Asian Penny Stock Insights: Jinhai Medical Technology And 2 Other Noteworthy Picks

As global markets react to various economic developments, the Asian stock landscape continues to capture investor interest with its dynamic shifts and opportunities. Penny stocks, a term that may seem outdated, still hold relevance as they often represent smaller or newer companies with potential for growth at lower price points. By focusing on those with strong financials and clear growth trajectories, investors can uncover hidden gems within this sector.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.86 | THB3.81B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.00 | HK$2.44B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.765 | SGD310.05M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.06 | SGD12.04B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.72 | THB9.54B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD4.05 | SGD1.11B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 985 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Jinhai Medical Technology (SEHK:2225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinhai Medical Technology Limited is an investment holding company offering minimally invasive surgery solutions, medical products, and related services in the People's Republic of China and Singapore, with a market cap of HK$2.96 billion.

Operations: The company generates revenue of SGD 14.82 million from Singapore and SGD 19.83 million from the People's Republic of China.

Market Cap: HK$2.96B

Jinhai Medical Technology has faced increasing financial challenges, reporting a net loss of SGD 10.25 million for the first half of 2025, with revenue declining to SGD 14.53 million from SGD 25.94 million the previous year. The company's debt to equity ratio has risen to 41.6% over five years, though its short-term assets exceed liabilities by SGD 3.5 million, suggesting some balance sheet resilience. Despite an experienced board and management team, high volatility in share price and reduced cash runway underscore the risks associated with this investment amidst ongoing unprofitability and declining earnings trajectory in recent years.

- Click here and access our complete financial health analysis report to understand the dynamics of Jinhai Medical Technology.

- Understand Jinhai Medical Technology's track record by examining our performance history report.

Carry Wealth Holdings (SEHK:643)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Carry Wealth Holdings Limited is an investment holding company that manufactures, trades, and markets garment products for various brands globally, with a market cap of HK$575.90 million.

Operations: The company generates revenue from its Garment Manufacturing and Trading segment, amounting to HK$470.8 million.

Market Cap: HK$575.9M

Carry Wealth Holdings Limited is navigating financial difficulties, with recent earnings showing a sharp decline in sales to HK$86.95 million for the first half of 2025, compared to HK$280.84 million a year earlier, and an increased net loss of HK$29.74 million. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company remains unprofitable with losses growing over the past five years at 34.2% annually. The board and management team are relatively new and inexperienced, contributing to high share price volatility which may pose risks for investors considering this stock in their portfolio.

- Dive into the specifics of Carry Wealth Holdings here with our thorough balance sheet health report.

- Gain insights into Carry Wealth Holdings' historical outcomes by reviewing our past performance report.

CSE Global (SGX:544)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CSE Global Limited is an investment holding company that provides integrated industrial automation, information technology, and intelligent transport solutions across the Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of SGD493.79 million.

Operations: The company's revenue is derived from three main segments: Automation (SGD193.85 million), Communications (SGD246.50 million), and Electrification (SGD432.82 million).

