BrilliA Inc Soars Over 87% After Hours Following Cash Dividend Announcement

BrilliA Inc. (NYSEAMERICAN: BRIA) shares surged 86.73% in after-hours trading on Wednesday, reaching $4.78 from the closing price of $2.56. The dramatic price movement in the extended trading session followed the company’s announcement of a cash dividend declaration.

Check out the current price of BRIA stock here.

Dividend Declaration Details

The intimate apparel solutions provider declared a cash dividend of $0.133 per Class A share, totaling $2,992,500 across 22.5 million outstanding shares. The dividend carries a record date of September 15, with payment scheduled for September 30.

CEO Kendrew Hartanto stated the dividend “reflects the Company’s strong fundamentals and disciplined approach to growth,” emphasizing confidence in executing strategy and generating sustainable cash flows.

Market Fundamentals and Context

BRIA trades with a market capitalization of $78.40 million and maintains a price-to-earnings ratio of 21.23. The stock’s 52-week range spans $1.78 to $4.38, with an average daily volume of 2,760 shares. Prior to the after-hours surge, shares had declined 36% over the past year.

Company Operations

The Singapore-based company operates as a comprehensive service provider for over 30 ladies’ intimate apparel brands globally, managing sourcing, design, prototyping, supply chain, and quality control. The company partners with major retailers, including Fruit of the Loom, Hanes Brands Inc. (NYSE:HBI), and H&M.

The after-hours movement reflects investor response to the dividend announcement, though the stock’s low average volume suggests limited liquidity during regular trading hours.

Price Action: Based on data from Benzinga Pro, BRIA recorded a marginal loss of 0.012% on Wednesday.

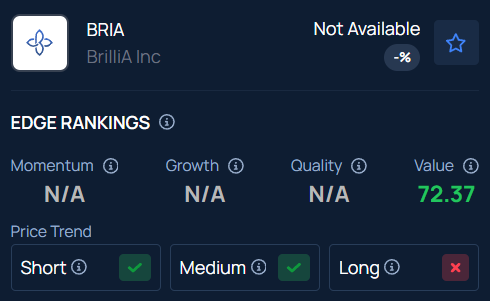

Benzinga’s Edge Stock Rankings indicate BRIA has a Value score of 72.37. Here is how the stock fares on other parameters.

Read Next:

Photo Courtesy: SFIO CRACHO on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English