Will Oxford Lane Capital’s (OXLC) Stock Split Shift the Narrative on Investor Access and Market Appeal?

- Oxford Lane Capital Corp. recently completed a 1-for-5 stock split on September 8, 2025, aiming to adjust its share structure and accessibility to investors.

- This move often prompts increased investor attention by altering the price per share, which can attract a broader base of market participants.

- We'll explore how Oxford Lane Capital's stock split announcement could influence its investment narrative, particularly regarding investor accessibility and market visibility.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Oxford Lane Capital's Investment Narrative?

Owning a stake in Oxford Lane Capital means believing in its ability to deliver income in the face of ongoing volatility and often unpredictable market moves. The recent 1-for-5 stock split may reshape the company’s investor base, making the shares appear more accessible, but the core business fundamentals are unchanged for now. The split itself is unlikely to materially alter short-term catalysts such as upcoming earnings or the impact of the ongoing share buyback plan. Risks remain firmly rooted in earnings quality concerns, a fairly high price-to-earnings ratio, and a dividend that is still not fully covered by profits or cash flow. Management continues to benefit from experience, but a lack of new board appointments lingers in the background. If anything, the split draws attention to the wider question of sustainable returns and how value will ultimately be created. On the other hand, the sustainability of the dividend is something investors should keep in mind.

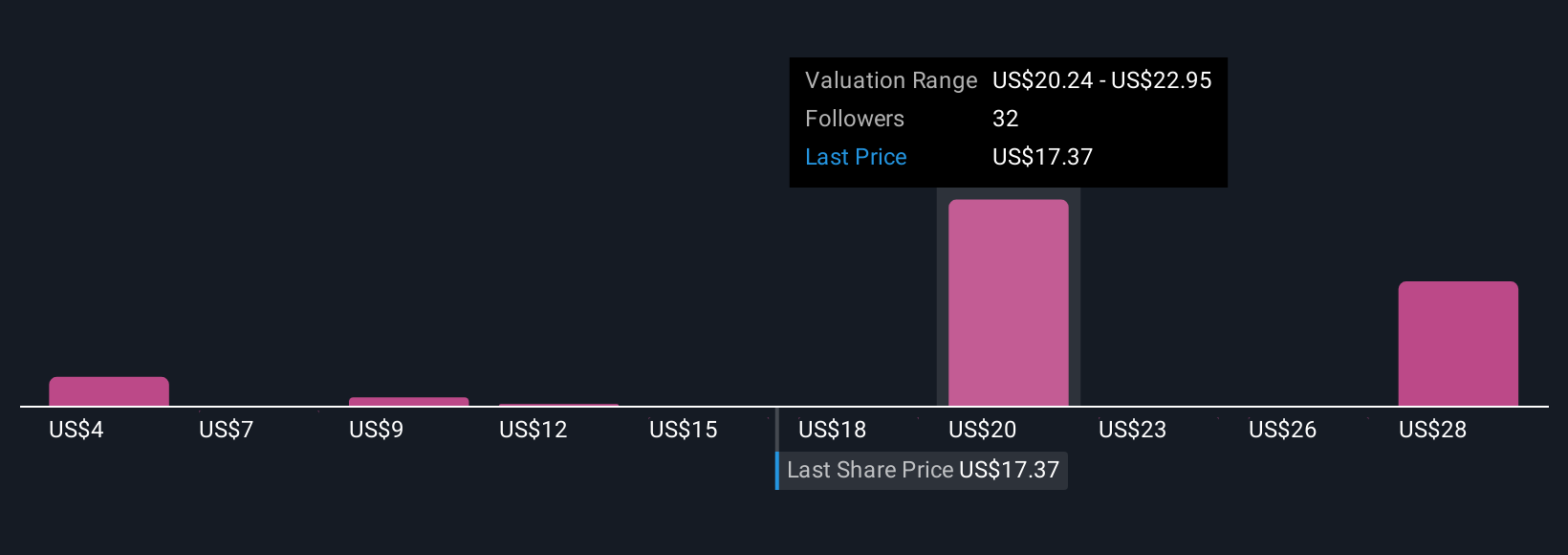

Despite retreating, Oxford Lane Capital's shares might still be trading 43% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 14 other fair value estimates on Oxford Lane Capital - why the stock might be worth as much as 77% more than the current price!

Build Your Own Oxford Lane Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oxford Lane Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Oxford Lane Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oxford Lane Capital's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English