Is PCCW (SEHK:8) Still Undervalued? A Fresh Look at Its Valuation

If you’ve been monitoring PCCW (SEHK:8) lately, you might be wondering whether the recent share price movements mean it’s time to reconsider your position. While there hasn’t been a specific event to shake up the market, the subtle shifts in performance could be a signal for those looking to spot value ahead of the curve. Sometimes, the lack of news is news itself, especially when it prompts investors to reassess whether everything is already priced in.

Over the past year, PCCW shares have put up consistent gains, with a year-to-date return of 16% and a total one-year return of 28%. This momentum stands out against a long-term backdrop of steady growth. The stock is also up more than 70% in the past three years. Even as near-term shifts have been mild, those longer-term results may catch the attention of investors weighing risk and opportunity, especially with modest revenue growth reported this year and a sharp swing in net income.

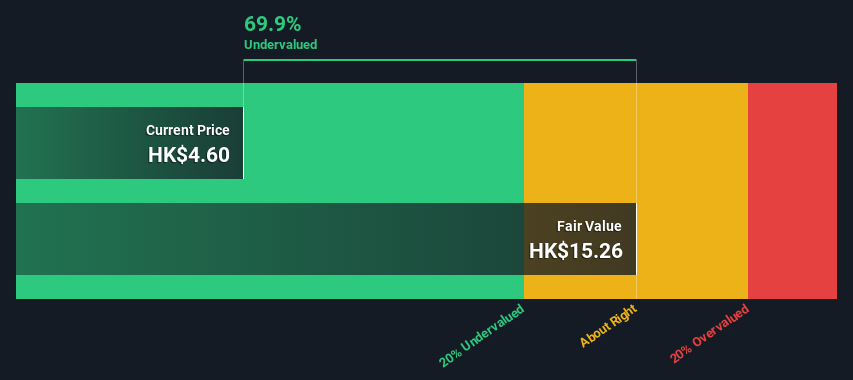

So, is there real value here that the market has yet to recognize, or has PCCW’s growth trajectory already been fully reflected in its share price?

Most Popular Narrative: 1.5% Undervalued

According to the most widely followed narrative, PCCW is currently seen as slightly undervalued, with a fair value estimate just above its prevailing share price. This perspective balances expected earnings growth with sector risks to set its target.

“Strong growth in OTT (over-the-top) streaming subscribers and advertising revenue, particularly the 27% increase in subscription and advertising revenues and pathway to positive cash flow, positions PCCW's media businesses to benefit from increased consumption of digital content in emerging Asian markets, supporting future revenue and EBITDA expansion.”

This price target is grounded in bold forecasts. Curious what’s boosting revenue and profit margins in the analysts’ numbers, and why future multiples rival top industry players? The real surprise comes from the growth math behind the fair value. Find out what unusual assumptions are powering this bullish call.

Result: Fair Value of $5.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued pressure on legacy TV revenues or intensifying streaming competition could quickly challenge even the most optimistic growth story for PCCW.

Find out about the key risks to this PCCW narrative.Another View: Discounted Cash Flow Perspective

Our SWS DCF model tells a similar story, suggesting PCCW's shares might still be trading below what their future cash flows are worth. This approach supports the idea of underlying value. However, which estimate comes closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PCCW Narrative

If you have a different perspective or prefer diving into your own research, it only takes a few minutes to craft your personal view and share insights. Do it your way

A great starting point for your PCCW research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Big Move?

Smart investors never settle for just one opportunity. Expand your horizons now and tap into fresh strategies that could give your portfolio an edge before everyone else catches on.

- Spot opportunities among fast-growing low-priced companies and seize them early by browsing penny stocks with strong financials, which are making waves with robust financial performance.

- Amplify your returns by checking out dividend stocks with yields > 3%, which deliver attractive yields and consistent income potential straight to your portfolio.

- Gain an inside track on value by targeting undervalued stocks based on cash flows, which may be trading below their true worth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English