How Investors May Respond To Skyworks Solutions (SWKS) Appointing Philip Carter as CFO

- On August 25, 2025, Skyworks Solutions announced that Philip Carter will rejoin the company as Senior Vice President and Chief Financial Officer, effective September 8, 2025, succeeding the interim CFO.

- Carter’s previous tenure at Skyworks, paired with recent executive experience at Advanced Micro Devices, brings both company familiarity and fresh industry perspective to the finance function.

- To understand how Carter’s return could shape Skyworks Solutions’ path, we’ll examine its impact on the company’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Skyworks Solutions Investment Narrative Recap

To be a shareholder in Skyworks Solutions, it’s important to believe in the company’s ability to adapt amid competitive pressures in mobile and diversify into higher-growth segments like automotive and IoT, while managing heavy reliance on its largest customer. The return of Philip Carter as CFO is unlikely to materially impact Skyworks’ most relevant short-term catalyst, the rollout of new wireless standards boosting RF chip demand, or change the biggest risk, which remains the concentration of revenue from a single customer.

Among recent announcements, the August 2025 unveiling of the SKY53510/80/40 clock fanout buffers stands out. This new product targets high-speed infrastructure and aligns with industry trends toward more complex wireless solutions, supporting Skyworks’ focus on broadening its market reach and capitalizing on emerging connectivity opportunities.

However, investors should be aware that, in contrast to potential growth through diversification, the concentration risk from Skyworks’ largest customer still poses a significant vulnerability in the near term…

Read the full narrative on Skyworks Solutions (it's free!)

Skyworks Solutions' outlook anticipates $4.1 billion in revenue and $520.7 million in earnings by 2028. This scenario assumes a 1.0% annual revenue growth rate and a $124.5 million increase in earnings from the current $396.2 million.

Uncover how Skyworks Solutions' forecasts yield a $72.47 fair value, a 4% downside to its current price.

Exploring Other Perspectives

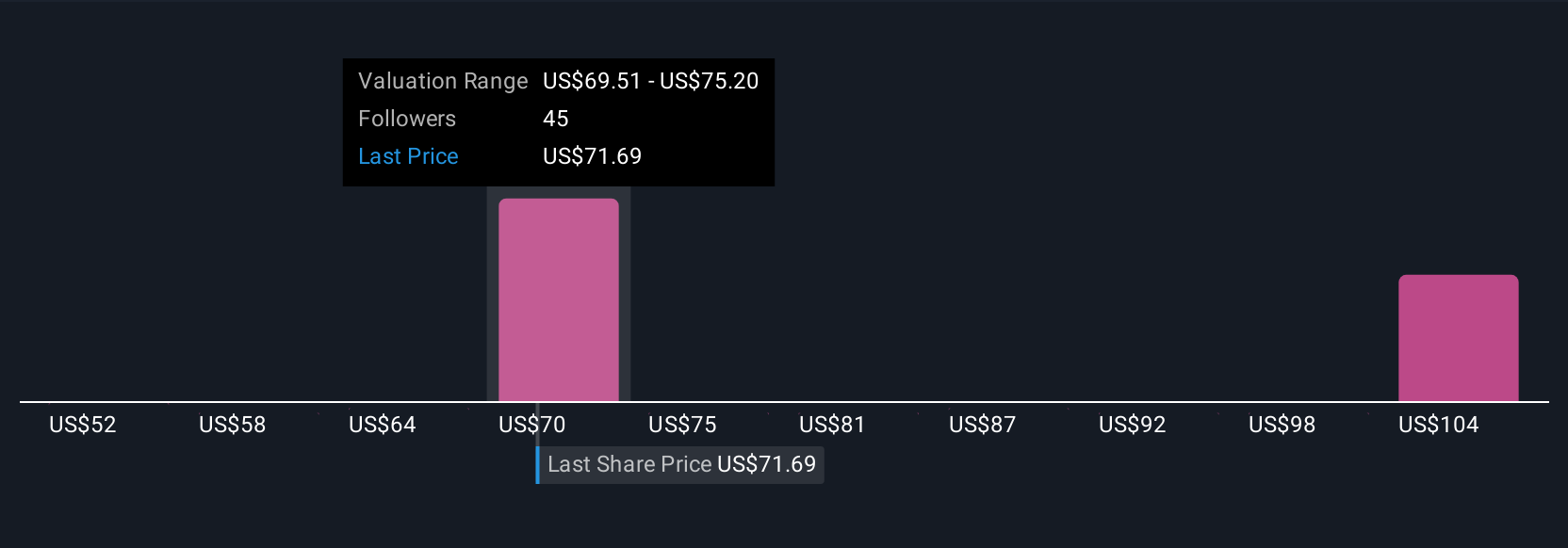

Simply Wall St Community members have submitted five independent fair value estimates for Skyworks Solutions, ranging widely from US$58 to US$111.73. When considering such a spread, remember that customer concentration remains the company’s most critical risk, affecting both earnings and business resilience.

Explore 5 other fair value estimates on Skyworks Solutions - why the stock might be worth 23% less than the current price!

Build Your Own Skyworks Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Skyworks Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyworks Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English