Evercore ISI’s Upgrade Could Be a Game Changer for Brinker International (EAT)

- Earlier this week, Evercore ISI upgraded Brinker International to 'Outperform' based on its expectations for sustainable earnings growth supported by restaurant remodels, menu enhancements, and new unit openings.

- This upgrade was grounded in new forecasts projecting strong long-term earnings growth, highlighting the potential benefits of Brinker's operational improvements and evolving customer satisfaction.

- We’ll explore how Evercore ISI’s recognition of Brinker's remodel and menu programs may impact the company’s investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Brinker International Investment Narrative Recap

To be a shareholder in Brinker International, you need to believe in sustained earnings growth driven by restaurant remodels, refreshed menus, and new unit openings. Evercore ISI’s upgrade reinforces this outlook, though the upgrade itself does not materially shift the key short-term catalyst: Brinker's ability to boost same-store traffic while offsetting the risk of rising labor costs that threaten margins.

The company’s most relevant recent announcement to these themes is its August 2025 guidance for fiscal 2026, projecting total revenues of US$5.60 billion to US$5.70 billion and net income per diluted share of US$9.90 to US$10.50. These targets align with expectations for operational improvement and growth, tying closely to the catalysts spotlighted by Evercore ISI’s positive rating revision. Yet, it’s crucial to contrast these targets with ongoing inflationary labor pressures and what they could mean if ...

Read the full narrative on Brinker International (it's free!)

Brinker International's outlook anticipates $6.2 billion in revenue and $562.8 million in earnings by 2028. This implies a 4.7% annual revenue growth and a $179.7 million increase in earnings from the current level of $383.1 million.

Uncover how Brinker International's forecasts yield a $179.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

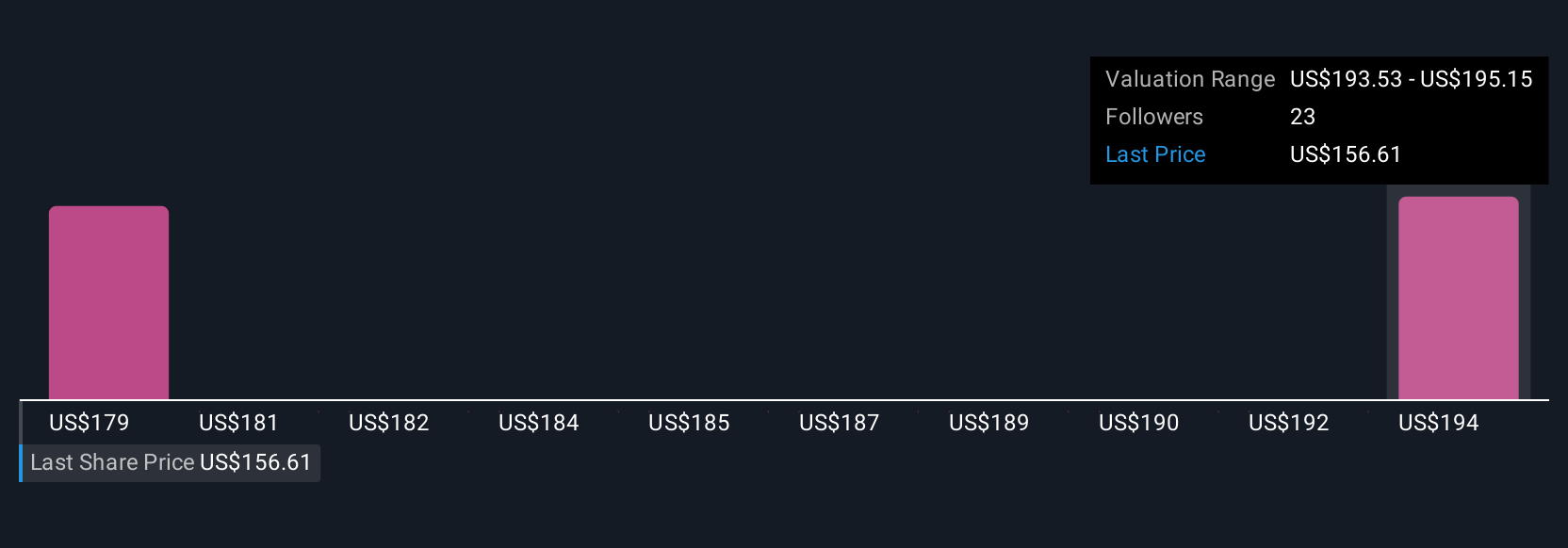

Simply Wall St Community members have contributed 2 fair value estimates for Brinker International, ranging from US$179 to US$194.70 per share. While optimism surrounds Brinker's remodels and menu upgrades, the range of views highlights just how differently investors assess the company’s earnings growth story and margin risks.

Explore 2 other fair value estimates on Brinker International - why the stock might be worth just $179.00!

Build Your Own Brinker International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brinker International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brinker International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brinker International's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English