Argan (AGX): Examining Valuation Following Strong Q2 and Half-Year Earnings Growth

If you are watching Argan (AGX) after its latest earnings announcement, you are not alone. The company just posted its second quarter and half-year results, and both sales and net income jumped sharply compared to last year. Investors are clearly taking notice as profits more than doubled, adding a fresh momentum to the story and catching the eye of anyone considering what’s next for the stock.

This surge comes against a backdrop of mixed short-term performance. Over the past month, Argan’s shares have dropped by 15%, erasing previous gains, and momentum has faded in the past quarter. Still, when looking at a longer-term perspective, the stock has shot up 120% over the past year, with sustained multi-year growth beyond most of its peers. This year’s rally, combined with earnings growth, signals that investor expectations and risk perceptions may be shifting after the latest results.

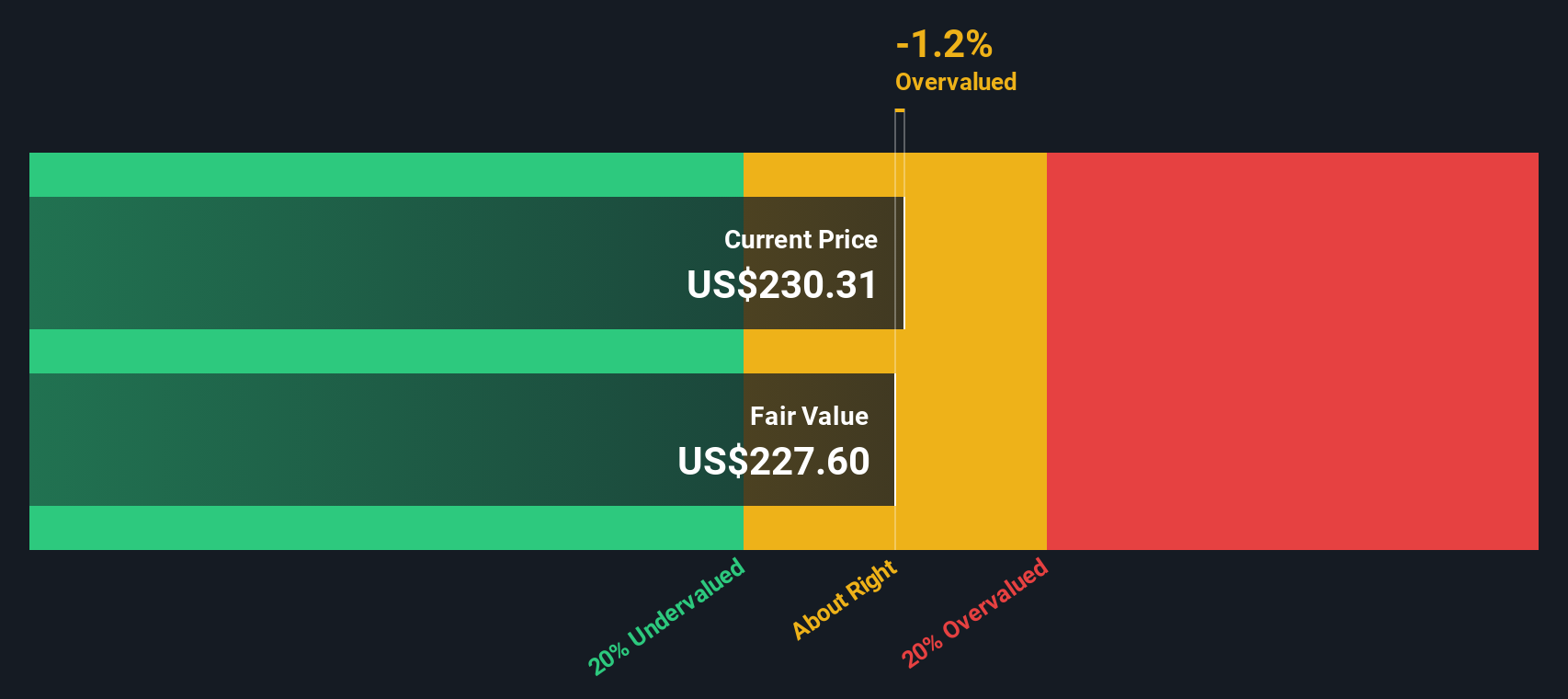

After such a rapid jump in both earnings and share price over twelve months, the question arises: is Argan undervalued on the back of strong fundamentals, or is the market already pricing in more ambitious future growth?

Most Popular Narrative: 28% Undervalued

According to the most widely followed narrative, Argan shares are trading at a significant discount to fair value. The narrative suggests that the company is undervalued based on projected growth trends and robust fundamentals.

Argan’s project backlog is a major growth catalyst and has exceeded $1 billion as of the latest reports. This backlog includes a significant mix of renewable energy projects and provides strong revenue visibility for future quarters. Recent contract wins, particularly in infrastructure and power generation, have bolstered investor confidence and set the stage for sustained top-line growth.

Curious what is fueling this bullish price target? The secret recipe is found in expectations of future revenue acceleration and profit levers that rivals rarely achieve. If you want to discover the unique growth expectations and the margins supporting this call, you’ll want to review the detailed financial blueprint underlying the narrative’s projection.

Result: Fair Value of $284.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, material and labor cost inflation, or unforeseen project losses, could quickly dampen the bullish view and trigger renewed caution among investors.

Find out about the key risks to this Argan narrative.Another View: Discounted Cash Flow Perspective

Looking at Argan through the lens of our DCF model, we see a result that supports the previous view. Shares appear undervalued when plugging in conservative growth assumptions. But can one model tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Argan Narrative

If you’re interested in diving deeper or see the numbers differently, you have the tools to build your own view in just minutes. Do it your way.

A great starting point for your Argan research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Missing out on the next big opportunity is easy if you only focus on one stock. Make your investment shortlist stronger with these tailored ideas from Simply Wall Street’s Screener, designed to match your goals and style.

- Uncover potential in fast-growing opportunities by checking out penny stocks with strong financials with strong balance sheets and real momentum behind their numbers.

- Power up your portfolio with AI penny stocks leading the way in artificial intelligence breakthroughs and innovation across industries.

- Lock in steady potential income with dividend stocks with yields > 3% that offer solid yields above 3% and robust track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English