Can Chagee Holdings (CHA) Balance Global Ambitions With Domestic Challenges?

- Chagee Holdings Limited recently reported strong revenue growth and successful expansion into Southeast Asia and North America, while also disclosing ongoing challenges in its domestic market from heightened competition and rising operating costs.

- An interesting aspect is the company’s continued focus on premium brand positioning and long-term overseas investments despite domestic pressures impacting short-term performance.

- We’ll look at how Chagee’s global growth strategy shapes the company’s investment narrative amid ongoing operational headwinds.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Chagee Holdings' Investment Narrative?

To be a shareholder in Chagee Holdings right now, you need to believe that its focus on international expansion and premium brand building can offset the pronounced headwinds at home. The recent news showing strong global revenue growth and new stores in the US and Southeast Asia suggests these initiatives are gaining ground, but surging competition and increased expenses continue to weigh on domestic earnings. With the share price down sharply after weak quarterly numbers and shifting operational tactics, investors are now more attuned to how quickly overseas expansion can deliver meaningful returns and whether streamlining actions improve profitability. Short-term catalysts now depend on evidence that international markets are driving both margins and growth, while risks have shifted more clearly to execution: sustaining profit growth as costs rise, especially with a very new board and an upcoming lock-up expiration. The recent news makes earnings momentum outside China a critical watch point for both recovery and downside.

However, the October lock-up expiration could introduce an additional layer of volatility for those holding shares.

Exploring Other Perspectives

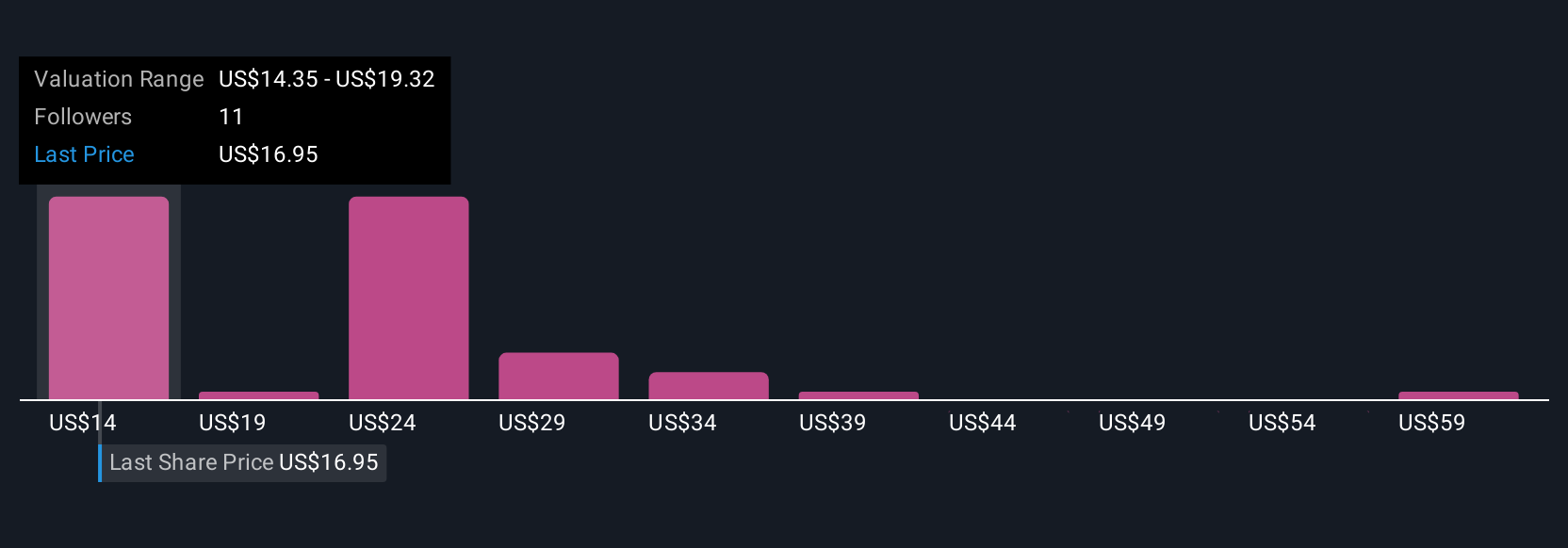

Explore 12 other fair value estimates on Chagee Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Chagee Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chagee Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chagee Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chagee Holdings' overall financial health at a glance.

No Opportunity In Chagee Holdings?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English