Benzinga's 'Stock Whisper' Index: 5 Stocks Investors Secretly Monitor But Don't Talk About Yet

Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending September 5:

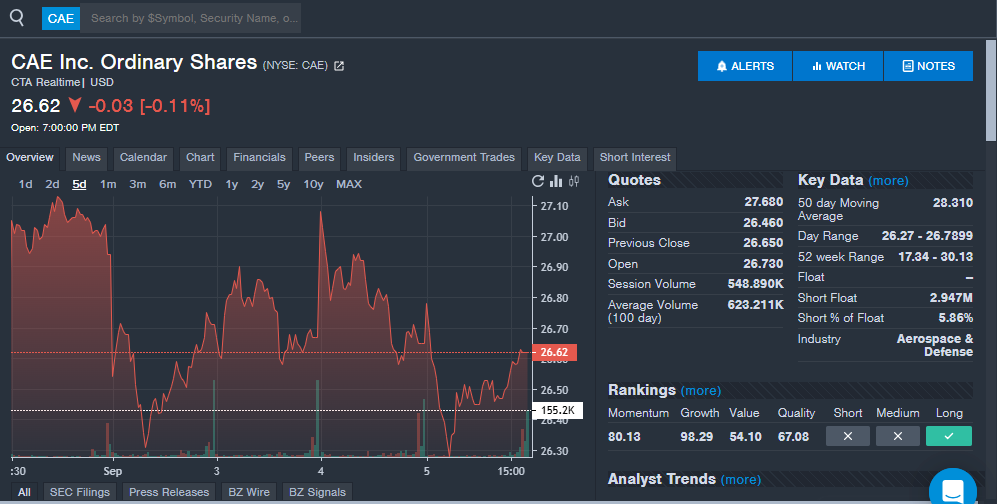

CAE Inc (NYSE:CAE): The training and aviation company saw increased interest from investors during the week with minimal news. The company announced the inauguration of its first business aviation training centers in Central Europe recently. The center features simulators for several large aircrafts and is said to be a helper with Europe's need for thousands of new pilots. In mid-Augusts the company reported first-quarter results that were missed with earnings per share inline and revenue missing analyst estimates. With the increased interest and the growth of training in Europe, the stock could be one to watch.

Vipshop Holdings (NYSE:VIPS): The Chinese discount online retailer saw increased attention from investors during the week and shares traded higher by over 2% on the week. The company reported second-quarter earnings in mid-August with earnings per share and revenue beating consensus estimates. The company also guided for third-quarter revenue of $2.89 billion to $3.03 billion, ahead of Street guidance of $2.88 billion. The beat and strong guidance could send shares higher, with the stock already up 27% year-to-date in 2025.

Nyxoah SA (NASDAQ:NYXH): The health technology company saw strong interest during the week with shares down nearly 8% on the week. In mid-August the company reported quarterly financial results and the commercial launch of its Genio System, which was recently approved by the FDA. Genio and the company's other developments target obstructive sleep apnea. One of the reasons for the increased interest from investors is likely the company's September calendar full of event presentations. The company's calendar in September includes the Wells Fargo Healthcare Conference, Cantor Global Healthcare Conference, Morgan Stanley Annual Global Healthcare Conference and the Baird's Global Healthcare Conference.

UP Fintech Holding (NASDAQ:TIGR): Shares of the online brokerage company, which focuses on Chinese investors, fell on the week. The company recently reported second-quarter financial results with a mix of positive and negative news. The company saw total revenue up 58.7% year-over-year. Total account balances and new funded customers also rose in the quarter on a year-over-year basis. On the negative side, the company saw expenses rise in the quarter and the announcement that a member of the Board of Directors is resigning. With shares up over 80% year-to-date, the stock may have sold off on some of the bad news and profit taking. The growth in accounts and trading volume could set the company up well for future quarters.

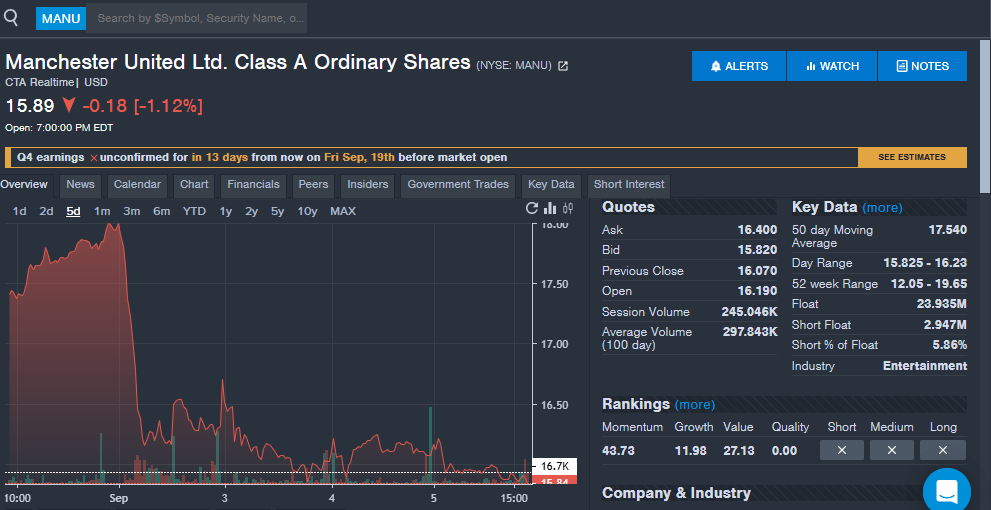

Manchester United (NYSE:MANU): The English Premier League soccer team, which is publicly traded, saw strong interest from readers during the week. The company recently announced a new partnership with Coca-Cola that could show strength in branding deals and increased sponsorship revenue. The team recently kicked off a new EPL season with a 1-1-1 record and 9th place standing, as the team looks to improve on a rough 15th place finish in the last season. Likely helping interest in Manchester United is surging valuations for the sale of professional sports teams with the NFL's New York Giants valued at a reported $10 billion.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English