Day One Biopharmaceuticals, Inc. (NASDAQ:DAWN) Held Back By Insufficient Growth Even After Shares Climb 30%

Day One Biopharmaceuticals, Inc. (NASDAQ:DAWN) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

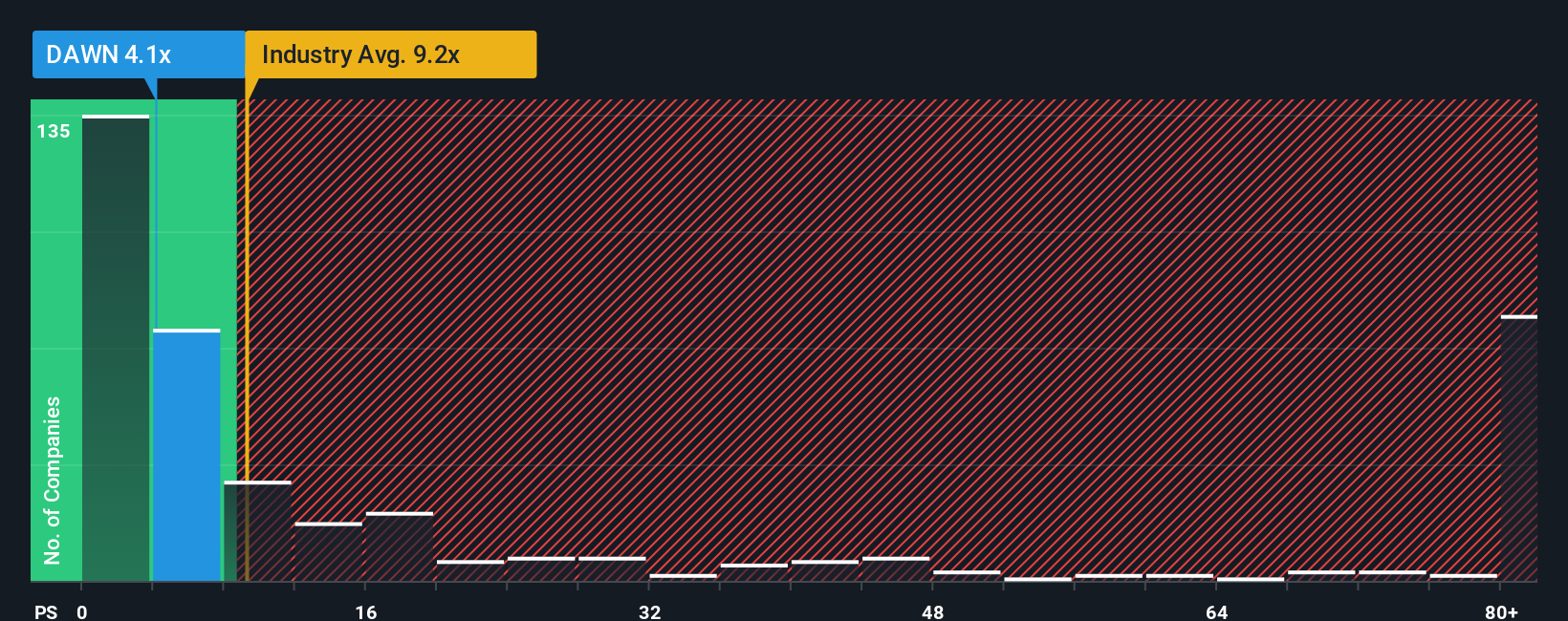

In spite of the firm bounce in price, Day One Biopharmaceuticals may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9.2x and even P/S higher than 69x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Day One Biopharmaceuticals

How Has Day One Biopharmaceuticals Performed Recently?

With revenue growth that's superior to most other companies of late, Day One Biopharmaceuticals has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Day One Biopharmaceuticals will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Day One Biopharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 26% per annum as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 119% each year growth forecast for the broader industry.

In light of this, it's understandable that Day One Biopharmaceuticals' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Day One Biopharmaceuticals' P/S?

Day One Biopharmaceuticals' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Day One Biopharmaceuticals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Day One Biopharmaceuticals with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English