This 1 ETF Yields Nearly 8% and Can Help You Fight Inflation

Inflation is a quiet killer of wealth. By cutting into purchasing power and making food, gasoline, clothing, and housing more expensive, inflation can sap the momentum out of the economy and bring spending to a standstill. Currently, the rate of inflation in the U.S. is 2.7%—not horrific, but not great, either. In April, inflation was only 2.3%.

Investors can find a workaround, though. Stocks and exchange-traded funds (ETFs) that provide a solid dividend yield can help you battle inflation because the payout you get more than makes up for the higher cost of living. One ETF that comes to mind is the APLS Alerian MLP ETF (AMLP), which has a yield of just over 8%.

About the APLS Alerian MLP ETF

The APLS Alerian MLP ETF is operated by APLS Advisors, an investment manager headquartered in Denver. The company has nearly $30 billion in assets under management and offers a family of ETFs, mutual funds, variable insurance trusts, and closed-end funds.

The AMLP ETF is a passively managed fund that tracks the performance of the Alerian MLP Infrastructure Index, which is a grouping of energy infrastructure master limited partnerships (MLPs) that generate cash flow from midstream activities, such as transportation, processing, and treatment of raw materials.

MLPs themselves are a specific type of investment that combines the tax benefits of private partnerships with the liquidity of publicly traded companies. MLPs are popular with income investors because they are required to distribute a specific percentage of cash to investors. They are limited by federal law to real estate and natural resources.

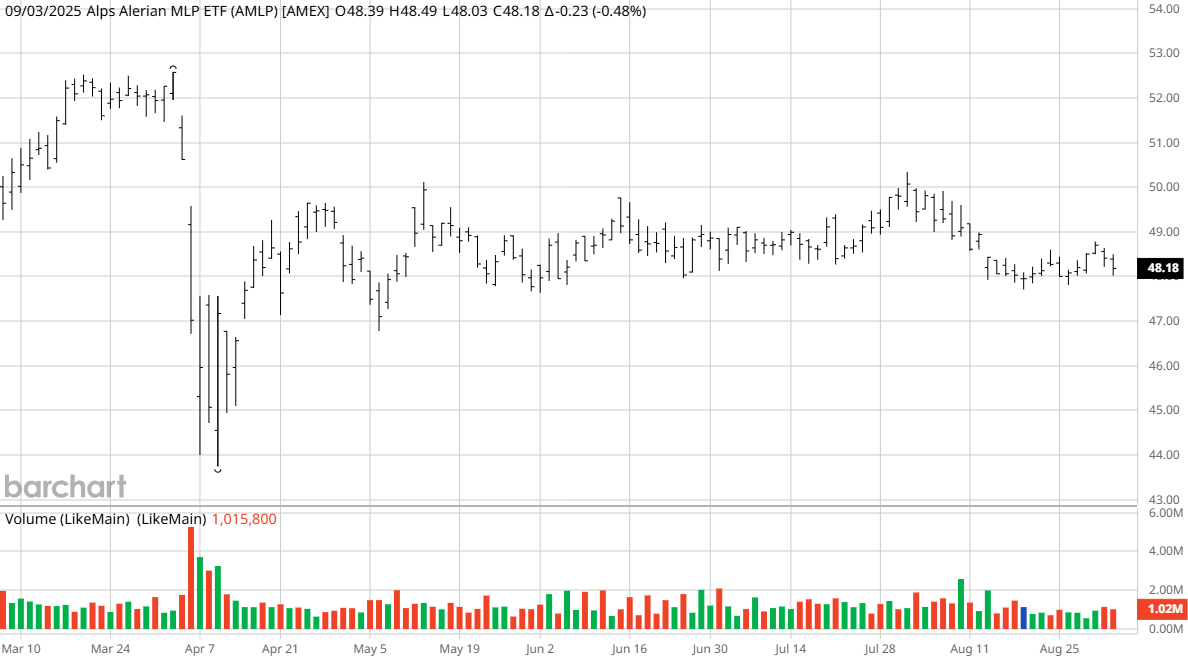

The AMLP ETF is up 3.2% in the last 12 months and is flat on a year-to-date basis. At just over $48 per share, it’s trading near the midpoint of its 52-week range but roughly 50% off its all-time high set a decade ago.

