These 4 Precious Metals Stocks Outshine As Gold Rallies

Four leading precious metals stocks have surged into the top 10th percentile of the latest market momentum rankings, as shifting global demand boosts gold prices and gives miners a competitive edge.

Their standout percentile improvements highlight a robust trend in the sector, combining strong price movement with volatile upward action relative to peers.

Precious Metals Shine On Strong Momentum

Momentum, as defined in the Benzinga Edge stock ranking framework, is the relative strength of a stock based on multi-timeframe price action and volatility—ranked as a percentile against all other stocks.

Newmont Corp. (NYSE:NEM), McEwen Inc. (NYSE:MUX), New Pacific Metals Corp. (NYSE:NEWP), and Hecla Mining Co. (NYSE:HL) have not only benefited from gold's rally but have also outperformed most competitors in the broader materials sector.

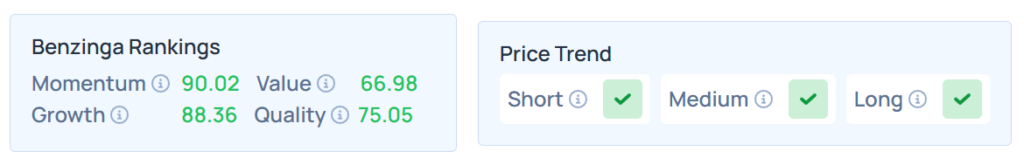

Newmont Corp.

- As one of the world's largest gold producers, NEM’s steady operational performance, combined with its leveraged exposure to rising gold prices, propelled its momentum score from 89.79 to the 90.02 percentile.

- The stock has gained 98.51% year-to-date and 50.18% over a year.

- It maintains a stronger price trend over the short, medium, and long terms with a robust growth ranking. Additional performance details are available here.

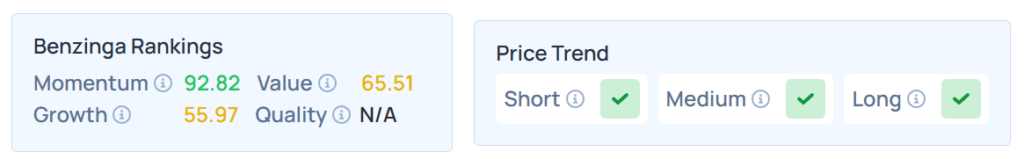

McEwen

- MUX, a diversified precious metals miner, has shown significant momentum percentile improvement from 85.44 to the 92.82th percentile, driven by new discoveries and asset expansions.

- Higher by 64.29% in the YTD, the stock was up 60.02% over the year.

- With a moderate vaue ranking, this stock maintained a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

See Also: 4 Asset Management Fund Stocks Shine As Their Growth Rankings Jump This Week

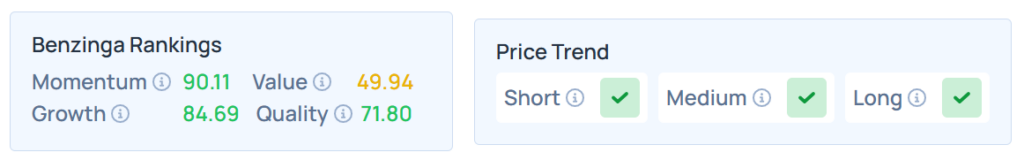

New Pacific Metals Corp.

- Specializing in silver and precious metal exploration, NEWP experienced a surge in its momentum ranking from 86.9 to the 91.28th percentile amid the commodities rally.

- The stock advanced 62.70% YTD and 62.70% over a year.

- It had a strong price trend in the short, medium, and long terms. Additional performance details are available here.

Hecla Mining

- HL’s momentum improvement traces to operational upgrades and strong silver output. As silver prices swung upward in recent months, Hecla's ranking rose from 87.78 to the 91.02th percentile, reflecting not only price advances but increased trading volatility and investor activity.

- It was up 62.23% over a year, and 71.48% YTD.

- The stock had a stronger price trend in the short, medium, and long terms with a moderate value ranking. Additional performance details are available here.

What Does The Momentum Score Mean?

Stocks entering the top 10% momentum rankings have displayed superior price movement, typically over several months or quarters, often accompanied by high trading volume and volatility.

Both broader commodity price trends and individual successes in resource development, production, or financial management drive this percentile jump.

Price Action

Gold Spot US Dollar rose 0.34% to hover around $3,599.14 per ounce. Its last record high stood at $3,600.33 per ounce.

It was up 39.69% over a year and 23.65% in the last six months.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and the Nasdaq 100 index, respectively, ended the day mixed on Friday. The SPY was down 0.29% at $647.24, while the QQQ advanced 0.14 to $576.06, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English