BJ’s Wholesale Club (BJ): What Q2 Results, Cautious Analyst Outlook, and CEO Stock Sale Mean for Valuation

If you’re holding shares of BJ’s Wholesale Club Holdings (BJ) or thinking about starting a position, the past few weeks probably caught your eye. The company just wrapped up Q2 with upbeat metrics: membership is now at 8 million and digital sales jumped 34%. Still, the headlines were shaped as much by news of President & CEO Eddy Robert W. selling 17,900 shares as they were by the results themselves. At the same time, outside analysts grew cautious, highlighting how softer revenue growth and unpredictable macro conditions might challenge BJ’s path forward. Together, these developments have left many investors weighing whether risk is growing or if the opportunity is just beginning.

Share price performance has reflected this push-pull narrative. While BJ’s has faded a bit in the past month, dropping nearly 8%, it is still up 12% for the year and boasts a healthy 27% gain over the past 12 months. Looking further back, three- and five-year returns are both strong, hinting at durable momentum. Yet, the market seems to be re-evaluating where the growth ceiling stands, especially as short-term volatility creeps in after the CEO’s share sale and more moderate outlooks from the analyst community.

So after the stock’s climb this year and the latest round of mixed signals, is the market underappreciating BJ’s long-term value, or is all that future upside already baked in?

Most Popular Narrative: 14% Undervalued

According to the most widely followed narrative, BJ’s Wholesale Club Holdings currently trades well below its estimated fair value, with analysts pointing to significant upside potential if current business trends continue.

Accelerating membership growth, particularly in higher-tier memberships and underpenetrated secondary markets, is likely to boost recurring revenues and expand BJ's addressable market. This provides a strong base for future earnings growth. Expansion of BJ's physical footprint, with 25 to 30 new clubs planned over two years, especially in high-growth suburban and Sunbelt markets, supports sustained topline revenue growth and fixed cost leverage, which helps drive margin expansion.

Want to know what’s fueling this double-digit undervaluation? The narrative banks on bold projections around revenue, profit margins, and future multiples far above industry norms. Which assumptions are locking in such a premium? There’s more behind these numbers than meets the eye. Discover how today’s performance stacks up against tomorrow’s blueprint for growth.

Result: Fair Value of $115.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff uncertainty and shifts in consumer demand remain key risks that could undermine BJ's growth outlook in the coming quarters.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.Another View: How Does the Market Compare?

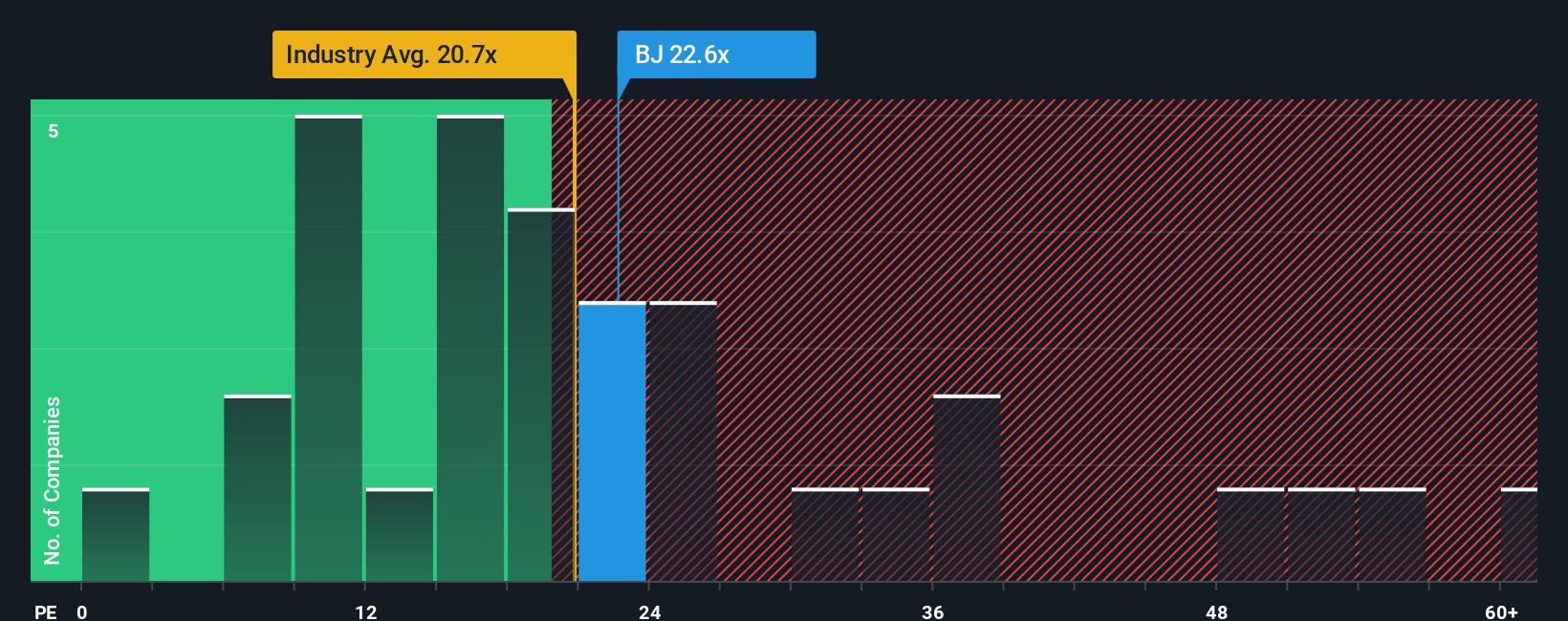

While analyst estimates suggest BJ’s Wholesale Club is undervalued based on future growth projections, a look at its current price-to-earnings ratio tells a different story. By this measure, the stock appears overvalued compared to its industry. Could the market be factoring in risks analysts may be downplaying, or is there more growth ahead than the numbers reveal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you see the numbers differently or want to dig deeper, you can explore the data and craft your own perspective. Most find it takes less than three minutes. Do it your way

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors never settle; they’re always on the hunt for the next big winner. Give yourself an edge and don’t miss out on these compelling stocks shaping tomorrow’s markets.

- Boost your potential dividend income by checking out the steady growers thriving in today's market with dividend stocks with yields > 3%.

- Spot trailblazers accelerating innovation in artificial intelligence and see where cutting-edge talent is creating real value using AI penny stocks.

- Pinpoint unloved gems trading below their true worth. Seize value stocks poised for a turnaround with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English