Market Cap: SGD493.79M

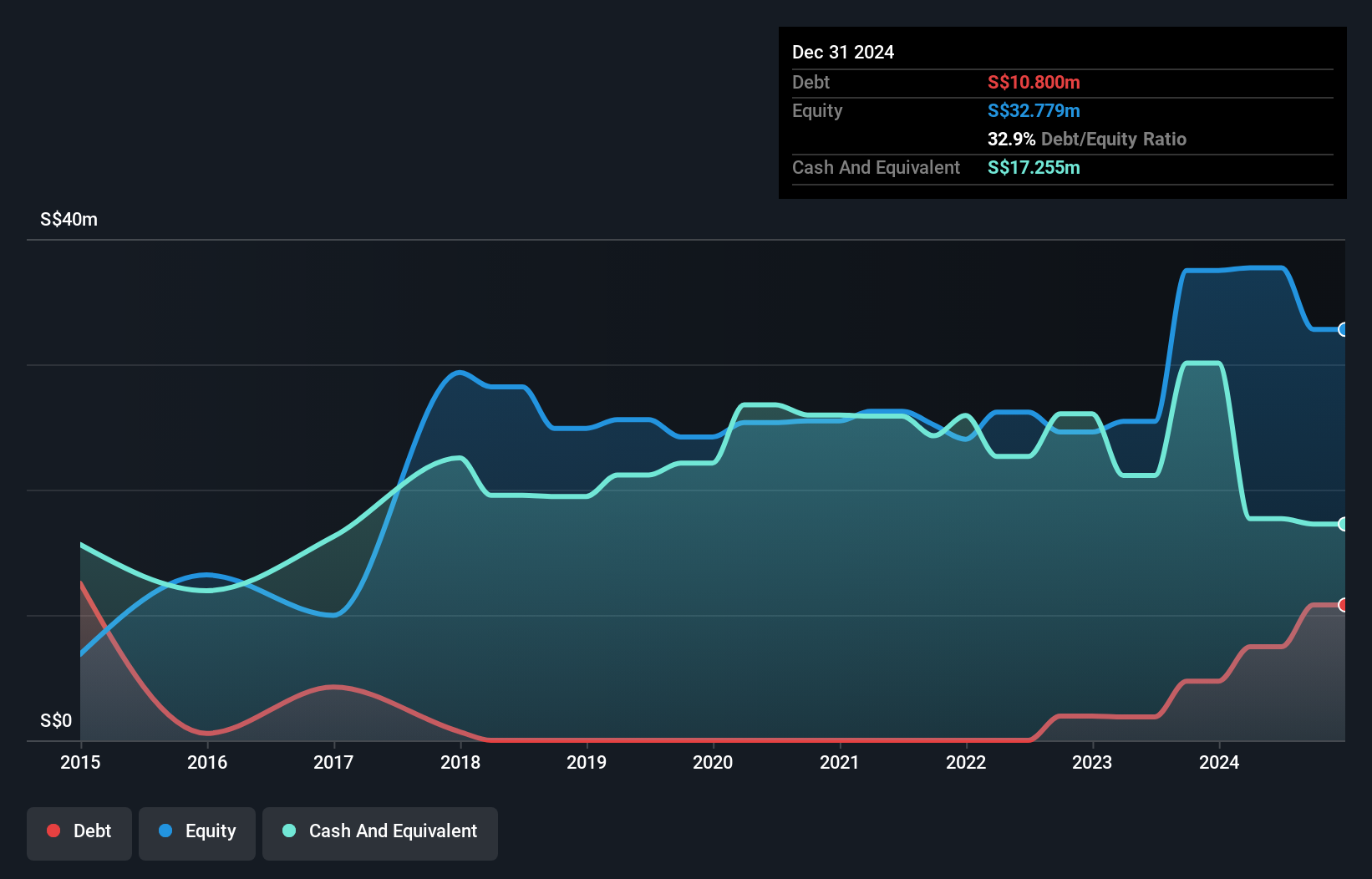

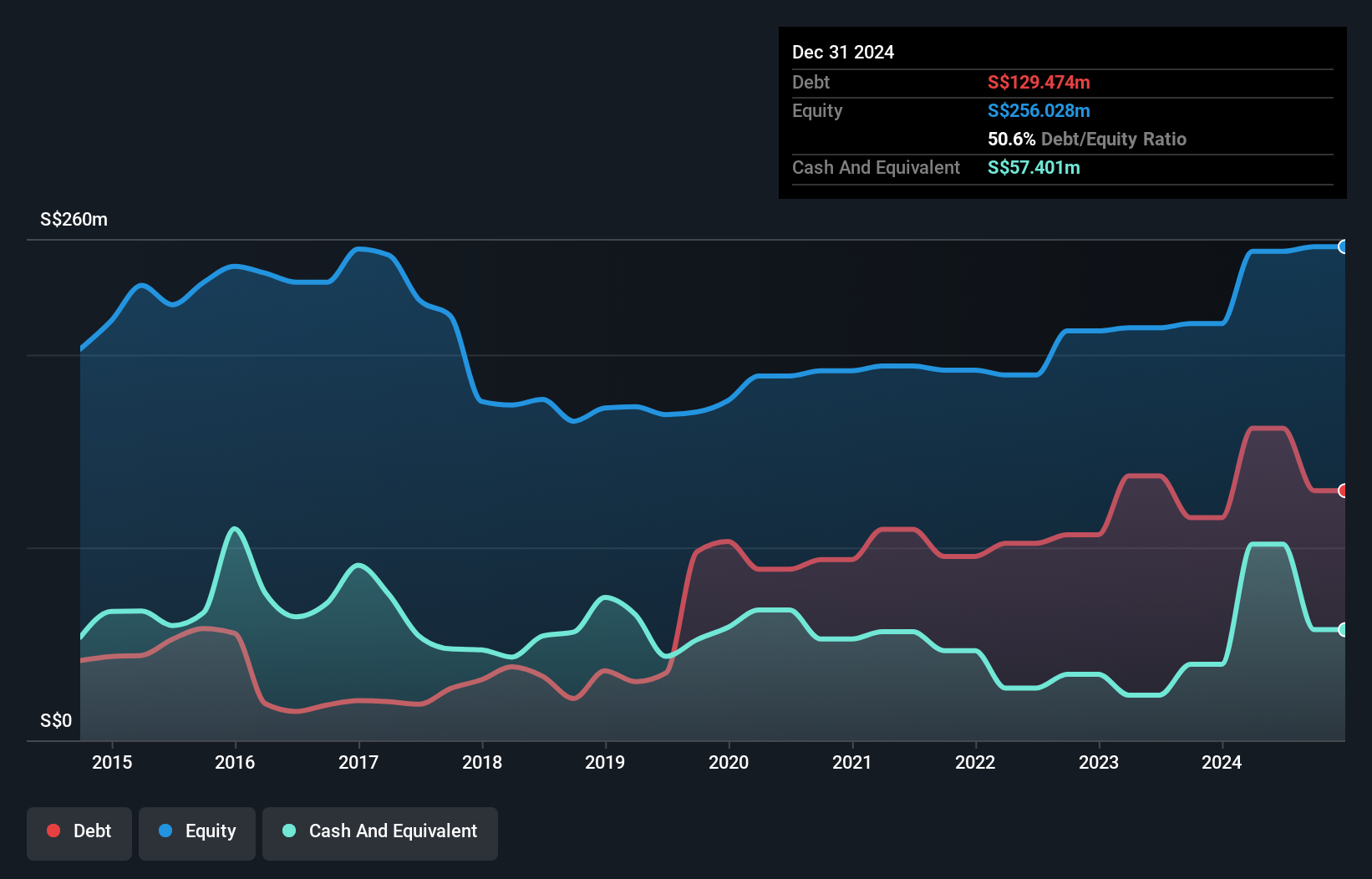

CSE Global Limited, with a market cap of SGD493.79 million, has shown stable earnings growth, reporting SGD440.88 million in sales for the first half of 2025, up from the previous year. The recent contract extension worth US$46 million in the U.S. data center market highlights its operational expansion efforts. Despite a slight decrease in net profit margins and an increased debt to equity ratio over five years, the company maintains satisfactory debt levels and interest coverage. However, negative operating cash flow raises concerns about debt sustainability while dividends remain inadequately covered by free cash flows.

- Get an in-depth perspective on CSE Global's performance by reading our balance sheet health report here.

- Examine CSE Global's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Gain an insight into the universe of 985 Asian Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English