Eli Lilly (LLY) Announces Promising Results For Jaypirca In CLL Phase 3 Trial

Eli Lilly (LLY) recently announced positive results from its Phase 3 BRUIN CLL-313 trial, revealing significant progression-free survival improvements for its drug Jaypirca in treatment-naive CLL/SLL patients. This announcement likely played a key role in the company’s 16% share price rise over the past month. The FDA's Breakthrough Therapy designation for the company's olomorasib, targeting NSCLC in combination with KEYTRUDA, supports their innovative momentum. These developments, occurring amidst slight market fluctuations and growing expectations for Federal Reserve rate cuts, appear to have bolstered confidence in Eli Lilly’s growth prospects.

We've spotted 2 weaknesses for Eli Lilly you should be aware of, and 1 of them is a bit unpleasant.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

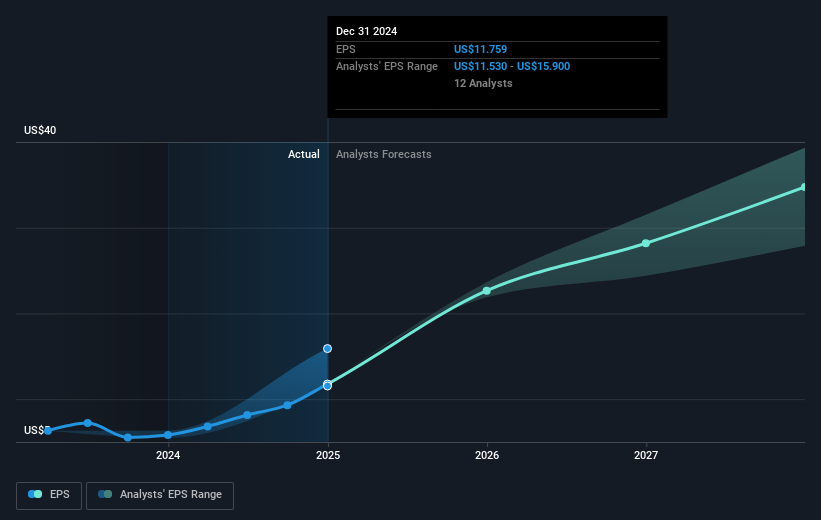

The recent positive trial results for Eli Lilly's drug Jaypirca and the FDA Breakthrough Therapy designation for olomorasib may positively influence the company's growth trajectory in the neurodegenerative and specialty drug markets. These advancements could enhance Eli Lilly's offerings in the chronic disease treatment sphere, potentially boosting future revenue and earnings growth projections. Currently, the company's shares trade at US$727.21, showing a considerable discount to the consensus price target of US$891.62, indicating potential room for upward correction should these growth drivers effectively materialize.

Over the past five years, Eli Lilly's total shareholder return, inclusive of share price appreciation and dividends, reached 416.18%, demonstrating significant longer-term performance. However, more recently, Eli Lilly underperformed the broader U.S. market, which gained 20.8% over the past year, and the U.S. Pharmaceuticals industry, which had an 11.5% decline. These dynamics highlight the company's varied performance across different time frames.

Examine Eli Lilly's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English