Intercontinental Exchange Stock: Is ICE Outperforming the Financial Sector?

Atlanta-based Intercontinental Exchange, Inc. (ICE) provides market infrastructure, data services, and technology solutions to institutions, corporations, and government entities. With a market cap of $100.2 billion, ICE operates through Exchanges, Fixed Income and Data Services, and Mortgage Technology segments.

Companies worth $10 billion or more are generally described as “large-cap stock,” and ICE fits the bill perfectly. It operates the New York Stock Exchange, giving it unmatched scale and liquidity in equity trading. Its strong foothold in derivatives, commodities, and fixed-income markets is reinforced by proprietary technology and risk-management infrastructure.

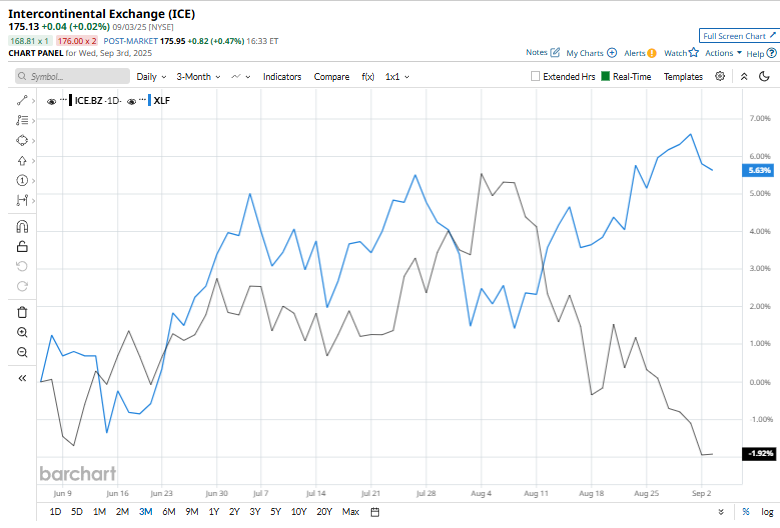

ICE stock recently touched its 52-week high of $189.35 on Aug. 8 and is currently trading 7.5% below that peak. The stock has dipped 2.4% over the past three months, falling behind the Financial Select Sector SPDR Fund’s (XLF) 4.7% return over the same time frame.

ICE has surged 8.5% over the past 52 weeks, trailing XLF’s 17.8% returns over the same time frame. However, ICE’s performance looks impressive in 2025, surging 17.5%, compared to XLF’s 10.7% gains.

While ICE has been trading mostly above its 200-day moving average over the past year, it has dipped below the 50-day moving average since mid-August.

Intercontinental Exchange reported stronger-than-expected Q2 results on Jul. 31, yet its stock saw a marginal decline in the subsequent trading session. Its revenues climbed 12.6% year-over-year to $3.3 billion. Adjusted net income advanced 19.1% to over $1 billion, and adjusted EPS came in at $1.81, topping consensus by 2.3%.

Intercontinental Exchange slightly has outperformed its top peer, CME Group Inc.’s (CME) 16% gains in 2025, but has lagged behind CME’s 26.7% rise over the past 52 weeks.

Furthermore, the stock has a consensus “Strong Buy” rating, among the 19 analysts covering it. ICE’s mean price target of $206.76 suggests a 18.1% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English