What Global Payments (GPN)'s Analyst Upgrades and International Expansion Mean for Shareholders

- In recent weeks, Global Payments expanded its footprint into both existing and new international markets through acquisitions and joint ventures, while seven analysts raised their earnings estimates for fiscal 2025.

- An upward shift in analyst outlook and a robust push into global markets hint at renewed optimism surrounding Global Payments' growth prospects.

- We'll explore how analyst upgrades following the company's international expansion could reshape the investment case for Global Payments.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Global Payments Investment Narrative Recap

Being a shareholder in Global Payments means believing in the company’s ability to grow through international expansion, integrating acquisitions, and maintaining leadership in payment technology. The recent momentum in analyst upgrades and stock performance reflects optimism, but the most immediate catalyst, successful integration and scaling of newly acquired businesses, remains unchanged. The biggest risk continues to be execution and integration challenges, especially as the business becomes more complex with each acquisition. For now, the recent news does not materially shift this risk profile.

Among the latest announcements, Global Payments’ renewed partnership with Banco Nacional de Mexico stands out. This extension into a large, fast-growing market aligns with the company’s strategy to boost cross-border capabilities and unlock new revenue streams. As international markets become a bigger focus, the relevance of seamless integration and effective execution is only set to grow.

Yet, what investors should not overlook is the flip side, if integration issues emerge, especially in...

Read the full narrative on Global Payments (it's free!)

Global Payments is projected to reach $12.3 billion in revenue and $1.7 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 7.0% and a $0.2 billion increase in earnings from the current $1.5 billion level.

Uncover how Global Payments' forecasts yield a $103.14 fair value, a 19% upside to its current price.

Exploring Other Perspectives

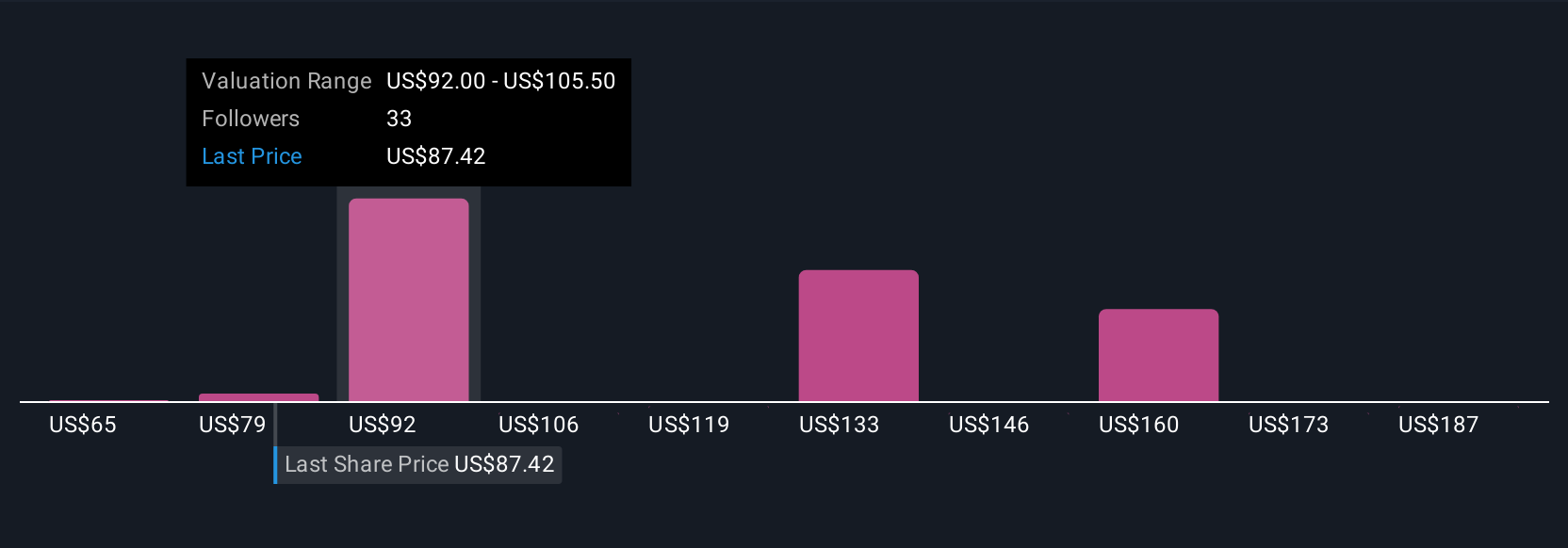

Ten fair value estimates from the Simply Wall St Community span US$64 to US$3,236, reflecting strikingly different outlooks. As acquisition integration remains the core risk, consider how differing assumptions could shape the outlook for Global Payments.

Explore 10 other fair value estimates on Global Payments - why the stock might be a potential multi-bagger!

Build Your Own Global Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Payments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Global Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Payments' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English