With AWS Transforming the Investment Thesis for Procore Technologies (PCOR)?

- Procore Technologies, Inc. recently announced a multi-year strategic collaboration agreement with Amazon Web Services (AWS), focused on co-investing in go-to-market initiatives and advancing AI-driven product innovation for the global construction industry, with expanded distribution through AWS Marketplace in North America and Europe.

- This collaboration gives Procore direct access to AWS's large language models and customer cloud spend, potentially accelerating adoption of its platform and strengthening its position in data-driven construction management solutions.

- We'll explore how AWS Marketplace integration and expanded AI capabilities may reshape Procore's growth story and investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

Procore Technologies Investment Narrative Recap

To be a shareholder in Procore Technologies, you need to believe that accelerating digital transformation and AI-driven productivity gains in construction can drive sustainable platform growth, despite ongoing losses and a high concentration in North America. The partnership with AWS and the launch on AWS Marketplace could help address Procore’s biggest short-term catalyst, broader international distribution and adoption, but ongoing profitability challenges and sensitivity to global construction activity remain significant risks that have not been fully mitigated by this news. Among recent announcements, the Company’s launch of Procore Copilot, an AI-driven interface, stands out as particularly relevant. Tightly aligned with the AWS collaboration, Copilot leverages expanded AI capabilities that support automation and analytics, reinforcing product innovation as a key growth driver and addressing demands for more efficient, data-centric project management. But on the other hand, investors should remain aware that persistent losses and exposure to global market cycles mean...

Read the full narrative on Procore Technologies (it's free!)

Procore Technologies' outlook anticipates $1.8 billion in revenue and $239.5 million in earnings by 2028. This is based on a 14.3% annual revenue growth rate and a $382.3 million increase in earnings from the current $-142.8 million.

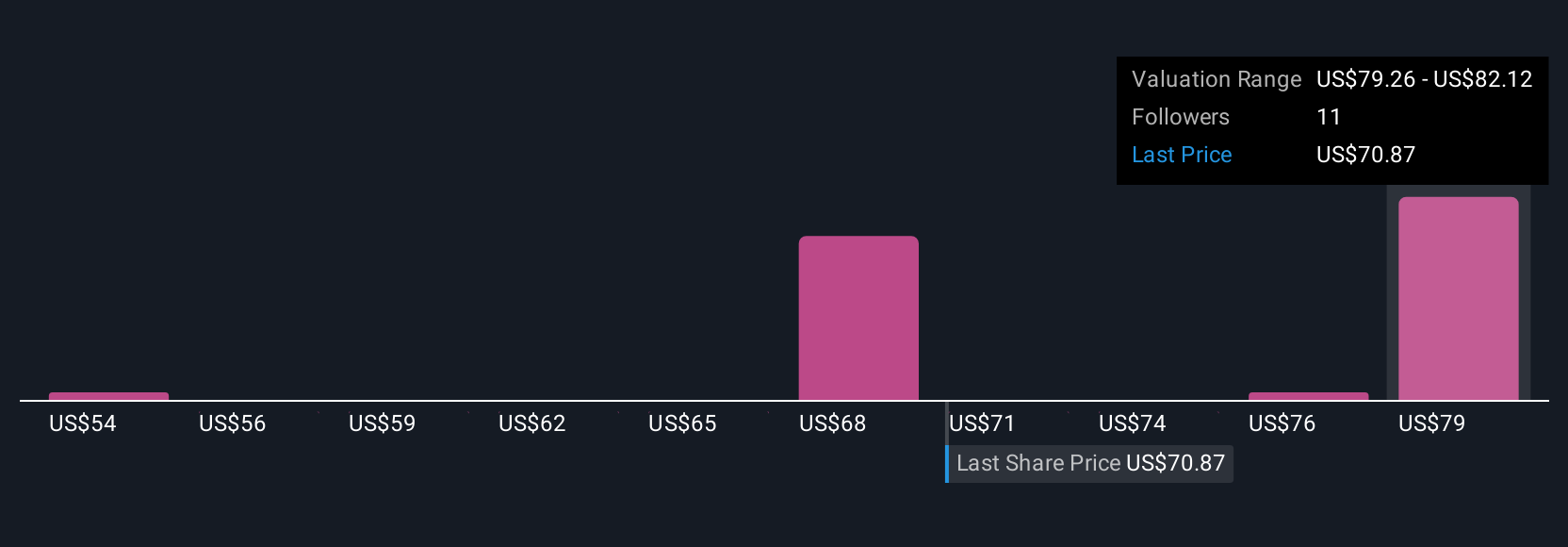

Uncover how Procore Technologies' forecasts yield a $82.12 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Four unique fair value estimates from the Simply Wall St Community range from US$53.58 to US$82.12 per share. Several contributors see robust platform and product expansion as a catalyst, but views differ widely on the company’s path forward.

Explore 4 other fair value estimates on Procore Technologies - why the stock might be worth as much as 21% more than the current price!

Build Your Own Procore Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procore Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Procore Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procore Technologies' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English