Can New Leadership at AutoZone (AZO) Balance Tradition and Innovation in Its Strategic Direction?

- AutoZone, Inc. announced that two of its most seasoned leaders, Bill Hackney and Rick Smith, have notified the company of their retirements, with Hackney stepping down in November 2025 and Smith in January 2026, after each serving for 40 years.

- The company has named long-tenured internal team members and an external executive as successors, signaling both a commitment to institutional continuity and a willingness to introduce fresh leadership perspectives.

- We'll examine how these senior leadership transitions and appointments could shape AutoZone's investment outlook, especially around operational continuity and strategy.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AutoZone Investment Narrative Recap

To be a shareholder in AutoZone, you need to believe in the company’s ability to deliver consistent growth through operational efficiency and expansion while managing external cost pressures. The recent retirement announcements of two long-serving executives and their internal and external successors signal management continuity, which should minimize disruption to near-term growth catalysts such as store and supply chain expansion; the effect on the biggest risks, like persistent margin pressures from tariffs and inflation, appears immaterial at this stage.

Among recent developments, the upcoming launch of new distribution centers in California and Virginia stands out, aiming to enhance supply chain efficiency and support faster delivery, directly tied to maintaining AutoZone’s edge as it navigates competitive and margin headwinds. These improvements align with key business catalysts and reinforce the importance of effective operational execution amidst leadership transitions.

However, it’s important to remember that despite management stability, persistent inflation and higher SG&A expenses could still weigh on profit growth if not offset efficiently…

Read the full narrative on AutoZone (it's free!)

AutoZone's outlook anticipates $22.5 billion in revenue and $3.1 billion in earnings by 2028. This scenario implies 6.0% annual revenue growth and a $0.5 billion increase in earnings from the current $2.6 billion.

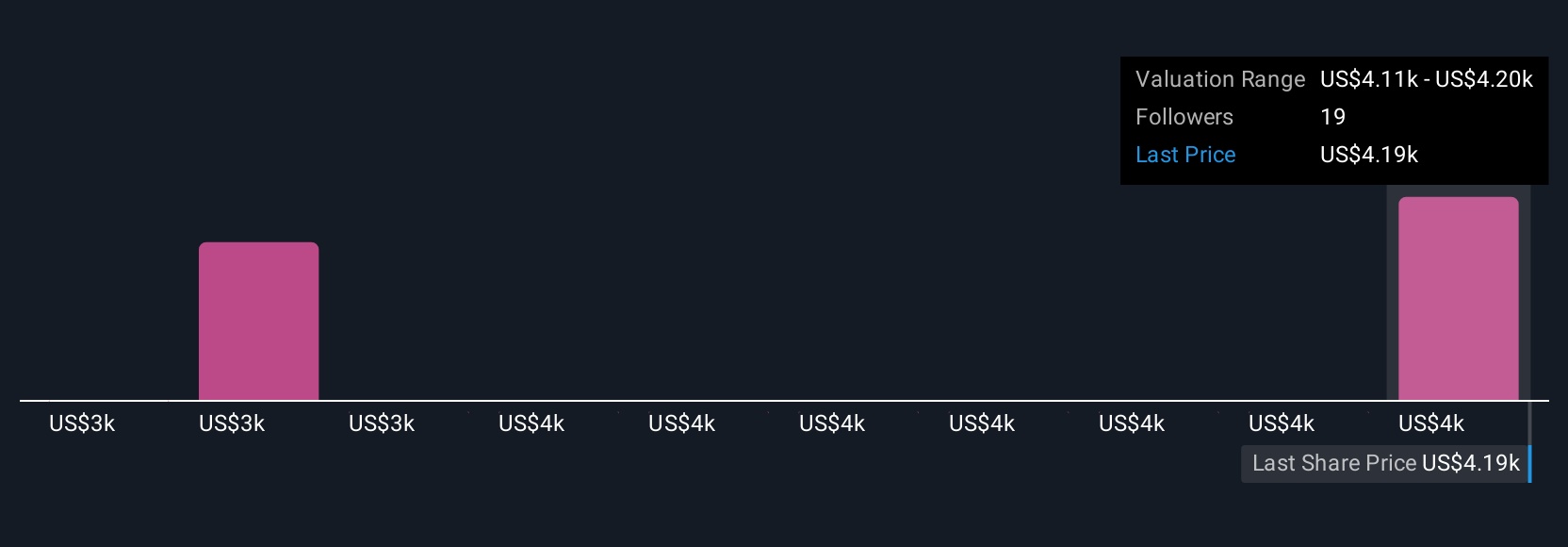

Uncover how AutoZone's forecasts yield a $4202 fair value, in line with its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community set AutoZone’s range between US$3,230 and US$4,202 per share. As you consider these varied perspectives, keep in mind that internal leadership changes may influence supply chain performance and long-term outlook in ways that differ from consensus forecasts.

Explore 4 other fair value estimates on AutoZone - why the stock might be worth 23% less than the current price!

Build Your Own AutoZone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AutoZone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free AutoZone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AutoZone's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English