MP Materials (MP) Announces US$275 Million Revolving Credit Facility With JPMorgan Chase

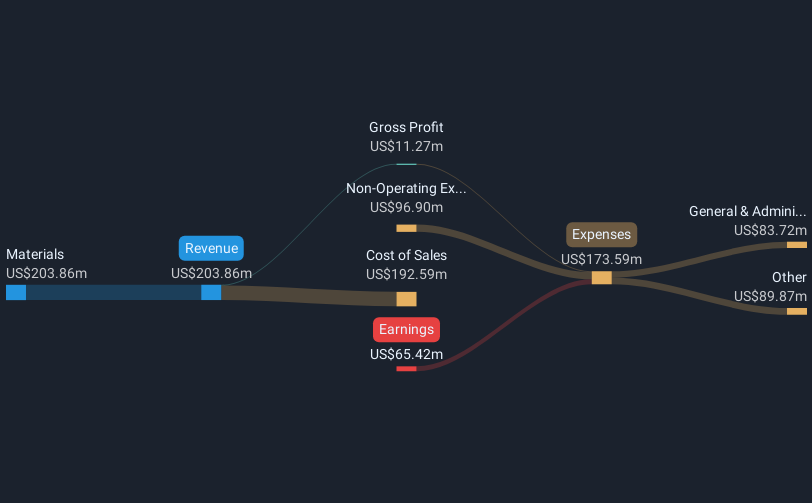

MP Materials (MP) announced a $275 million revolving credit facility with JPMorgan Chase in August, aiming to enhance operational flexibility. Despite reporting a reduced net loss for Q2 2025 compared to last year, sales saw significant growth, shining a positive light on its earnings announcement. The company's performance in the market, with a 145% price move over the last quarter, aligns well with recent market trends where indices like the S&P 500 hit record highs. Strengthened partnerships, notably with Apple, and an active credit management approach seem to reinforce investor confidence amid a generally rising market.

MP Materials has 2 possible red flags we think you should know about.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

MP Materials' new $275 million revolving credit facility with JPMorgan Chase and its strengthened partnerships, such as those with Apple, have positioned the company to enhance operational flexibility and reinforce investor confidence. This financial maneuvering comes amid a market environment where significant indices like the S&P 500 have recently hit record highs. With a 145% share price increase over the last quarter, MP Materials continues to align with these positive market themes.

Over the past year, MP Materials delivered a very large total shareholder return of 353.27%. This performance markedly exceeded the Metals and Mining industry, which saw a 37.4% return, as well as the broader US market's return of 21.6%. Such exceptional returns may reflect the market's response to MP's strategic initiatives and robust revenue growth driven by its government and corporate partnerships.

The recent financial arrangements and partnerships are likely to positively impact MP Materials' revenue and earnings forecasts. Analysts anticipate future revenue growth supported by secured government contracts and expansion initiatives. The shares currently trade at US$63.05, below the current analyst consensus price target of US$77. Despite the share's significant growth, the market price still sits at a discount of over 22% to the consensus target, indicating potential upside according to analyst forecasts. This discount highlights analyst confidence in MP Materials' ability to leverage its new financial agreements and partnerships to achieve its ambitious growth plans.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English