Argan (AGX) Is Down 7.3% After Surging Backlog and Strong Q2 Results – What's Changed

- Argan, Inc. recently reported its second quarter fiscal 2025 results, revealing sales of US$237.74 million and net income of US$35.28 million, both higher than the previous year.

- This performance was highlighted by a record project backlog of approximately US$2 billion, reflecting continued strong momentum in securing major natural gas and renewable energy contracts.

- We’ll now consider how Argan’s surge in project backlog and earnings impacts the investment narrative outlined by analysts.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Argan Investment Narrative Recap

To own shares of Argan, I’d need confidence in the company’s ability to consistently deliver on large-scale energy infrastructure projects while managing cost controls and execution risks. The recent record-high project backlog and surge in earnings meaningfully support the key short-term catalyst, timely backlog conversion, though execution risk on these complex contracts remains the biggest concern and has not materially changed with this report.

Among recent announcements, the second-quarter fiscal 2025 results stand out: both sales and net income grew robustly year-over-year. This uptick in performance closely aligns with the positive catalyst of increasing project backlog and suggests ongoing demand for Argan’s services, but also heightens the need for successful execution on multi-year, fixed-price contracts.

By contrast, investors should be aware that the company’s fixed-price project commitments leave little room for error if supply chains disrupt or input costs spike…

Read the full narrative on Argan (it's free!)

Argan's outlook forecasts $1.4 billion in revenue and $140.0 million in earnings by 2028. This is based on a projected annual revenue growth rate of 15.6% and a $39.9 million increase in earnings from the current level of $100.1 million.

Uncover how Argan's forecasts yield a $230.33 fair value, a 9% upside to its current price.

Exploring Other Perspectives

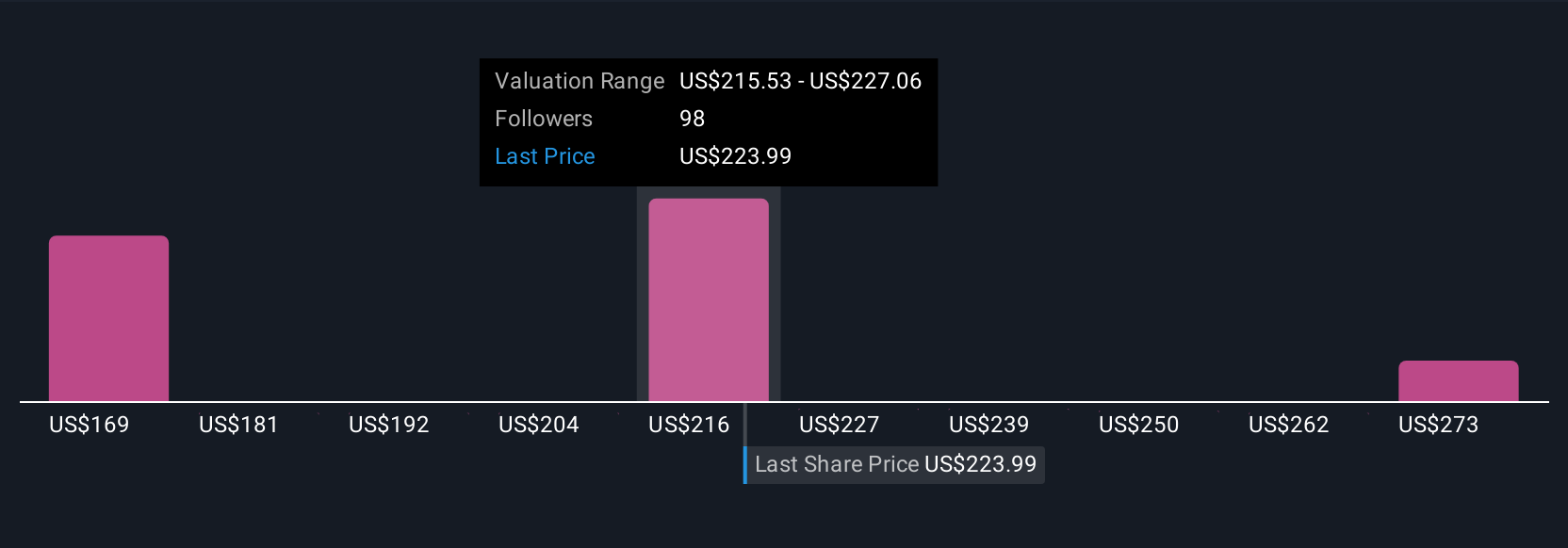

Nine different fair value estimates from the Simply Wall St Community range from US$171.99 to US$284.68 per share. While these varied views show how opinions can differ, keep in mind that execution risk on major new projects could weigh on results if delays or overruns arise.

Explore 9 other fair value estimates on Argan - why the stock might be worth as much as 35% more than the current price!

Build Your Own Argan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English