A Look at Cummins’s Valuation After Analyst Upgrade Highlights AI-Fueled Growth Potential

Investors keeping an eye on Cummins (NYSE:CMI) have a new fire to consider. Melius just upgraded Cummins from Hold to Buy, pointing to higher demand fueled by artificial intelligence, improvements in how the company is operating, and a valuation that looks appealing even with the truck market cooling. What is sparking this optimism is not just AI chatter; analysts specifically called out Cummins’ expansion in large engines for generators, suggesting that the market has yet to fully recognize the potential revenue and margin boost from powering data centers and AI infrastructure.

This upgrade arrives as Cummins’ share price momentum gathers steam. The stock has jumped 22% over the past 3 months and sits up 37% from a year ago, a pace that outstrips many peers. Despite a day and week where the share price dipped slightly, it is clear that longer-term confidence has been building. That rising optimism tracks both with recent company performance, with annual net income up 11% and revenue up 5%, and signals that investors are becoming more comfortable with the mix of risks and rewards on offer.

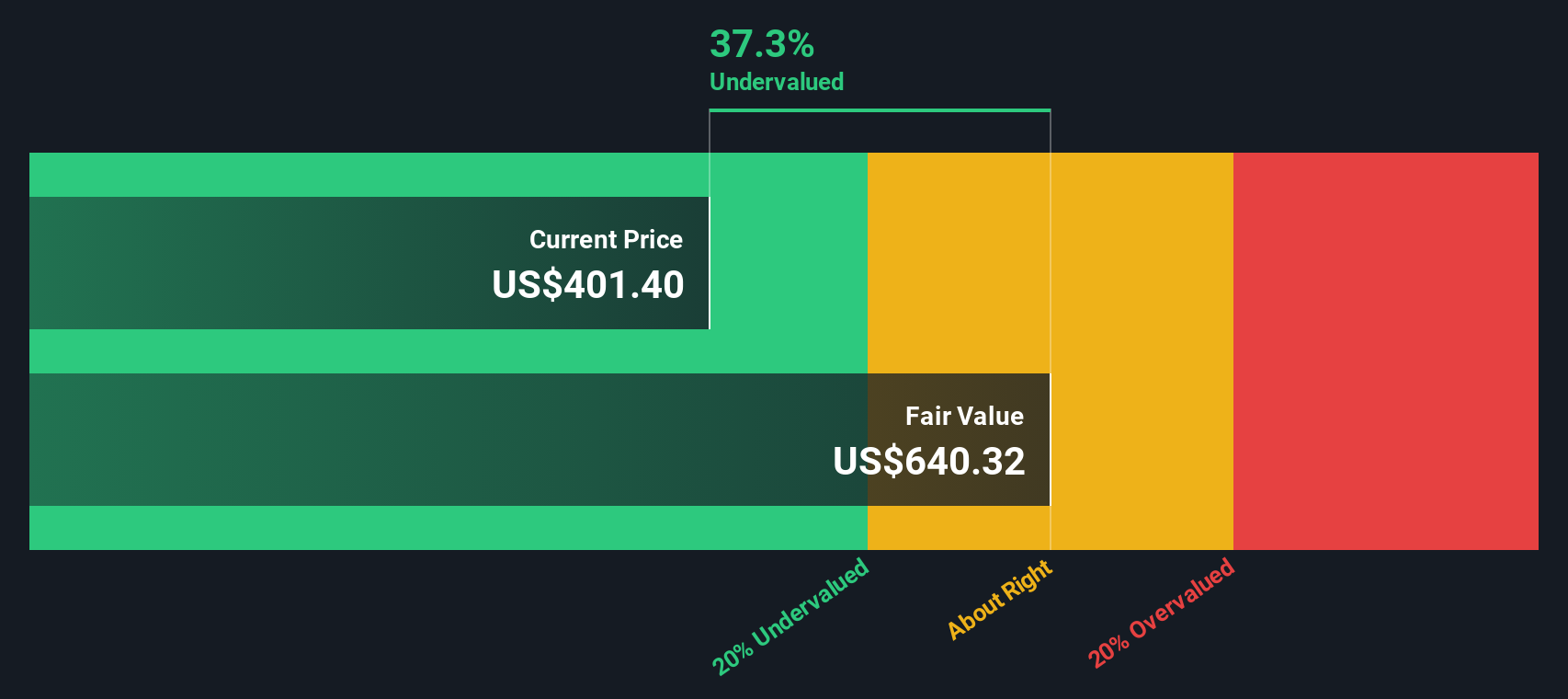

After these moves and the recent analyst confidence, is Cummins now a buy, or is the market already factoring in all of the company’s future growth from AI and beyond?

Most Popular Narrative: 3.1% Undervalued

The prevailing narrative suggests Cummins is currently trading just below its estimated fair value, with several catalysts underpinning moderate undervaluation. Analysts believe the company’s forward opportunities in data centers and electrification could unlock outsized earnings and margin growth.

“Cummins is experiencing strong and steadily growing demand for power generation equipment, especially from the data center sector, driven by increasing urbanization, digital infrastructure expansion, and the global shift toward cleaner, efficient energy solutions. This diversification is lifting revenue and supporting higher EBITDA margins, offsetting softness in the traditional truck markets.”

Think Cummins’ recent rally is all about trucks? Look closer. The narrative hinges on bold long-term bets, surprising profitability forecasts, and a discounted valuation rarely seen for an industrial stalwart. The full story digs into ambitious growth rates, future cash flows, and the financial multiple that could redefine the company’s value. The real numbers will surprise you.

Result: Fair Value of $410.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in truck demand or regulatory uncertainty could quickly challenge the bullish outlook and have a negative impact on Cummins’ projected earnings growth trajectory.

Find out about the key risks to this Cummins narrative.Another View: The SWS DCF Model Weighs In

The SWS DCF model paints a notably different picture. It suggests that Cummins could be meaningfully undervalued when using a long-term cash flow approach. However, is this perspective more reliable than market-based comparisons?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cummins Narrative

If you want to take a different view or dig into the numbers yourself, it's easy to create your own narrative in just a few minutes. Do it your way

A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the trends and uncover opportunities the market might be missing. Propelling your portfolio forward starts with choosing the right stocks in the right sectors.

- Accelerate your returns with up-and-coming companies showing financial strength by tapping into penny stocks with strong financials, where you can find hidden gems before the crowd catches on.

- Target consistent, worry-free income streams by browsing dividend stocks with yields > 3%, which highlights businesses that deliver robust dividend yields above 3%.

- Ride the wave of demand for machine intelligence by scanning AI penny stocks and spotting companies that are powering tomorrow's AI breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English