Eli Lilly (LLY): Assessing Valuation Following Breakthrough Lung Cancer and Obesity Drug Milestones

If you are wondering what to make of the recent headlines about Eli Lilly (LLY), you are not alone. The company just scored an FDA Breakthrough Therapy designation for its lung cancer drug olomorasib in combination with pembrolizumab, signaling strong regulatory momentum in oncology. On top of that, Lilly announced encouraging Phase 3 results for orforglipron, its oral GLP-1 candidate for obesity and type 2 diabetes, a space that continues to capture investor attention. These late-stage clinical wins are precisely the kind of catalysts that make investors rethink their stance, wondering if the growth story is just getting started.

Looking beyond this month's milestones, Eli Lilly's stock has navigated a mixed path. The past month brought solid gains, but the past year has seen some correction, even as multi-year performance remains outstanding. The current tone in the market suggests that while enthusiasm is building around new drug launches and pipeline updates, expectations for future growth are already running high.

Now, with momentum coming from breakthrough designations and positive clinical data, the question is clear: does Eli Lilly still offer a compelling entry point at today's price, or is the stock now fully valued as markets try to price in future breakthroughs?

Most Popular Narrative: 18.2% Undervalued

According to the most-widely followed narrative, Eli Lilly is considered undervalued by over 18% relative to its projected fair value, using a discount rate of 6.8%. This finding is based on robust future earnings and margin expansion assumptions, as well as anticipated growth from global expansion and innovation in key drug segments.

Strong volume and revenue growth in obesity and diabetes treatments (notably Mounjaro and Zepbound) is supported by the global rise in chronic diseases and expanding access in emerging markets. Management highlights both robust international launches and substantial production capacity increases. This is likely to drive continued revenue and earnings growth.

Want to find out why analysts think Eli Lilly’s earnings trajectory deserves this premium? One key set of projections powering this view might surprise you. The playbook behind the valuation leans on future growth rates and profitability benchmarks that few other companies in the sector can match. Curious about what makes this revenue story stand out from the rest?

Result: Fair Value of $888.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing regulatory pressure on pricing and heavy reliance on a few blockbuster drugs could disrupt Lilly’s growth outlook more rapidly than analysts currently expect.

Find out about the key risks to this Eli Lilly narrative.Another View: Market Ratios Tell a Different Story

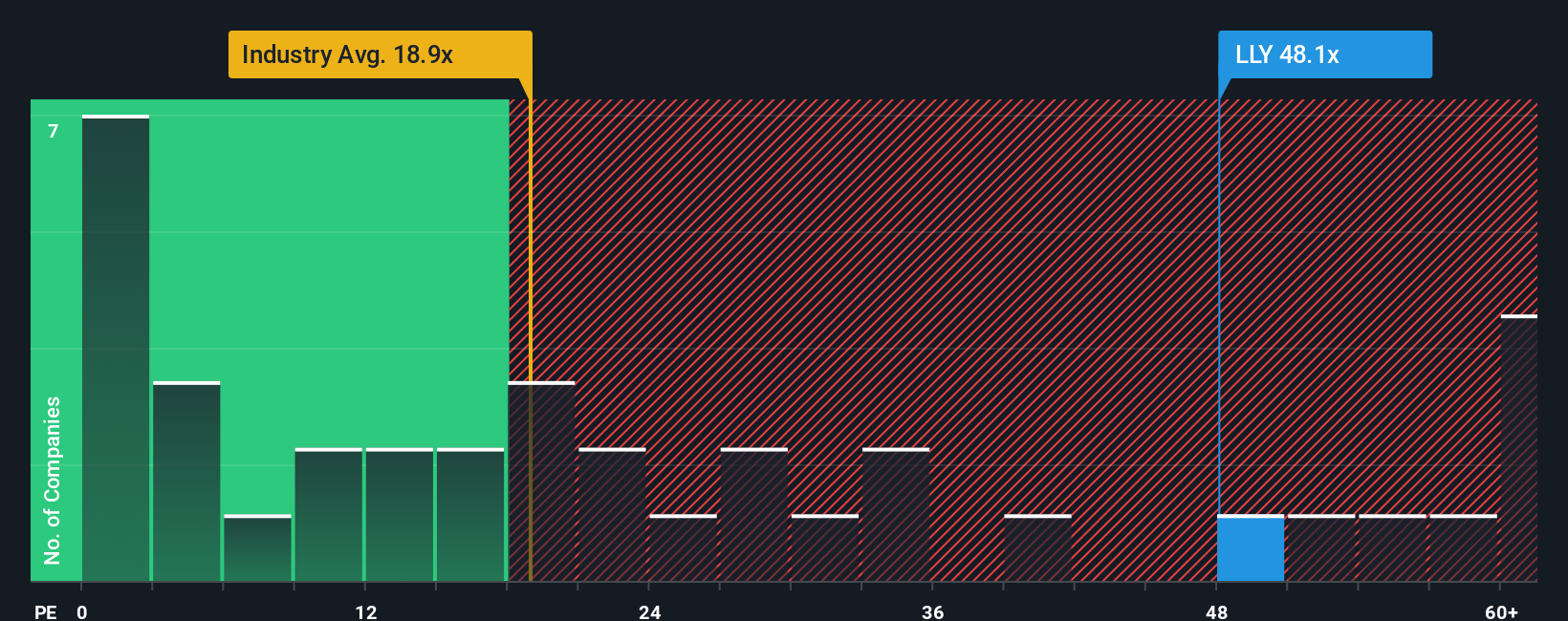

Looking at Eli Lilly’s valuation through the lens of current market ratios changes the picture. By this popular approach, the stock appears expensive compared to its industry, raising questions about whether recent optimism is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eli Lilly Narrative

If you would rather dig into the data and shape your own outlook, you can analyze and craft a narrative in just a few minutes. Do it your way.

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Stay ahead of the market by broadening your investment search with tools designed to help you uncover promising companies in overlooked or up-and-coming sectors. If you miss out, you might let incredible potential slip by.

- Target steady cash flow for your portfolio by checking out high-yield opportunities in dividend stocks with yields > 3%.

- Kickstart your hunt for innovators at the frontier of artificial intelligence and healthcare by exploring healthcare AI stocks.

- Find undervalued gems before the crowd and seize value with confidence using our latest picks in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English