The AMLP ETF’s net asset value (NAV) is $48.11. Net asset value calculates the value of a fund’s assets, subtracts the liabilities, and divides the total by the number of outstanding shares. It’s the best way to determine if an ETF is fairly valued. With shares at $48.18 and a NAV of $48.11, AMLP is trading almost exactly in line with the value of its underlying assets, indicating it's fairly valued.

The fund has a high expense ratio for a passive fund at 0.85%, or $85 annually for each $10,000 invested. However, the fund more than makes up for it with its generous dividend. It is currently paying a quarterly dividend of $0.98 per share.

What Stocks Does the AMLP ETF Hold?

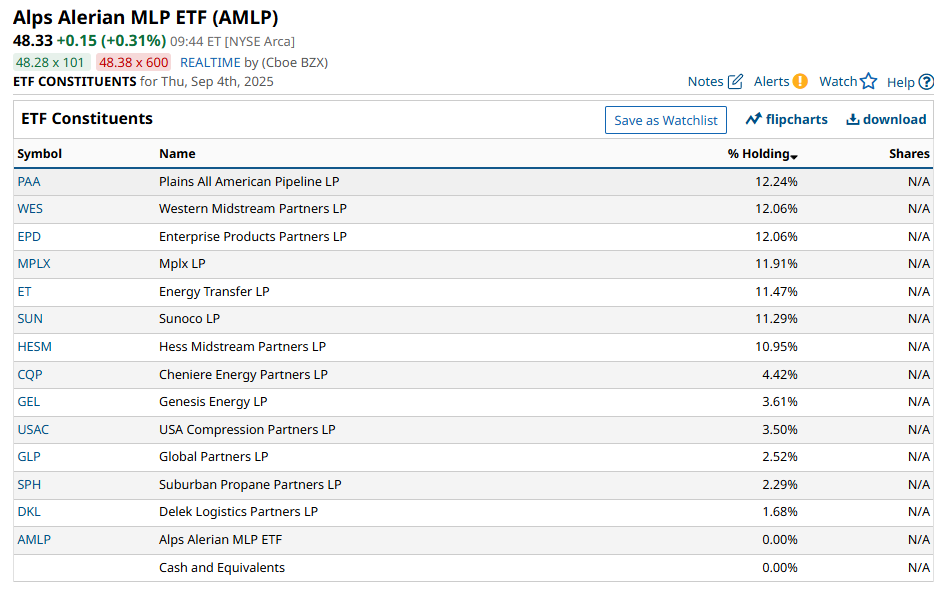

Currently, the Alerian MLP ETF has 13 stocks, with seven of them having more than 10% weighting each. AMLP spreads exposure across major energy infrastructure players while keeping a tight focus. Top holdings include:

- Plains All American Pipeline (PAA) operates in the Permian Basin, South Texas/Eagle Ford area, Rocky Mountain and Gulf Coast in the U.S., and Manito, South Saskatchewan, and Alberta regions in Canada.

- Western Midstream Partners (WES) gathers, processes, and transports natural gas, natural gas liquids (NGLs), and crude oil in west Texas, New Mexico, Colorado, and Wyoming.

- Enterprise Products Partners (EPD) transports natural gas, natural gas liquids, crude oil, refined products, and petrochemicals from North American supply basins to domestic and international customers.

- MPLX (MPLX) is an Ohio-based MLP that operates pipelines, rail facilities, docks, tanks, and transportation infrastructure for liquefied petroleum gas, natural gas, natural gas liquids, and crude oil.

- Energy Transfer (ET) is a large Texas-based MLP with assets in 44 states. It transports and stores natural gas, crude oil, liquified natural gas, and refined products.

- Sunoco (SUN) is also based in Texas and is one of the biggest independent distributors of fuel in North America. The company has assets from coast to coast, with terminals, pipeline systems, and fuel distribution infrastructure.

- Hess Midstream Partners (HESM) is a Houston-based MLP that provides transportation and storage services to Hess, which was recently acquired by Chevron (CVX). It owns oil, gas, and produced water handling assets that are primarily in North Dakota.

The AMLP ETF is an interesting way to combat inflation and is a backdoor way to capitalize on the growth of artificial intelligence (AI). Data centers across the country are growing and drawing more power to handle workloads and to operate expansive cooling systems. The demand for electrical power in the U.S. is expected to grow 2.5% annually through 2035, in part because of the expansion of data centers.

While you may not get strong annual returns with the AMLP ETF, the dividend alone makes it a fund to consider when trying to invest ahead of the inflationary curve.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English