MediNet Group Limited (HKG:8161) Surges 52% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, MediNet Group Limited (HKG:8161) shares have been powering on, with a gain of 52% in the last thirty days. The last month tops off a massive increase of 130% in the last year.

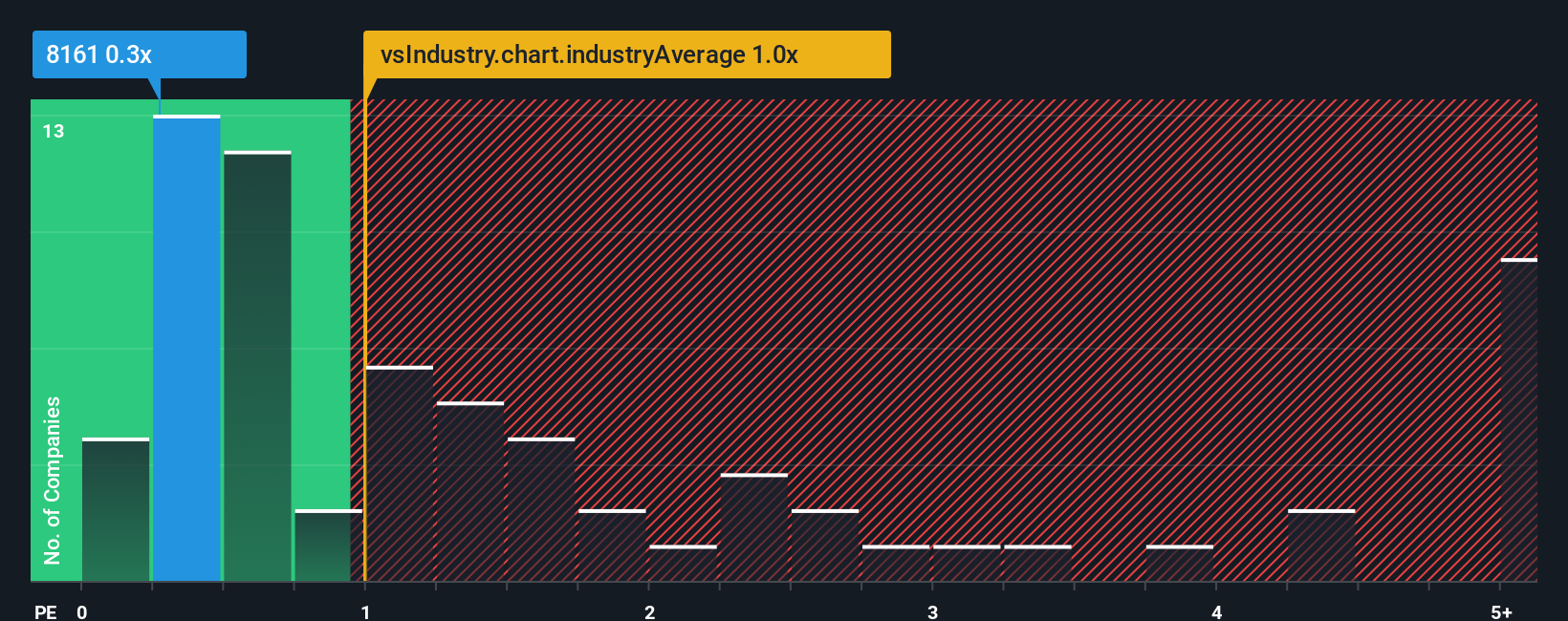

In spite of the firm bounce in price, given about half the companies operating in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") above 1x, you may still consider MediNet Group as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for MediNet Group

How Has MediNet Group Performed Recently?

As an illustration, revenue has deteriorated at MediNet Group over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on MediNet Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, MediNet Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 8.5% decrease to the company's top line. As a result, revenue from three years ago have also fallen 12% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 10% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that MediNet Group's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Despite MediNet Group's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of MediNet Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

And what about other risks? Every company has them, and we've spotted 3 warning signs for MediNet Group (of which 2 are significant!) you should know about.

If you're unsure about the strength of MediNet Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English