Viasat (VSAT) Valuation in Focus Following Defense Wins, Space Force Contracts, and ViaSat-3 F2 Launch Momentum

Most Popular Narrative: 24% Overvalued

The most popular narrative in the market today suggests that Viasat is trading above its fair value estimate, with a consensus view projecting the stock to be nearly a quarter overvalued compared to underlying earnings growth assumptions.

Expanding secure connectivity and advanced satellite networks positions Viasat for broader market access, higher pricing power, and sustained top-line growth. Strategic integration, operational efficiency, and heightened demand for digital inclusion support improved cash flow, reduced debt, and better earnings quality.

What is behind this attention-grabbing fair value? Analysts are betting on a game-changing financial turnaround, driven by a set of bold forecasts that could put Viasat in a new league. But which future numbers hold the key to justifying this target, and could this scenario reshape how investors value the stock for years to come? The answers may change your view of what is possible for Viasat’s growth story.

Result: Fair Value of $24.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing heavy capital expenditures and declining U.S. broadband subscribers could quickly derail the expected growth path that supports the bullish outlook.

Find out about the key risks to this Viasat narrative.Another View: Discounted Cash Flow Perspective

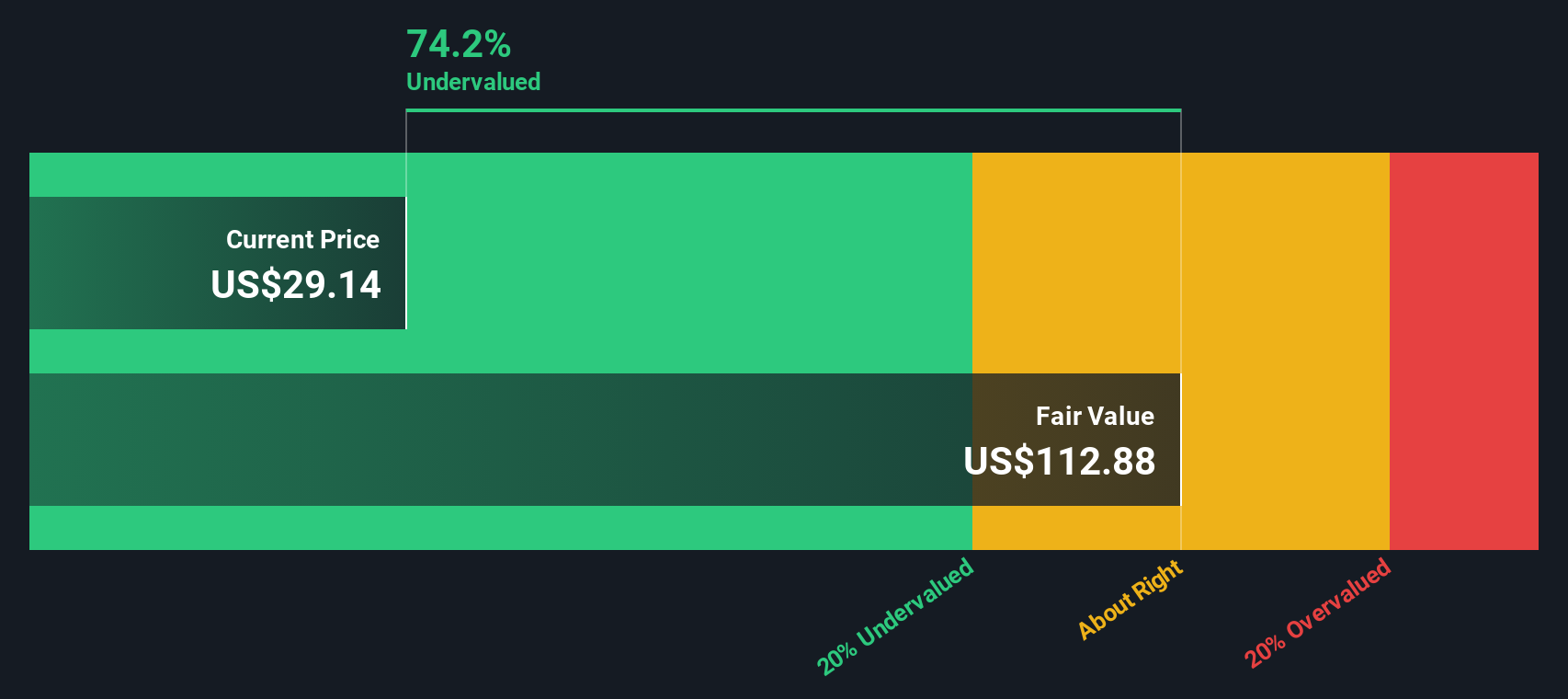

Looking from a different angle, our DCF model paints a sharply different picture for Viasat. This analysis suggests the shares may actually be undervalued. Does this new calculation upend the prevailing market narrative, or does it simply add another wrinkle?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viasat Narrative

If you see things differently or want to dig into the numbers on your own, you can build your own view of Viasat’s story in under three minutes with our tools. Do it your way.

A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to build a smarter portfolio and spot tomorrow’s winners before everyone else. With Simply Wall Street’s screeners, you can uncover fresh opportunities tailored to your goals.

- Unlock fast-growing potential by targeting penny stocks with robust financials and momentum using our penny stocks with strong financials.

- Capture strong income streams by uncovering companies offering dividend yields higher than 3 percent through our exclusive dividend stocks with yields > 3%.

- Harness breakthrough innovation by pinpointing healthcare companies leading the AI transformation with the powerful healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English