Investors Don't See Light At End Of Vivid Seats Inc.'s (NASDAQ:SEAT) Tunnel And Push Stock Down 38%

To the annoyance of some shareholders, Vivid Seats Inc. (NASDAQ:SEAT) shares are down a considerable 38% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

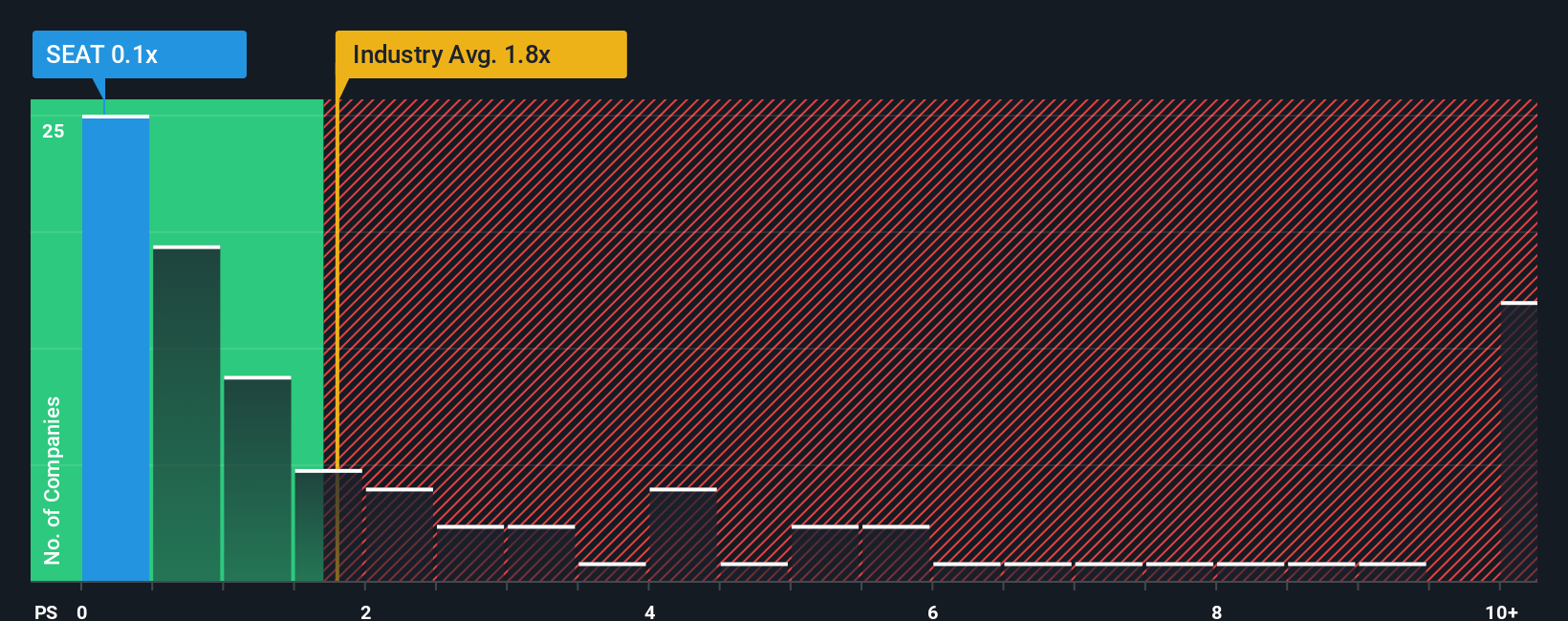

Following the heavy fall in price, Vivid Seats' price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Entertainment industry in the United States, where around half of the companies have P/S ratios above 1.8x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Vivid Seats

What Does Vivid Seats' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Vivid Seats' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Vivid Seats' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Vivid Seats' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.9% each year as estimated by the eleven analysts watching the company. With the industry predicted to deliver 13% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Vivid Seats' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Vivid Seats' P/S

Vivid Seats' recently weak share price has pulled its P/S back below other Entertainment companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Vivid Seats' P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 2 warning signs for Vivid Seats that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English