Choice Hotels International (CHH): Is the Current Valuation Reflecting Fading Momentum?

Most Popular Narrative: 13.7% Undervalued

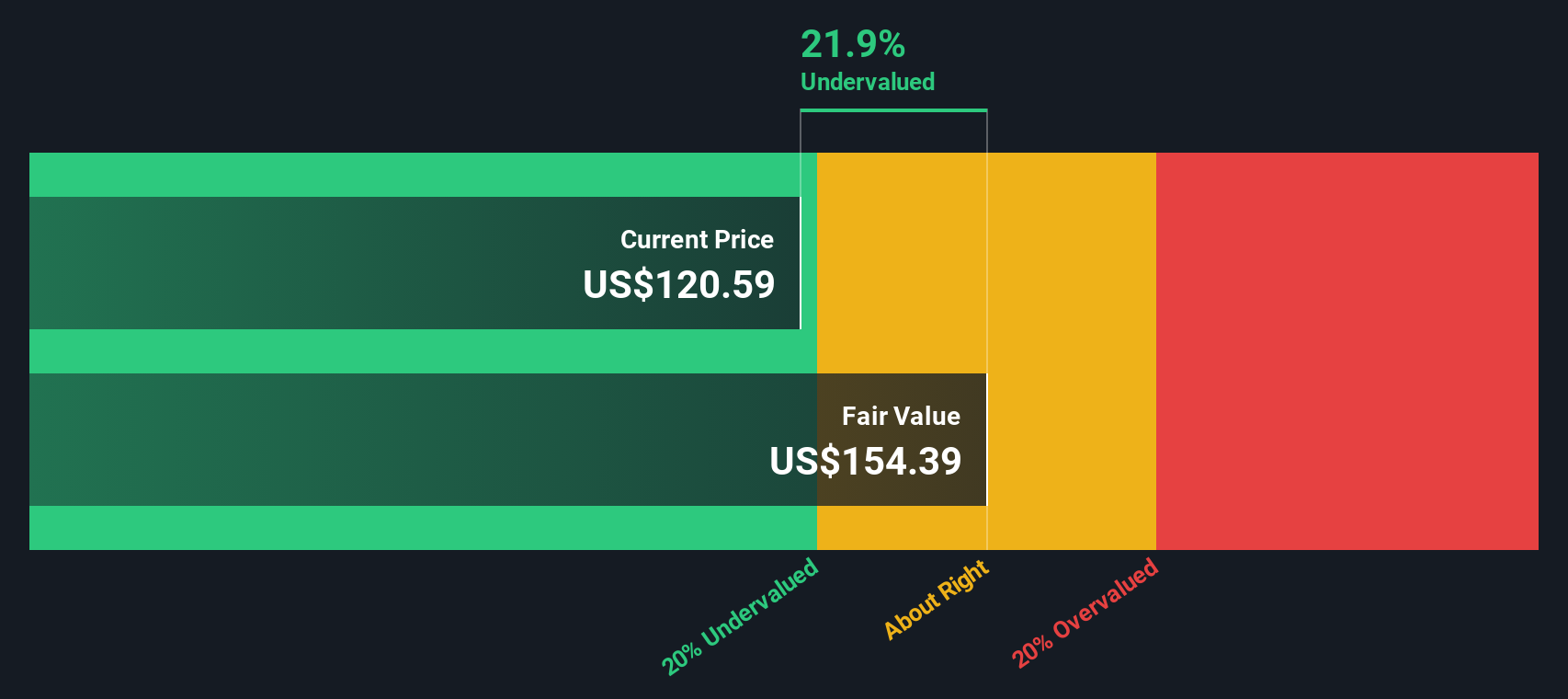

The prevailing narrative suggests that Choice Hotels International is currently undervalued, with a fair value estimate noticeably above its present share price based on future growth expectations.

Strong international expansion, including new direct franchising in Canada, a master franchising deal in China targeting 10,000 rooms, and increased presence in EMEA and South America, is set to capture rising global travel demand from growing middle-class populations. This is expected to drive significant future revenue and EBITDA growth compared to historical expectations.

Curious how ambitious international growth, loyal repeat customers, and a strategic business model power this bullish view? Beneath the headline, analysts factor in substantial increases for revenue and earnings, along with a key profit multiple well below what you might expect from its sector. Uncover which assumptions are fueling this double-digit undervaluation and the numbers driving a much higher fair value forecast. Do not miss what could be behind the next major move.

Result: Fair Value of $132.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, softness in international travel and ongoing margin pressure could quickly challenge the optimistic outlook for Choice Hotels International’s future growth and valuation.

Find out about the key risks to this Choice Hotels International narrative.Another View: What the DCF Model Says

While analyst forecasts support an undervalued outlook, our DCF model reaches a similar conclusion using discounted future cash flows. However, with any model, the outcome depends on your confidence in the inputs. Could different growth or risk assumptions lead to a different result?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Choice Hotels International Narrative

If you see things differently or want to dig into the data on your own terms, building your own view is quick and straightforward. Do it your way

A great starting point for your Choice Hotels International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay one step ahead by checking out new opportunities before the crowd. Don’t let a unique investment slip through your fingers. See what else is possible right now.

- Boost your portfolio with generous passive income when you check out dividend stocks with yields > 3%. This resource features stocks that excel at rewarding shareholders with high yields.

- Uncover the next tech game-changer by tapping into AI penny stocks, which spotlights companies at the forefront of artificial intelligence innovation.

- Capitalize on market mispricings by investigating undervalued stocks based on cash flows. This list is packed with stocks trading below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English